Required information Problem 15-3A (Algo) Debt Investments in available-for-sale securities; unrealized and realized gains and losses LO P3 [The following information applies to the questions displayed below.) Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Available-for-Sale Securities Company A bonds Company B notes Company C bonds Cost Fair Value $ 492,000 $534, 100 159, 140 662,400 155,000 642,140 Stoll enters into the following transactions involving its available-for-sale debt securities this year. January 29 Sold one-half of the Company B notes for $78,820. July 6 Purchased Company X bonds for $122, 100. November 13 Purchased Company 2 notes for $267,300. December 9 Sold all of the Company A bonds for $524,800. Fair values at December 31 are B, $82,300; C, $603,800; X, $120,000; and Z, $276,000. Problem 15-3A (Algo) Part 1 and 2 Required: 1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment for the long-term investments in available-for-sale securities. 2. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale securities. Complete this question by entering your answers in the tabs below. < Prev of 10 Next >

Required information Problem 15-3A (Algo) Debt Investments in available-for-sale securities; unrealized and realized gains and losses LO P3 [The following information applies to the questions displayed below.) Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Available-for-Sale Securities Company A bonds Company B notes Company C bonds Cost Fair Value $ 492,000 $534, 100 159, 140 662,400 155,000 642,140 Stoll enters into the following transactions involving its available-for-sale debt securities this year. January 29 Sold one-half of the Company B notes for $78,820. July 6 Purchased Company X bonds for $122, 100. November 13 Purchased Company 2 notes for $267,300. December 9 Sold all of the Company A bonds for $524,800. Fair values at December 31 are B, $82,300; C, $603,800; X, $120,000; and Z, $276,000. Problem 15-3A (Algo) Part 1 and 2 Required: 1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment for the long-term investments in available-for-sale securities. 2. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale securities. Complete this question by entering your answers in the tabs below. < Prev of 10 Next >

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

ChapterD: Investments

Section: Chapter Questions

Problem D.13EX

Related questions

Question

![2

Required information

Problem 15-3A (Algo) Debt Investments in available-for-sale securities; unrealized and realized gains and

losses LO P3

[The following information applies to the questions displayed below.]

Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following.

Available-for-Sale Securities

Company A bonds

Fair Value

$ 492,000

155,000

642,140

Stoll enters into the following transactions involving its available-for-sale debt securities this year.

January 29 Sold one-half of the Company B notes for $78,820.

July 6 Purchased Company X bonds for $122,100.

November 13 Purchased Company Z notes for $267,300.

December 9 Sold all of the Company A bonds for $524,800.

Fair values at December 31 are B, $82,300; C, $603,800; X. $120,000; and Z, $276,000.

Company B notes

Company C bonds

Problem 15-3A (Algo) Part 1 and 2

Cost

$ 534,100

159, 140

662,400

Required:

1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment

for the long-term investments in available-for-sale securities.

2. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale securities.

Complete this question by entering your answers in the tabs below.

< Prev

5

6

of 10

Next >](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fdb8eba44-347a-485f-a080-4fb6dd0d9a90%2F2e7055b8-be29-4bd7-a4a7-7d5613517f33%2Ftxnjz1r_processed.jpeg&w=3840&q=75)

Transcribed Image Text:2

Required information

Problem 15-3A (Algo) Debt Investments in available-for-sale securities; unrealized and realized gains and

losses LO P3

[The following information applies to the questions displayed below.]

Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following.

Available-for-Sale Securities

Company A bonds

Fair Value

$ 492,000

155,000

642,140

Stoll enters into the following transactions involving its available-for-sale debt securities this year.

January 29 Sold one-half of the Company B notes for $78,820.

July 6 Purchased Company X bonds for $122,100.

November 13 Purchased Company Z notes for $267,300.

December 9 Sold all of the Company A bonds for $524,800.

Fair values at December 31 are B, $82,300; C, $603,800; X. $120,000; and Z, $276,000.

Company B notes

Company C bonds

Problem 15-3A (Algo) Part 1 and 2

Cost

$ 534,100

159, 140

662,400

Required:

1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment

for the long-term investments in available-for-sale securities.

2. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale securities.

Complete this question by entering your answers in the tabs below.

< Prev

5

6

of 10

Next >

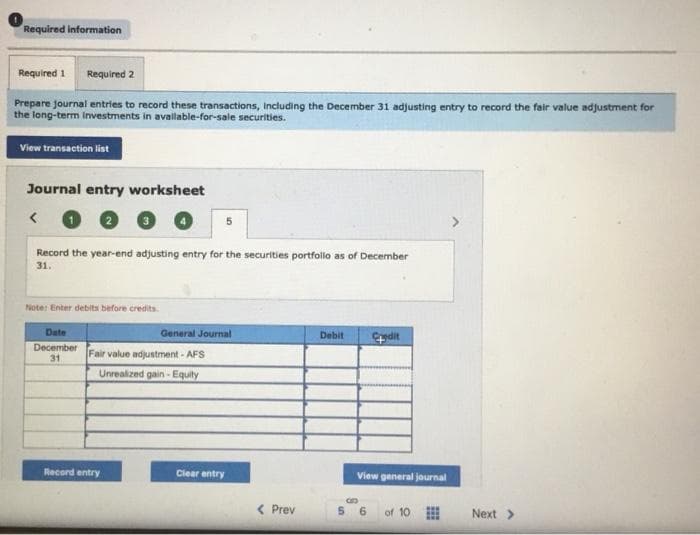

Transcribed Image Text:Required information

Required 1 Required 2

Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment for

the long-term investments in available-for-sale securities.

View transaction list

Journal entry worksheet

<

Record the year-end adjusting entry for the securities portfolio as of December

31.

Note: Enter debits before credits.

Date

December

31

Fair value adjustment-AFS

Unrealized gain-Equity

Record entry

5

General Journal

Clear entry

< Prev

Debit

Edit

View general journal

of 10

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Please provide all the five entries with supporting calculation,

and provide 2nd requirement with all working

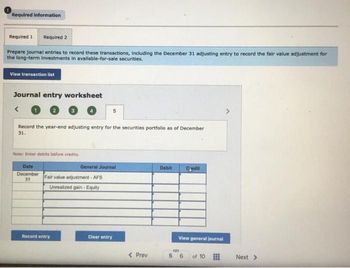

Transcribed Image Text:Required information

Required 1 Required 2

Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment for

the long-term investments in available-for-sale securities.

View transaction list

Journal entry worksheet

<

Record the year-end adjusting entry for the securities portfolio as of December

31.

Note: Enter debits before credits.

Date

December

31

Fair value adjustment-AFS

Unrealized gain-Equity

Record entry

5

General Journal

Clear entry

< Prev

Debit

Edit

View general journal

of 10

Next >

![2

Required information

Problem 15-3A (Algo) Debt Investments in available-for-sale securities; unrealized and realized gains and

losses LO P3

[The following information applies to the questions displayed below.]

Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following.

Available-for-Sale Securities

Company A bonds

Fair Value

$ 492,000

155,000

642,140

Stoll enters into the following transactions involving its available-for-sale debt securities this year.

January 29 Sold one-half of the Company B notes for $78,820.

July 6 Purchased Company X bonds for $122,100.

November 13 Purchased Company Z notes for $267,300.

December 9 Sold all of the Company A bonds for $524,800.

Fair values at December 31 are B, $82,300; C, $603,800; X. $120,000; and Z, $276,000.

Company B notes

Company C bonds

Problem 15-3A (Algo) Part 1 and 2

Cost

$ 534,100

159, 140

662,400

Required:

1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment

for the long-term investments in available-for-sale securities.

2. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale securities.

Complete this question by entering your answers in the tabs below.

< Prev

5

6

of 10

Next >](https://content.bartleby.com/qna-images/question/db8eba44-347a-485f-a080-4fb6dd0d9a90/d6b3ca10-1a22-4ab6-9de5-820269adea5c/p6ysp7_thumbnail.jpeg)

Transcribed Image Text:2

Required information

Problem 15-3A (Algo) Debt Investments in available-for-sale securities; unrealized and realized gains and

losses LO P3

[The following information applies to the questions displayed below.]

Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following.

Available-for-Sale Securities

Company A bonds

Fair Value

$ 492,000

155,000

642,140

Stoll enters into the following transactions involving its available-for-sale debt securities this year.

January 29 Sold one-half of the Company B notes for $78,820.

July 6 Purchased Company X bonds for $122,100.

November 13 Purchased Company Z notes for $267,300.

December 9 Sold all of the Company A bonds for $524,800.

Fair values at December 31 are B, $82,300; C, $603,800; X. $120,000; and Z, $276,000.

Company B notes

Company C bonds

Problem 15-3A (Algo) Part 1 and 2

Cost

$ 534,100

159, 140

662,400

Required:

1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment

for the long-term investments in available-for-sale securities.

2. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale securities.

Complete this question by entering your answers in the tabs below.

< Prev

5

6

of 10

Next >

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning