Questions 7-9 are based on the following lease amortization schedule. The five payments are made annually starting with the inception of the lease. A $2,000 bargain purchase option is exercisable at the end of the five-year lease. The asset has an expected economic life of eight years. Lease Cash Effective Decrease in Payment Payment Interest Balance Balance 34,600 26,600 21,260 1 8,000 ?? ?? 8,000 2,660 5.340 5,874 6,461 3. 2,126 15,386 8,000 8,000 1,539 8,925 ?? ?? 22 8,000 2,000 6. 182 1.818 2544

Questions 7-9 are based on the following lease amortization schedule. The five payments are made annually starting with the inception of the lease. A $2,000 bargain purchase option is exercisable at the end of the five-year lease. The asset has an expected economic life of eight years. Lease Cash Effective Decrease in Payment Payment Interest Balance Balance 34,600 26,600 21,260 1 8,000 ?? ?? 8,000 2,660 5.340 5,874 6,461 3. 2,126 15,386 8,000 8,000 1,539 8,925 ?? ?? 22 8,000 2,000 6. 182 1.818 2544

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 6MC: In the third year of a 6-year finance lease, the portion of the lease payment applicable to the...

Related questions

Question

Answer is $1,818

Please explain the reasoning and calculations

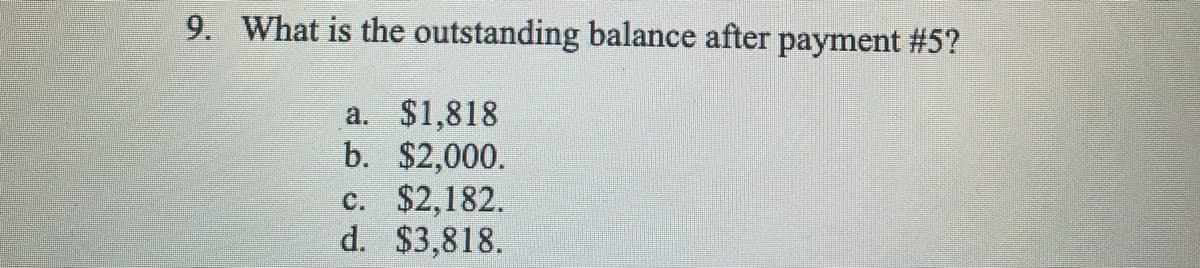

Transcribed Image Text:9. What is the outstanding balance after payment #5?

$1,818

b. $2,000.

c. $2,182.

d. $3,818.

a.

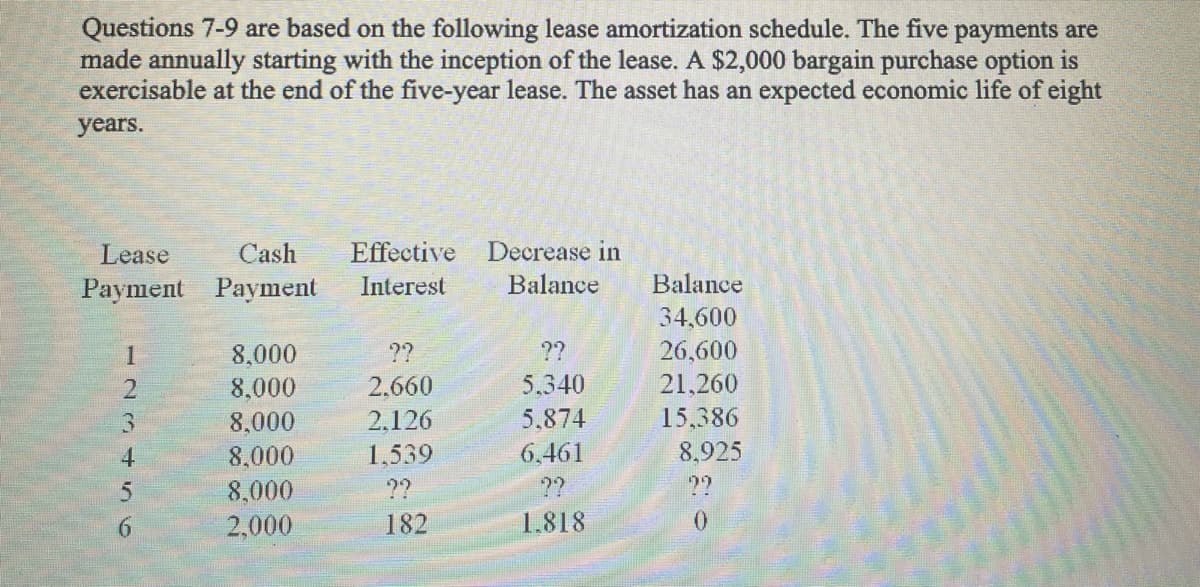

Transcribed Image Text:Questions 7-9 are based on the following lease amortization schedule. The five payments are

made annually starting with the inception of the lease. A $2,000 bargain purchase option is

exercisable at the end of the five-year lease. The asset has an expected economic life of eight

years.

Effective Decrease in

Balance

Lease

Cash

Payment Payment

Interest

Balance

34,600

8,000

??

??

26,600

8,000

2.660

5.340

21,260

15,386

8,925

2,126

5,874

8,000

8,000

1,539

6.461

??

??

??

8,000

2,000

182

1.818

1231t56

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning