nbulk Ltd. Lilydale Ltd Monbulk $2 950 300 17 100 ales (net credit) revenue for year llowance for Doubtful Debts, 1/7/18 llowance for Doubtful Debts, 30/6/19 ccounts receivable (gross) 1/7/18 ccounts receivable (gross) 30/6/19 $2 204 30 27 10 19780 28 10 722 650 368 00 485 800 384 20

nbulk Ltd. Lilydale Ltd Monbulk $2 950 300 17 100 ales (net credit) revenue for year llowance for Doubtful Debts, 1/7/18 llowance for Doubtful Debts, 30/6/19 ccounts receivable (gross) 1/7/18 ccounts receivable (gross) 30/6/19 $2 204 30 27 10 19780 28 10 722 650 368 00 485 800 384 20

Chapter6: Business Expenses

Section: Chapter Questions

Problem 44P

Related questions

Question

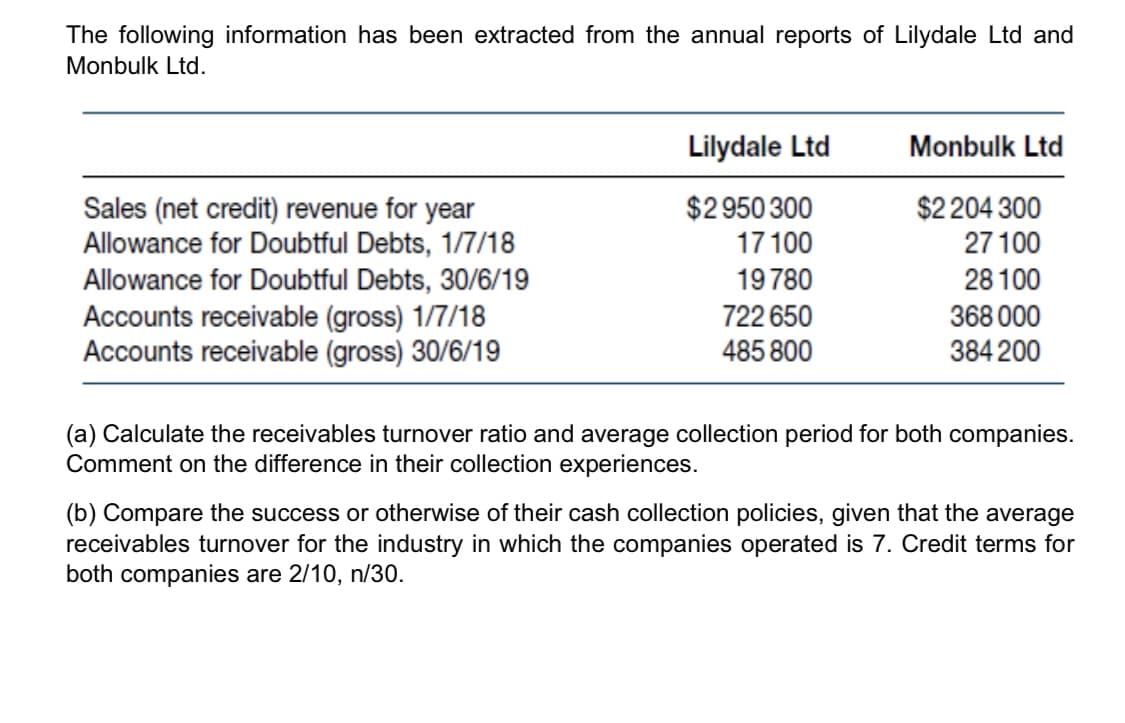

Transcribed Image Text:The following information has been extracted from the annual reports of Lilydale Ltd and

Monbulk Ltd.

Lilydale Ltd

Monbulk Ltd

$2 950 300

17 100

Sales (net credit) revenue for year

Allowance for Doubtful Debts, 1/7/18

Allowance for Doubtful Debts, 30/6/19

Accounts receivable (gross) 1/7/18

Accounts receivable (gross) 30/6/19

$2 204 300

27 100

19780

28 100

722 650

368 000

485 800

384 200

(a) Calculate the receivables turnover ratio and average collection period for both companies.

Comment on the difference in their collection experiences.

(b) Compare the success or otherwise of their cash collection policies, given that the average

receivables turnover for the industry in which the companies operated is 7. Credit terms for

both companies are 2/10, n/30.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,