Questions about the Income Statement. a. List 2 expense accounts AND their amounts for 2020. b. What was the net profit/(loss) for 2020? What about 2019? c. Compared with 2019, has the net profit/(loss) increased or decreased? Questions about the Statement of Financial Position. a. How much was the Cash account balance at December 31, 2020? What about 2019? b. Mention the biggest liability with its amount for the company at December 31, 2020. c. What was the Total Equity for the company at December 31, 2020? What about December 31, 2019?

Questions about the Income Statement. a. List 2 expense accounts AND their amounts for 2020. b. What was the net profit/(loss) for 2020? What about 2019? c. Compared with 2019, has the net profit/(loss) increased or decreased? Questions about the Statement of Financial Position. a. How much was the Cash account balance at December 31, 2020? What about 2019? b. Mention the biggest liability with its amount for the company at December 31, 2020. c. What was the Total Equity for the company at December 31, 2020? What about December 31, 2019?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 60APSA

Related questions

Question

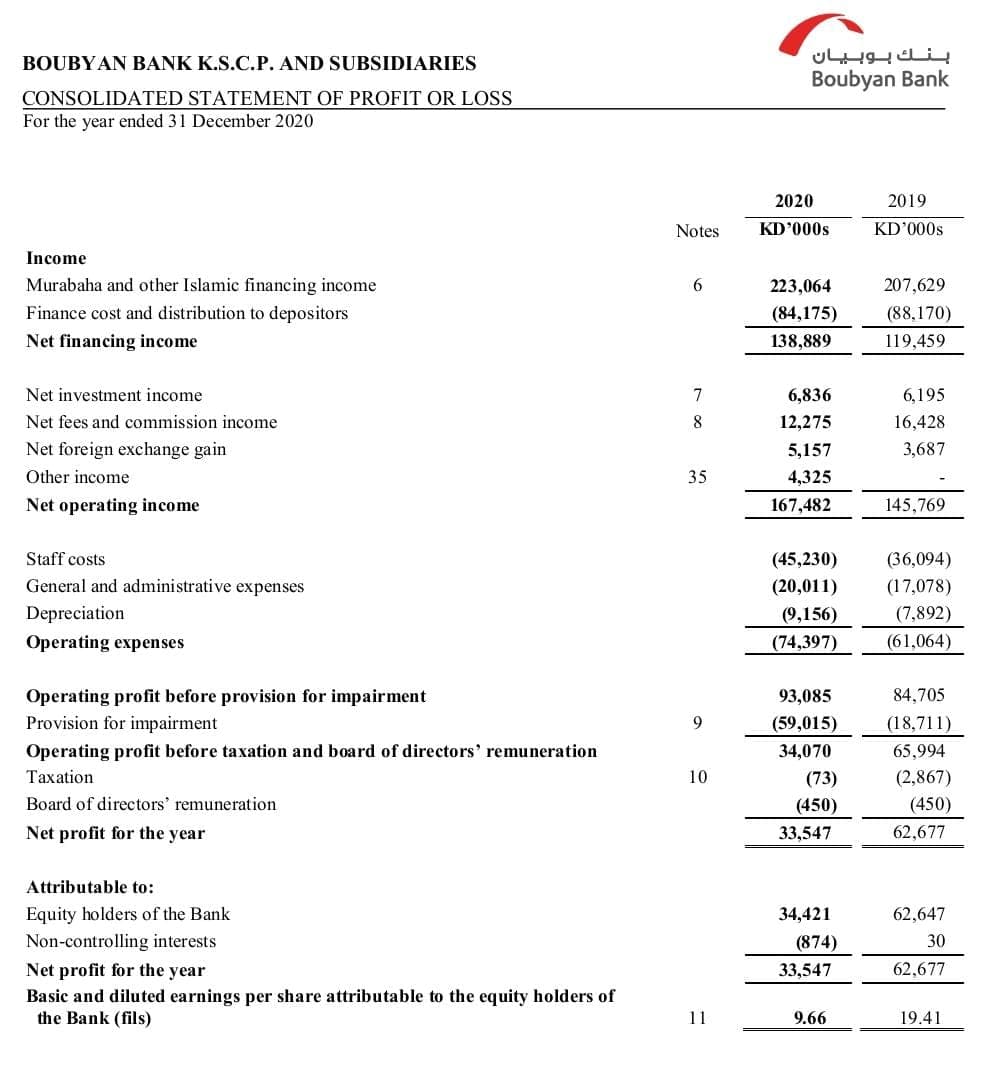

Questions about the Income Statement.

a. List 2 expense accounts AND their amounts for 2020.

b. What was the net

c. Compared with 2019, has the net profit/(loss) increased or decreased?

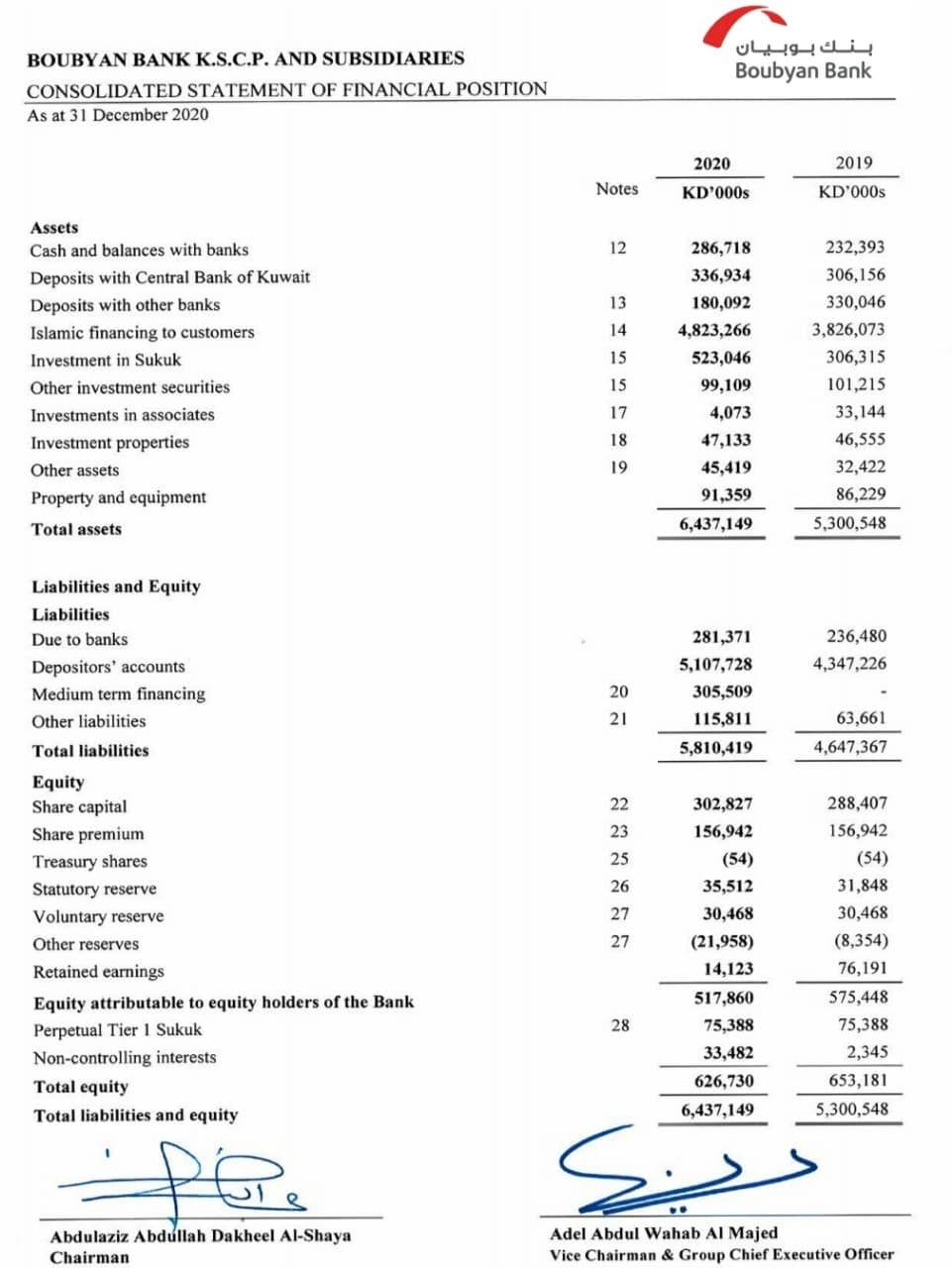

Questions about the

a. How much was the Cash account balance at December 31, 2020? What about 2019?

b. Mention the biggest liability with its amount for the company at December 31, 2020.

c. What was the Total Equity for the company at December 31, 2020? What about December 31, 2019?

Transcribed Image Text:بنك بوبیان

BOUBYAN BANK K.S.C.P. AND SUBSIDIARIES

Boubyan Bank

CONSOLIDATED STATEMENT OF PROFIT OR LOSS

For the year ended 31 December 2020

2020

2019

Notes

KD'000s

KD'000s

Income

Murabaha and other Islamic financing income

223,064

207,629

Finance cost and distribution to depositors

(84,175)

(88,170)

Net financing income

138,889

119,459

Net investment income

6,836

6,195

Net fees and commission income

8

12,275

16,428

Net foreign exchange gain

5,157

3,687

Other income

35

4,325

Net operating income

167,482

145,769

Staff costs

(45,230)

(36,094)

General and administrative expenses

(20,011)

(17,078)

Depreciation

(9,156)

(7,892)

Operating expenses

(74,397)

(61,064)

Operating profit before provision for impairment

93,085

84,705

Provision for impairment

9

(59,015)

(18,711)

Operating profit before taxation and board of directors' remuneration

34,070

65,994

Тахation

10

(73)

(2,867)

Board of directors' remuneration

(450)

(450)

Net profit for the year

33,547

62,677

Attributable to:

Equity holders of the Bank

34,421

62,647

Non-controlling interests

(874)

30

Net profit for the year

33,547

62,677

Basic and diluted earnings per share attributable to the equity holders of

the Bank (fils)

11

9.66

19.41

Transcribed Image Text:ہنك بوبیان

BOUBYAN BANK K.S.C.P. AND SUBSIDIARIES

Boubyan Bank

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 December 2020

2020

2019

Notes

KD'000s

KD'000s

Assets

Cash and balances with banks

12

286,718

232,393

Deposits with Central Bank of Kuwait

336,934

306,156

Deposits with other banks

13

180,092

330,046

Islamic financing to customers

14

4,823,266

3,826,073

Investment in Sukuk

15

523,046

306,315

Other investment securities

15

99,109

101,215

Investments in associates

17

4,073

33,144

Investment properties

18

47,133

46,555

Other assets

19

45,419

32,422

Property and equipment

91,359

86,229

Total assets

6,437,149

5,300,548

Liabilities and Equity

Liabilities

Due to banks

281,371

236,480

Depositors' accounts

5,107,728

4,347,226

Medium term financing

20

305,509

Other liabilities

21

115,811

63,661

Total liabilities

5,810,419

4,647,367

Equity

Share capital

22

302,827

288,407

Share premium

23

156,942

156,942

Treasury shares

25

(54)

(54)

Statutory reserve

26

35,512

31,848

Voluntary reserve

27

30,468

30,468

Other reserves

27

(21,958)

(8,354)

Retained earnings

14,123

76,191

Equity attributable to equity holders of the Bank

517,860

575,448

Perpetual Tier 1 Sukuk

28

75,388

75,388

Non-controlling interests

33,482

2,345

Total equity

626,730

653,181

Total liabilities and equity

6,437,149

5,300,548

Adel Abdul Wahab Al Majed

Vice Chairman & Group Chief Executive Officer

Abdulaziz Abdúllah Dakheel Al-Shaya

Chairman

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning