Required: a. From the above income statement and balance sheet for Gerrard Construction Co. What other financial statements are required? b. Indicate the note disclosures that should be provided by Gerrard Construction Co. c. Assume that the balance of "Accounts Receivable, net" at December 31, 2018, was $8,800. Calculate the following activity measures for Gerrard Construction Co. for the year ended December 31, 2019: 1. Accounts receivable turnover. 2. Number of days' sales in accounts receivable. d. Calculate the following financial leverage measures for Gerrard Construction Co. at December 31, 2019: 1. Debt ratio. 2. Debt/equity ratio. e. Gerrard Construction Co. wishes to lease some new earthmoving equipment from Caterpillar on a long-term basis. What impact (increase, decrease, or no effect) would a capital lease of 4.1 million have on the company's debt ratio and debt/equity ratio? f. (1) Calculate the amount of dividends declared and paid during the year ended December 31, 2019. (2) Review the answer from requirement f1 at this time. Assume that Gerrard Construction Co. had 1,026,000 shares of $1 par value common stock outstanding throughout 2019, and that the market price per share of common stock at December 31, 2019, was $18.78. Calculate the following profitability measures for the year ended December 31, 2019: 1. Earnings per share of common stock. 2. Price/earnings ratio. 3. Dividend yield. 4. Dividend payout ratio.

Required: a. From the above income statement and balance sheet for Gerrard Construction Co. What other financial statements are required? b. Indicate the note disclosures that should be provided by Gerrard Construction Co. c. Assume that the balance of "Accounts Receivable, net" at December 31, 2018, was $8,800. Calculate the following activity measures for Gerrard Construction Co. for the year ended December 31, 2019: 1. Accounts receivable turnover. 2. Number of days' sales in accounts receivable. d. Calculate the following financial leverage measures for Gerrard Construction Co. at December 31, 2019: 1. Debt ratio. 2. Debt/equity ratio. e. Gerrard Construction Co. wishes to lease some new earthmoving equipment from Caterpillar on a long-term basis. What impact (increase, decrease, or no effect) would a capital lease of 4.1 million have on the company's debt ratio and debt/equity ratio? f. (1) Calculate the amount of dividends declared and paid during the year ended December 31, 2019. (2) Review the answer from requirement f1 at this time. Assume that Gerrard Construction Co. had 1,026,000 shares of $1 par value common stock outstanding throughout 2019, and that the market price per share of common stock at December 31, 2019, was $18.78. Calculate the following profitability measures for the year ended December 31, 2019: 1. Earnings per share of common stock. 2. Price/earnings ratio. 3. Dividend yield. 4. Dividend payout ratio.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 10MC: Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended...

Related questions

Question

Please do F1 thank you.

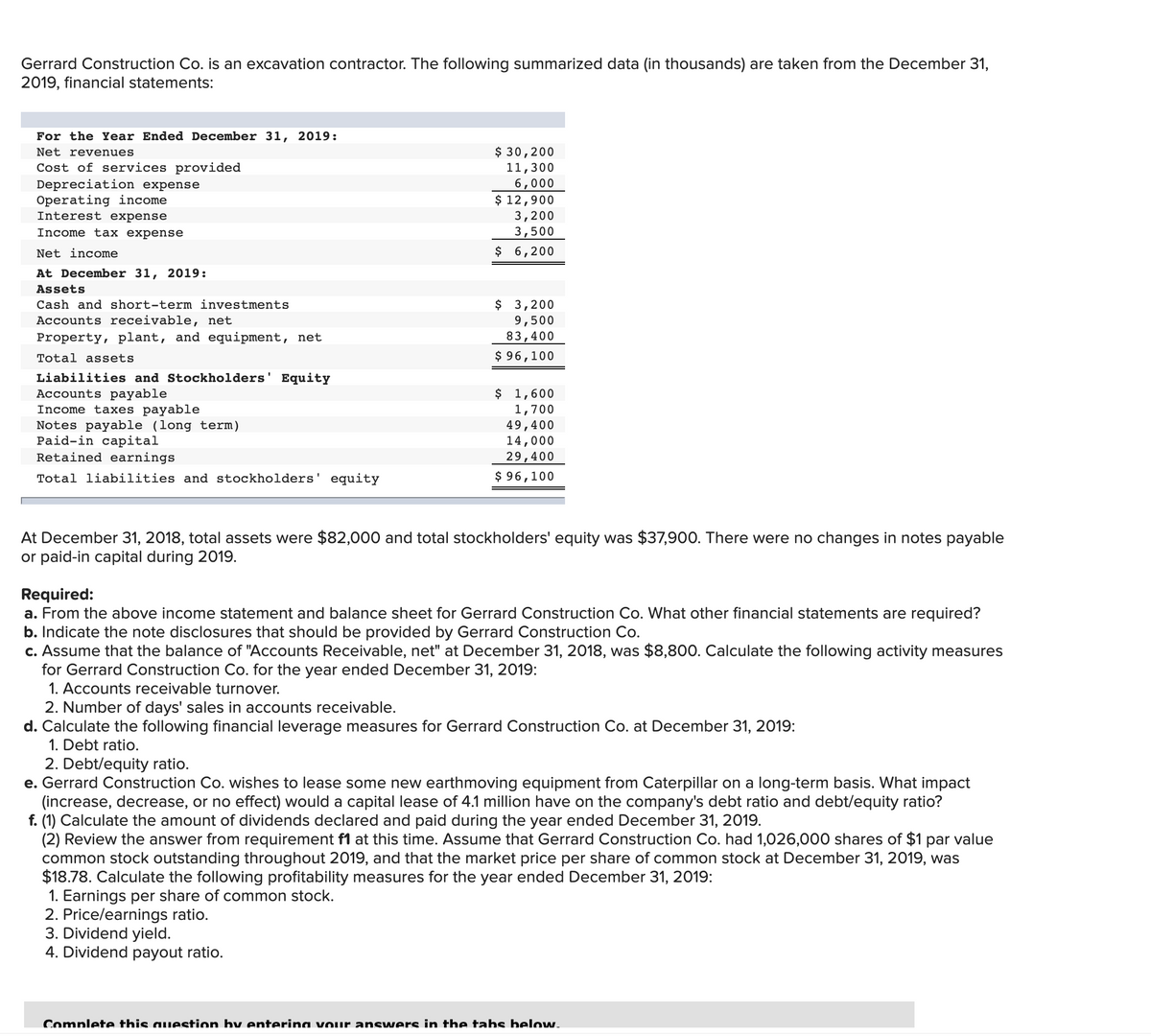

Transcribed Image Text:Gerrard Construction Co. is an excavation contractor. The following summarized data (in thousands) are taken from the December 31,

2019, financial statements:

For the Year Ended December 31, 2019:

$ 30,200

11,300

Net revenues

Cost of services provided

Depreciation expense

Operating income

Interest expense

6,000

$ 12,900

3,200

Income tax expense

3,500

Net income

$ 6,200

At December 31, 2019:

Assets

Cash and short-term investments

$ 3,200

Accounts receivable, net

9,500

Property, plant, and equipment, net

83,400

Total assets

$ 96,100

Liabilities and Stockholders' Equity

Accounts payable

Income taxes payable

Notes payable (long term)

Paid-in capital

Retained earnings

$ 1,600

1,700

49,400

14,000

29,400

Total liabilities and stockholders' equity

$ 96,100

At December 31, 2018, total assets were $82,000 and total stockholders' equity was $37,900. There were no changes in notes payable

or paid-in capital during 2019.

Required:

a. From the above income statement and balance sheet for Gerrard Construction Co. What other financial statements are required?

b. Indicate the note disclosures that should be provided by Gerrard Construction Co.

c. Assume that the balance of "Accounts Receivable, net" at December 31, 2018, was $8,800. Calculate the following activity measures

for Gerrard Construction Co. for the year ended December 31, 2019:

1. Accounts receivable turnover.

2. Number of days' sales in accounts receivable.

d. Calculate the following financial leverage measures for Gerrard Construction Co. at December 31, 2019:

1. Debt ratio.

2. Debt/equity ratio.

e. Gerrard Construction Co. wishes to lease some new earthmoving equipment from Caterpillar on a long-term basis. What impact

(increase, decrease, or no effect) would a capital lease of 4.1 million have on the company's debt ratio and debt/equity ratio?

f. (1) Calculate the amount of dividends declared and paid during the year ended December 31, 2019.

(2) Review the answer from requirement f1 at this time. Assume that Gerrard Construction Co. had 1,026,000 shares of $1 par value

common stock outstanding throughout 2019, and that the market price per share of common stock at December 31, 2019, was

$18.78. Calculate the following profitability measures for the year ended December 31, 2019:

1. Earnings per share of common stock.

2. Price/earnings ratio.

3. Dividend yield.

4. Dividend payout ratio.

Complete this auestion bv enterina vour answers in the tahs below.

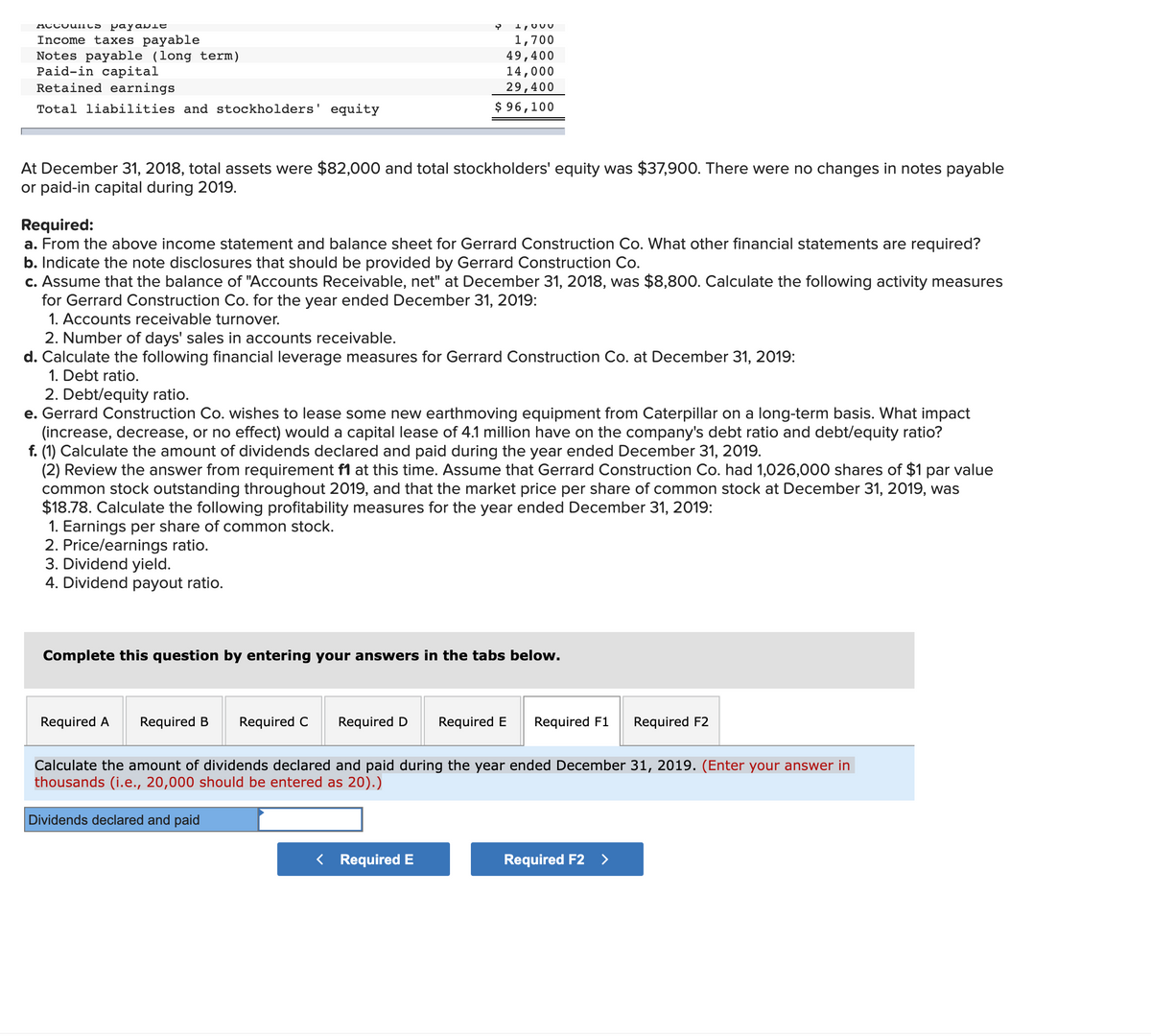

Transcribed Image Text:ACCOu1les

payabie

Income taxes payable

Notes payable (long term)

Paid-in capital

Retained earnings

1,700

49,400

14,000

29,400

Total liabilities and stockholders' equity

$ 96,100

At December 31, 2018, total assets were $82,000 and total stockholders' equity was $37,900. There were no changes in notes payable

or paid-in capital during 2019.

Required:

a. From the above income statement and balance sheet for Gerrard Construction Co. What other financial statements are required?

b. Indicate the note disclosures that should be provided by Gerrard Construction Co.

c. Assume that the balance of "Accounts Receivable, net" at December 31, 2018, was $8,800. Calculate the following activity measures

for Gerrard Construction Co. for the year ended December 31, 2019:

1. Accounts receivable turnover.

2. Number of days' sales in accounts receivable.

d. Calculate the following financial leverage measures for Gerrard Construction Co. at December 31, 2019:

1. Debt ratio.

2. Debt/equity ratio.

e. Gerrard Construction Co. wishes to lease some new earthmoving equipment from Caterpillar on a long-term basis. What impact

(increase, decrease, or no effect) would a capital lease of 4.1 million have on the company's debt ratio and debt/equity ratio?

f. (1) Calculate the amount of dividends declared and paid during the year ended December 31, 2019.

(2) Review the answer from requirement f1 at this time. Assume that Gerrard Construction Co. had 1,026,000 shares of $1 par value

common stock outstanding throughout 2019, and that the market price per share of common stock at December 31, 2019, was

$18.78. Calculate the following profitability measures for the year ended December 31, 2019:

1. Earnings per share of common stock.

2. Price/earnings ratio.

3. Dividend yield.

4. Dividend payout ratio.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Required D

Required E

Required F1

Required F2

Calculate the amount of dividends declared and paid during the year ended December 31, 2019. (Enter your answer in

thousands (i.e., 20,000 should be entered as 20).)

Dividends declared and paid

< Required E

Required F2

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning