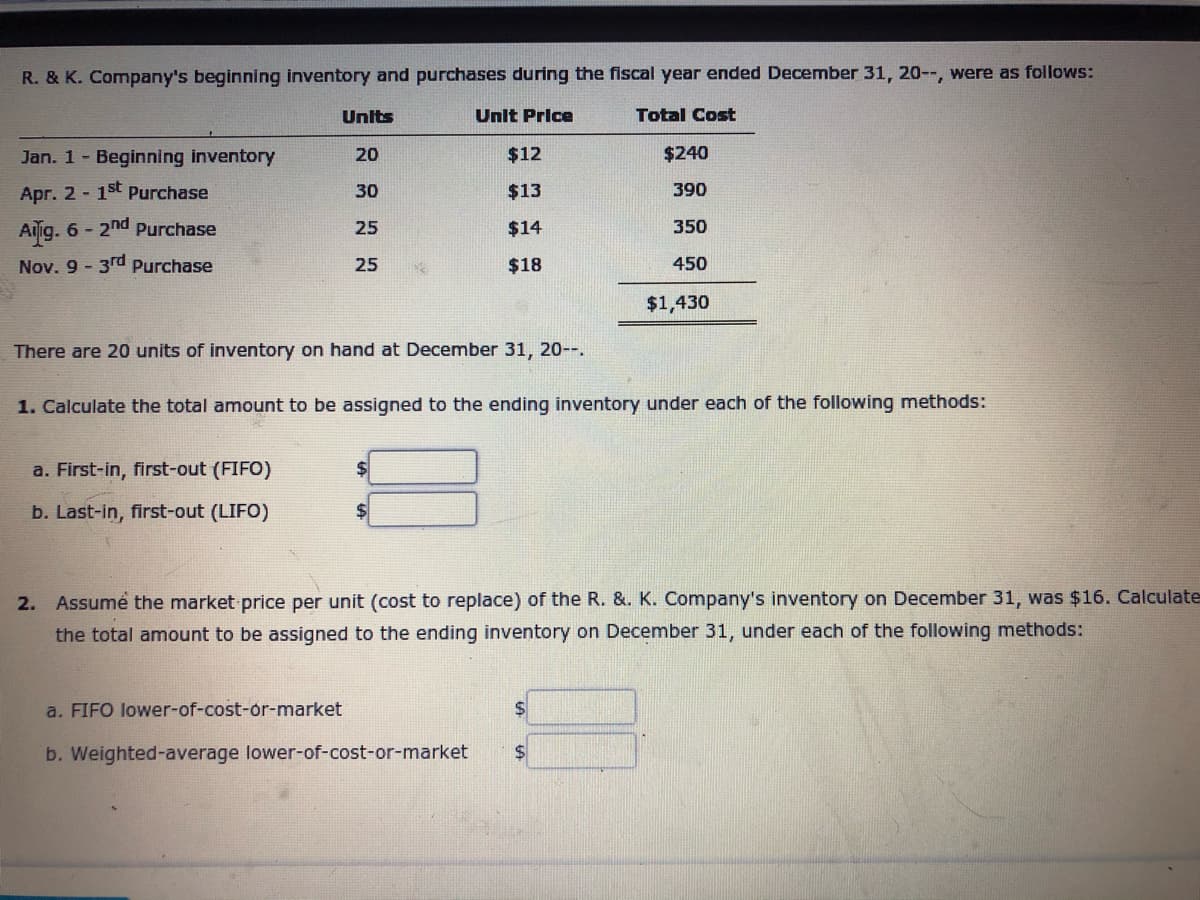

R. & K. Company's beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows: Units Unit Price Total Cost Jan. 1 Beginning inventory 20 $12 $240 Apr. 2 - 1st Purchase 30 $13 390 Ailig. 6 - 2nd Purchase 25 $14 350 Nov. 9 - 3rd Purchase 25 $18 450 $1,430 here are 20 units of inventory on hand at December 31, 20--. 1. Calculate the total amount to be assigned to the ending inventory under each of the following methods: a. First-in, first-out (FIFO) %24 b. Last-in, first-out (LIFO) 24 2. Assumê the market price per unit (cost to replace) of the R. &. K. Company's inventory on December 31, was $16. the total amount to be assigned to the ending inventory on December 31, under each of the following methods:

R. & K. Company's beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows: Units Unit Price Total Cost Jan. 1 Beginning inventory 20 $12 $240 Apr. 2 - 1st Purchase 30 $13 390 Ailig. 6 - 2nd Purchase 25 $14 350 Nov. 9 - 3rd Purchase 25 $18 450 $1,430 here are 20 units of inventory on hand at December 31, 20--. 1. Calculate the total amount to be assigned to the ending inventory under each of the following methods: a. First-in, first-out (FIFO) %24 b. Last-in, first-out (LIFO) 24 2. Assumê the market price per unit (cost to replace) of the R. &. K. Company's inventory on December 31, was $16. the total amount to be assigned to the ending inventory on December 31, under each of the following methods:

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter13: Accounting For Merchandise Inventory

Section: Chapter Questions

Problem 7SPB: COST ALLOCATION AND LOWER-OF-COST-OR-MARKET Hall Companys beginning inventory and purchases during...

Related questions

Topic Video

Question

Transcribed Image Text:R. & K. Company's beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows:

Units

Unlt Price

Total Cost

Jan. 1 Beginning inventory

20

$12

$240

Apr. 2 - 1st Purchase

30

$13

390

Aig. 6 - 2nd Purchase

25

$14

350

Nov. 9 - 3rd Purchase

25

$18

450

$1,430

There are 20 units of inventory on hand at December 31, 20--.

1. Calculate the total amount to be assigned to the ending inventory under each of the following methods:

a. First-in, first-out (FIFO)

b. Last-in, first-out (LIFO)

2. Assumé the market price per unit (cost to replace) of the R. &. K. Company's inventory on December 31, was $16. Calculate

the total amount to be assigned to the ending inventory on December 31, under each of the following methods:

a. FIFO lower-of-cost-or-market

b. Weighted-average lower-of-cost-or-market

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,