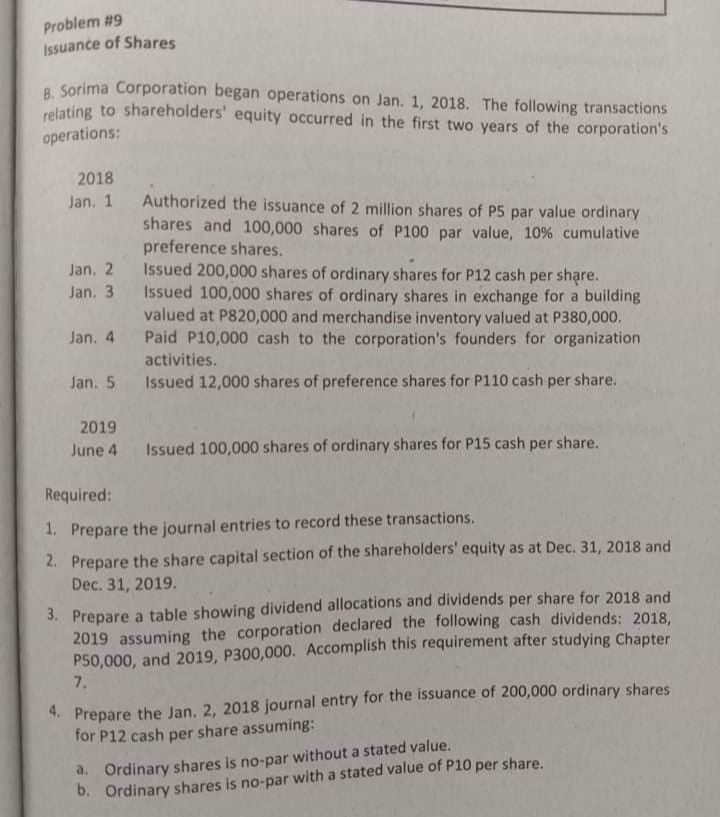

R. Sorima Corporation began operations on Jan. 1, 2018. The following transactions relating to shareholders' equity occurred in the first two years of the corporation's operations: 2018 Jan. 1 Authorized the issuance of 2 million shares of P5 par value ordinary shares and 100,000 shares of P100 par value, 10% cumulative preference shares. Issued 200,000 shares of ordinary shares for P12 cash per share. Issued 100,000 shares of ordinary shares in exchange for a building valued at P820,000 and merchandise inventory valued at P380,000. Jan. 2 Jan. 3 Jan. 4 Paid P10,000 cash to the corporation's founders for organization activities. Jan. 5 Issued 12,000 shares of preference shares for P110 cash per share. 2019 June 4 Issued 100,000 shares of ordinary shares for P15 cash per share. Required: 1. Prepare the journal entries to record these transactions. 2. Prepare the share capital section of the shareholders' equity as at Dec. 31, 2018 and Dec. 31, 2019. 3. Prepare a table showing dividend allocations and dividends per share for 2018 and 2019 assuming the corporation declared the following cash dividends: 2018, P50,000, and 2019, P300,000. Accomplish this requirement after studying Chapter 4. Prepare the Jan. 2, 2018 journal entry for the issuance of 200,000 ordinary shares for P12 cash per share assuming: 7. a. Ordinary shares is no-par without a stated value. b. Ordinary shares is no-par with a stated value of P10 per share.

R. Sorima Corporation began operations on Jan. 1, 2018. The following transactions relating to shareholders' equity occurred in the first two years of the corporation's operations: 2018 Jan. 1 Authorized the issuance of 2 million shares of P5 par value ordinary shares and 100,000 shares of P100 par value, 10% cumulative preference shares. Issued 200,000 shares of ordinary shares for P12 cash per share. Issued 100,000 shares of ordinary shares in exchange for a building valued at P820,000 and merchandise inventory valued at P380,000. Jan. 2 Jan. 3 Jan. 4 Paid P10,000 cash to the corporation's founders for organization activities. Jan. 5 Issued 12,000 shares of preference shares for P110 cash per share. 2019 June 4 Issued 100,000 shares of ordinary shares for P15 cash per share. Required: 1. Prepare the journal entries to record these transactions. 2. Prepare the share capital section of the shareholders' equity as at Dec. 31, 2018 and Dec. 31, 2019. 3. Prepare a table showing dividend allocations and dividends per share for 2018 and 2019 assuming the corporation declared the following cash dividends: 2018, P50,000, and 2019, P300,000. Accomplish this requirement after studying Chapter 4. Prepare the Jan. 2, 2018 journal entry for the issuance of 200,000 ordinary shares for P12 cash per share assuming: 7. a. Ordinary shares is no-par without a stated value. b. Ordinary shares is no-par with a stated value of P10 per share.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.6E

Related questions

Question

Transcribed Image Text:Problem #9

Issuance of Shares

A Sorima Corporation began operations on Jan. 1, 2018. The following transactions

relating to shareholders' equity occurred in the first two years of the corporation's

operations:

2018

Jan. 1 Authorized the issuance of 2 million shares of P5 par value ordinary

shares and 100,000 shares of P100 par value, 10% cumulative

preference shares.

Jan. 2

Issued 200,000 shares of ordinary shares for P12 cash per share.

Issued 100,000 shares of ordinary shares in exchange for a building

valued at P820,000 and merchandise inventory valued at P380,000.

Jan. 4 Paid P10,000 cash to the corporation's founders for organization

Jan. 3

activities.

Jan. 5

Issued 12,000 shares of preference shares for P110 cash per share.

2019

June 4

Issued 100,000 shares of ordinary shares for P15 cash per share.

Required:

1. Prepare the journal entries to record these transactions.

2. Prepare the share capital section of the shareholders' equity as at Dec. 31, 2018 and

Dec. 31, 2019.

3. Prepare a table showing dividend allocations and dividends per share for 2018 and

2019 assuming the corporation declared the following cash dividends: 2018.

P50,000, and 2019, P300,000. Accomplish this requirement after studying Chapter

7.

4. Prepare the Jan. 2, 2018 journal entry for the issuance of 200,000 ordinary shares

for P12 cash per share assuming:

a. Ordinary shares is no-par without a stated value.

b. Ordinary shares is no-par with a stated value of P10 per share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning