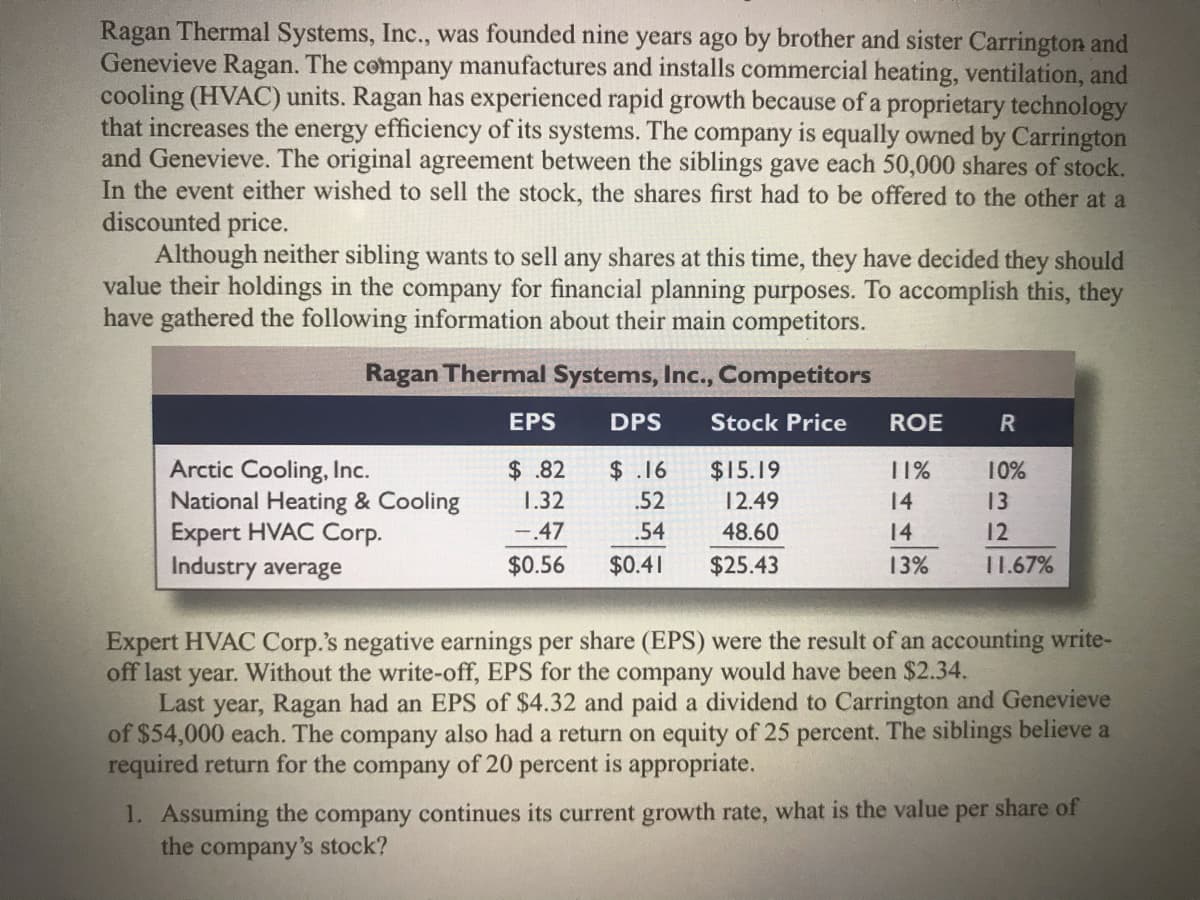

Ragan Thermal Systems, Inc., was founded nine years ago by brother and sister Carrington and Genevieve Ragan. The company manufactures and installs commercial heating, ventilation, and cooling (HVAC) units. Ragan has experienced rapid growth because of a proprietary technology that increases the energy efficiency of its systems. The company is equally owned by Carrington and Genevieve. The original agreement between the siblings gave each 50,000 shares of stock. In the event either wished to sell the stock, the shares first had to be offered to the other at a discounted price. Although neither sibling wants to sell any shares at this time, they have decided they should value their holdings in the company for financial planning purposes. To accomplish this, they have gathered the following information about their main competitors. Ragan Thermal Systems, Inc., Competitors EPS DPS Stock Price ROE Arctic Cooling, Inc. National Heating & Cooling Expert HVAC Corp. Industry average $.82 $.16 $15.19 11% 10% 1.32 .52 12.49 14 13 - 47 .54 48.60 14 12 $0.56 $0.41 $25.43 13% 11.67% Expert HVAC Corp.'s negative earnings per share (EPS) were the result of an accounting write- off last year. Without the write-off, EPS for the company would have been $2.34. Last year, Ragan had an EPS of $4.32 and paid a dividend to Carrington and Genevieve of $54,000 each. The company also had a return on equity of 25 percent. The siblings believe a required return for the company of 20 percent is appropriate. 1. Assuming the company continues its current growth rate, what is the value per share of the company's stock?

Ragan Thermal Systems, Inc., was founded nine years ago by brother and sister Carrington and Genevieve Ragan. The company manufactures and installs commercial heating, ventilation, and cooling (HVAC) units. Ragan has experienced rapid growth because of a proprietary technology that increases the energy efficiency of its systems. The company is equally owned by Carrington and Genevieve. The original agreement between the siblings gave each 50,000 shares of stock. In the event either wished to sell the stock, the shares first had to be offered to the other at a discounted price. Although neither sibling wants to sell any shares at this time, they have decided they should value their holdings in the company for financial planning purposes. To accomplish this, they have gathered the following information about their main competitors. Ragan Thermal Systems, Inc., Competitors EPS DPS Stock Price ROE Arctic Cooling, Inc. National Heating & Cooling Expert HVAC Corp. Industry average $.82 $.16 $15.19 11% 10% 1.32 .52 12.49 14 13 - 47 .54 48.60 14 12 $0.56 $0.41 $25.43 13% 11.67% Expert HVAC Corp.'s negative earnings per share (EPS) were the result of an accounting write- off last year. Without the write-off, EPS for the company would have been $2.34. Last year, Ragan had an EPS of $4.32 and paid a dividend to Carrington and Genevieve of $54,000 each. The company also had a return on equity of 25 percent. The siblings believe a required return for the company of 20 percent is appropriate. 1. Assuming the company continues its current growth rate, what is the value per share of the company's stock?

Chapter16: Tax Research

Section: Chapter Questions

Problem 71EDC

Related questions

Question

Transcribed Image Text:Ragan Thermal Systems, Inc., was founded nine years ago by brother and sister Carrington and

Genevieve Ragan. The company manufactures and installs commercial heating, ventilation, and

cooling (HVAC) units. Ragan has experienced rapid growth because of a proprietary technology

that increases the energy efficiency of its systems. The company is equally owned by Carrington

and Genevieve. The original agreement between the siblings gave each 50,000 shares of stock.

In the event either wished to sell the stock, the shares first had to be offered to the other at a

discounted price.

Although neither sibling wants to sell any shares at this time, they have decided they should

value their holdings in the company for financial planning purposes. To accomplish this, they

have gathered the following information about their main competitors.

Ragan Thermal Systems, Inc., Competitors

EPS

DPS

Stock Price

ROE

Arctic Cooling, Inc.

National Heating & Cooling

Expert HVAC Corp.

Industry average

$.82

$.16

$15.19

11%

10%

1.32

.52

12.49

14

13

- 47

.54

48.60

14

12

$0.56

$0.41

$25.43

13%

11.67%

Expert HVAC Corp.'s negative earnings per share (EPS) were the result of an accounting write-

off last year. Without the write-off, EPS for the company would have been $2.34.

Last year, Ragan had an EPS of $4.32 and paid a dividend to Carrington and Genevieve

of $54,000 each. The company also had a return on equity of 25 percent. The siblings believe a

required return for the company of 20 percent is appropriate.

1. Assuming the company continues its current growth rate, what is the value per share of

the company's stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT