ral unemployment tax l Security tax care tax ral income tax

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section13.3: Reporting Withholding And Payroll Taxes

Problem 1WT

Related questions

Question

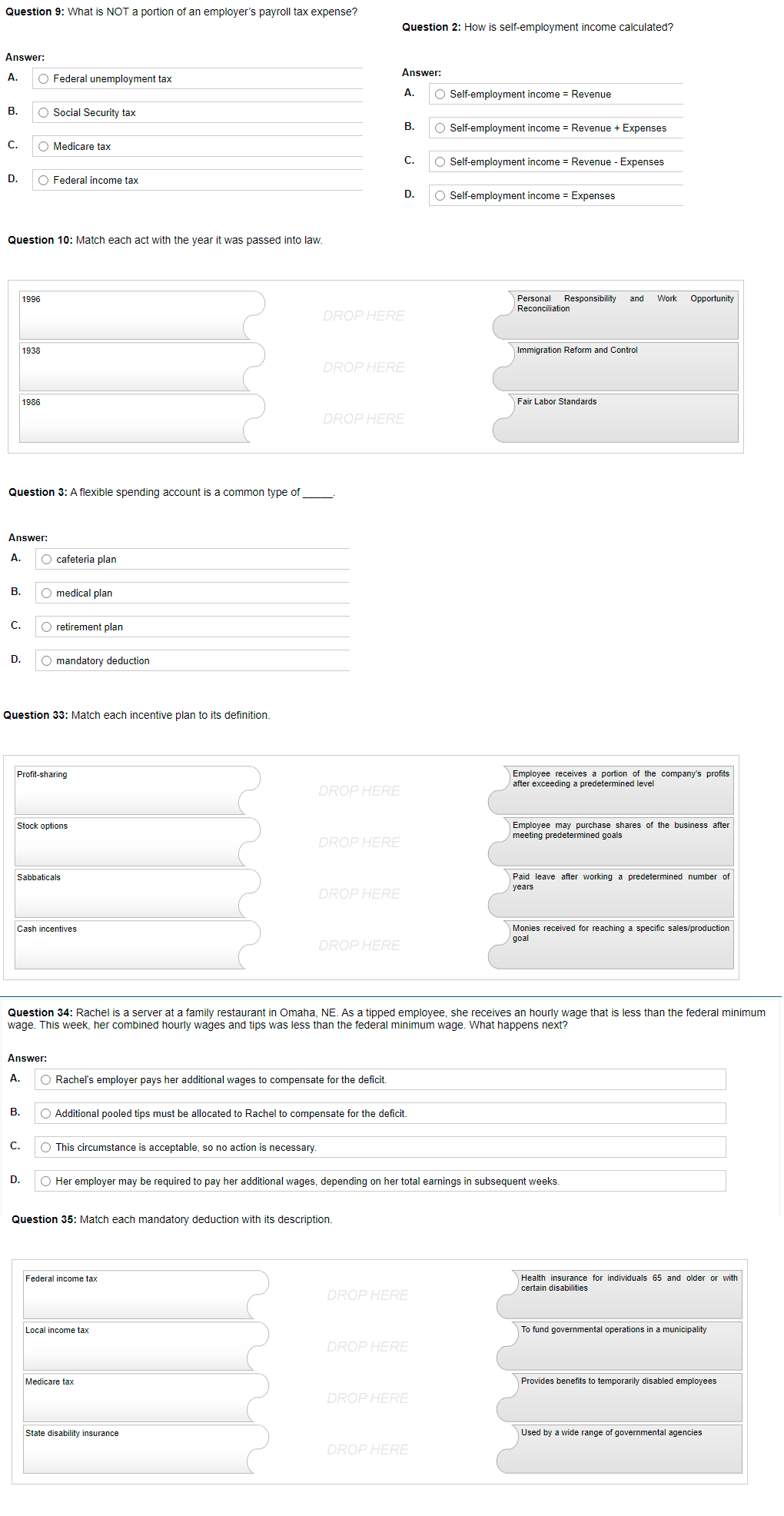

Transcribed Image Text:Question 9: What is NOT a portion of an employer's payroll tax expense?

Answer:

A.

O Federal unemployment tax

B.

O Social Security tax

C.

O Medicare tax

D. O Federal income tax

Question 10: Match each act with the year it was passed into law.

1996

Personal Responsibility and Work Opportunity

Reconciliation

1938

Immigration Reform and Control

Fair Labor Standards

1986

Question 3: A flexible spending account is a common type of

Answer:

A.

O cafeteria plan

B.

O medical plan

C.

O retirement plan

D. O mandatory deduction

Question 33: Match each incentive plan to its definition.

Profit-sharing

Employee receives a portion of the company's profits

after exceeding a predetermined level

DROP HERE

Stock options

Employee may purchase shares of the business after

meeting predetermined goals

DROP HERE

Sabbaticals

Paid leave after working a predetermined number of

years

DROP HERE

Cash incentives

Monies received for reaching specific sales/production

goal

DROP HERE

Question 34: Rachel is a server at a family restaurant in Omaha, NE. As a tipped employee, she receives an hourly wage that is less than the federal minimum

wage. This week, her combined hourly wages and tips was less than the federal minimum wage. What happens next?

Answer:

A. O Rachel's employer pays her additional wages to compensate for the deficit.

B. O Additional pooled tips must be allocated to Rachel to compensate for the deficit.

C.

O This circumstance is acceptable, so no action is necessary.

D.

O Her employer may be required to pay her additional wages, depending on her total earnings in subsequent weeks.

Question 35: Match each mandatory deduction with its description.

Federal income tax

Health insurance for individuals 65 and older or with

certain disabilities

DROP HERE

Local income tax

To fund governmental operations in a municipality

DROP HERE

Medicare tax

Provides benefits to temporarily disabled employees

DROP HERE

State disability insurance

Used by a wide range of governmental agencies

DROP HERE

。。

Question 2: How is self-employment income calculated?

Answer:

A.

O Self-employment income = Revenue

B.

O Self-employment income = Revenue + Expenses

O Self-employment income = Revenue - Expenses

O Self-employment income = Expenses

D.

DROP HERE

DROP HERE

DROP HERE

:ooo 이

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning