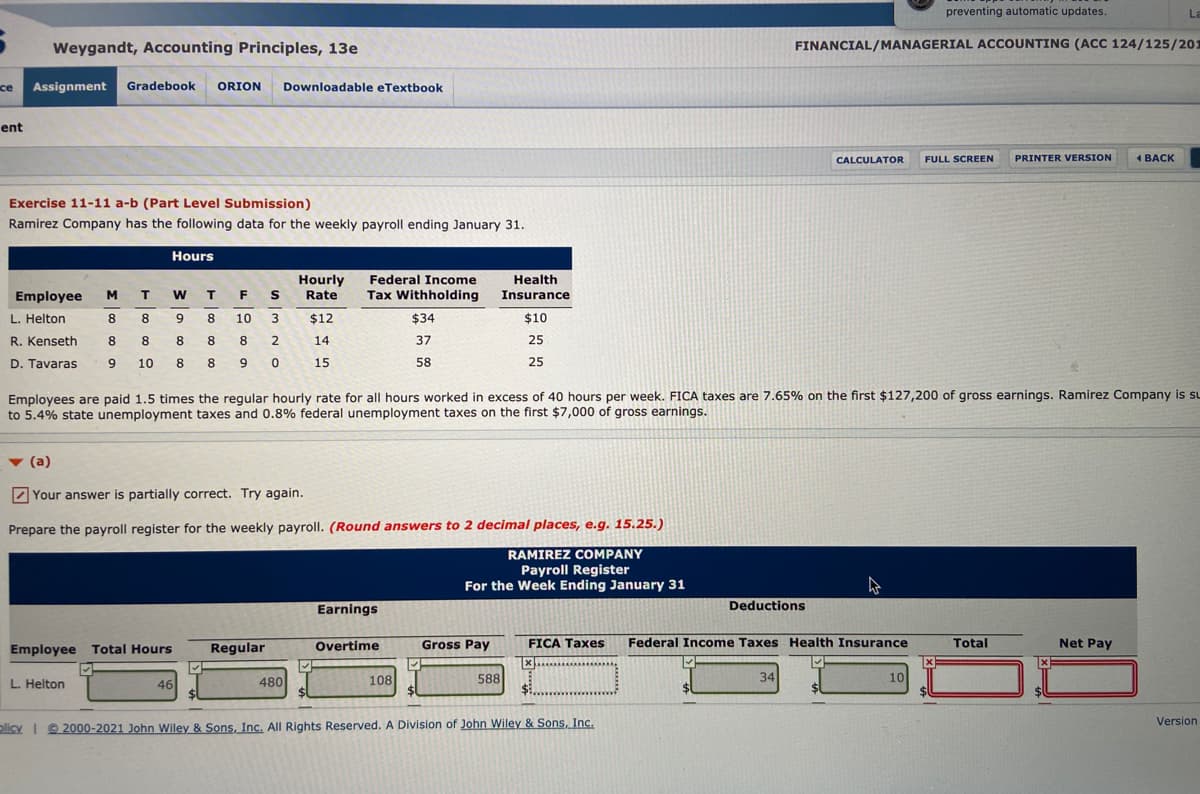

Ramirez Company has the following data for the weekly payroll ending January 31. Hours Hourly Rate Federal Income Tax Withholding Health Employee F Insurance L. Helton 8. 8 9 10 3 $12 $34 $10 R. Kenseth 8. 8 8 8 2 14 37 25 D. Tavaras 10 8 8 9 15 58 25 Employees are paid 1.5 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are 7.65% on the first $127,200 of gross earnings. Ramirez Company is s to 5.4% state unemployment taxes and 0.8% federal unemployment taxes on the first $7,000 of gross earnings. v (a) 2 Your answer is partially correct. Try again. Prepare the payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.)

Ramirez Company has the following data for the weekly payroll ending January 31. Hours Hourly Rate Federal Income Tax Withholding Health Employee F Insurance L. Helton 8. 8 9 10 3 $12 $34 $10 R. Kenseth 8. 8 8 8 2 14 37 25 D. Tavaras 10 8 8 9 15 58 25 Employees are paid 1.5 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are 7.65% on the first $127,200 of gross earnings. Ramirez Company is s to 5.4% state unemployment taxes and 0.8% federal unemployment taxes on the first $7,000 of gross earnings. v (a) 2 Your answer is partially correct. Try again. Prepare the payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.)

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section13.1: Recording A Payroll

Problem 1OYO

Related questions

Question

Please just find the FICA taxes. Thank you :)

Transcribed Image Text:preventing automatic updates.

La

Weygandt, Accounting Principles, 13e

FINANCIAL/MANAGERIAL ACCOUNTING (ACC 124/125/201

се

Assignment

Gradebook

ORION

Downloadable eTextbook

ent

CALCULATOR

FULL SCREEN

PRINTER VERSION

1 BACK

Exercise 11-11 a-b (Part Level Submission)

Ramirez Company has the following data for the weekly payroll ending January 31.

Hours

Federal Income

Tax Withholding

Health

Hourly

Rate

Employee

T.

F

Insurance

L. Helton

8

8

9

10

3

$12

$34

$10

R. Kenseth

8

8.

8

8.

8

2.

14

37

25

D. Tavaras

10

8

15

58

25

Employees are paid 1.5 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are 7.65% on the first $127,200 of gross earnings. Ramirez Company is su

to 5.4% state unemployment taxes and 0.8% federal unemployment taxes on the first $7,000 of gross earnings.

v (a)

Your answer is partially correct. Try again.

Prepare the payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.)

RAMIREZ COMPANY

Payroll Register

For the Week Ending January 31

Deductions

Earnings

Employee Total Hours

Regular

Overtime

Gross Pay

FICA Taxes

Federal Income Taxes Health Insurance

Total

Net Pay

L. Helton

480

108

588

34

10

46

Version

olicy I 9 2000-2021 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc.

Transcribed Image Text:n.wileyplus.com/edugen

mainir.uni

Some apps currently in use are

preventing automatic updates.

L.

Weygandt, Accounting Principles, 13e

FINANCIAL/MANAGERIAL ACCOUNTING (ACC 124/125/20

ctice

Assignment

Gradebook

ORION

Downloadable eTextbook

ment

CALCULATOR

FULL SCREEN

PRINTER VERSION

1 BACK

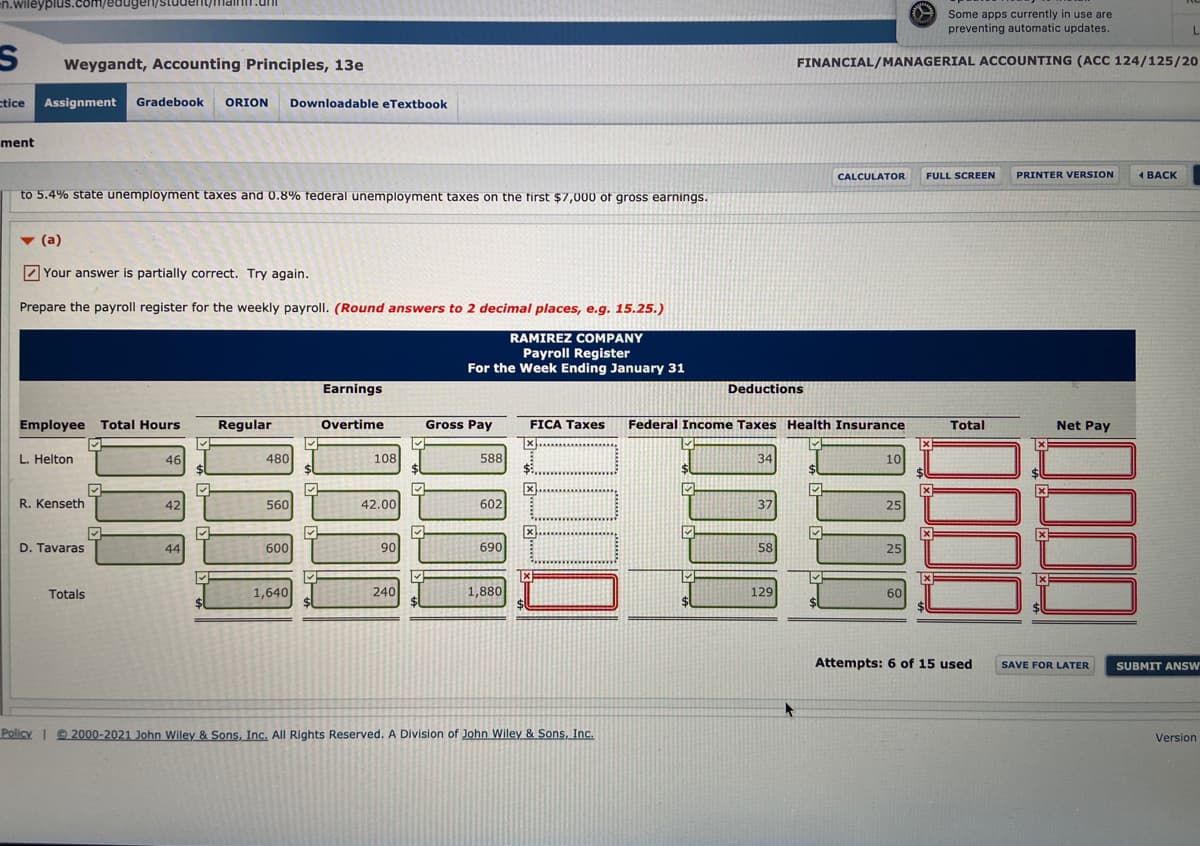

to 5.4% state unemployment taxes and 0.8% tederal unemployment taxes on the first $7,000 ot gross earnings.

v (a)

Z Your answer is partially correct. Try again.

Prepare the payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.)

RAMIREZ COMPANY

Payroll Register

For the Week Ending January 31

Earnings

Deductions

Employee Total Hours

Regular

Overtime

Gross Pay

FICA Taxes

Federal Income Taxes Health Insurance

Total

Net Pay

L. Helton

46

480

108

588

34

10

R. Kenseth

42

560

42.00

602

37

25

D. Tavaras

44

600

90

690

58

25

1,640

1,880

Totals

240

129

60

Attempts: 6 of 15 used

SAVE FOR LATER

SUBMIT ANSW

Policy I © 2000-2021 John wiley & Sons, Inc, All Rights Reserved. A Division of John Wiley & Sons, Inc.

Version

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,