rand plc generates profit after tax of 15 per cent on sl apital structure is as follows: Ordinary shares of 50p each 2 Reserves 4

rand plc generates profit after tax of 15 per cent on sl apital structure is as follows: Ordinary shares of 50p each 2 Reserves 4

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 12P

Related questions

Question

Kindly help me

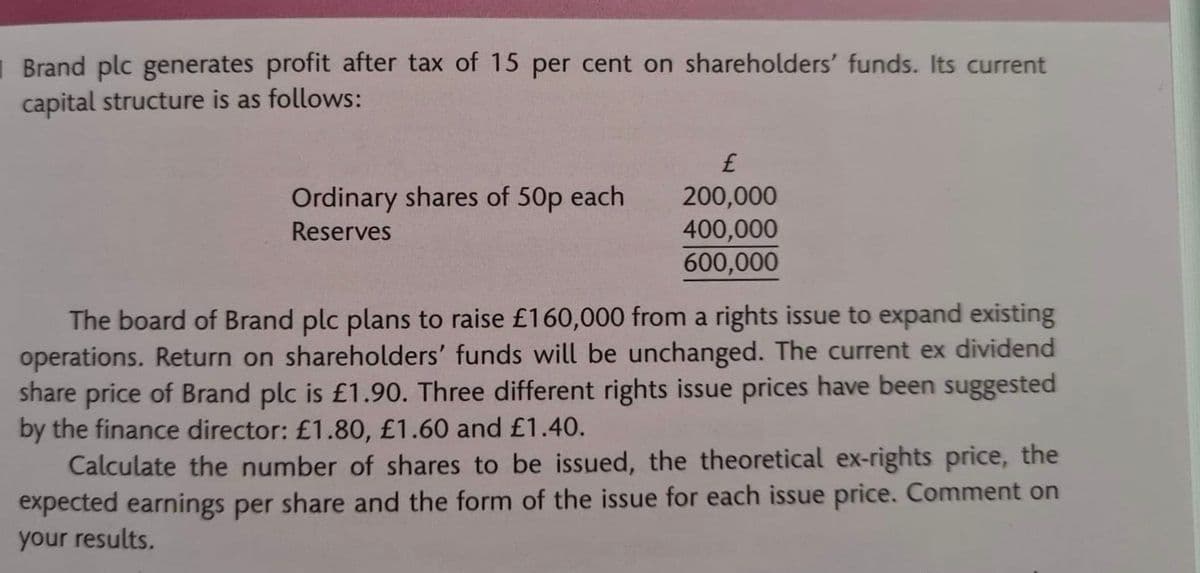

Transcribed Image Text:I Brand plc generates profit after tax of 15 per cent on shareholders' funds. Its current

capital structure is as follows:

£

Ordinary shares of 50p each

200,000

400,000

600,000

Reserves

The board of Brand plc plans to raise £160,000 from a rights issue to expand existing

operations. Return on shareholders' funds will be unchanged. The current ex dividend

share price of Brand plc is £1.90. Three different rights issue prices have been suggested

by the finance director: £1.80, £1.60 and £1.40.

Calculate the number of shares to be issued, the theoretical ex-rights price, the

expected earnings per share and the form of the issue for each issue price. Comment on

your results.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT