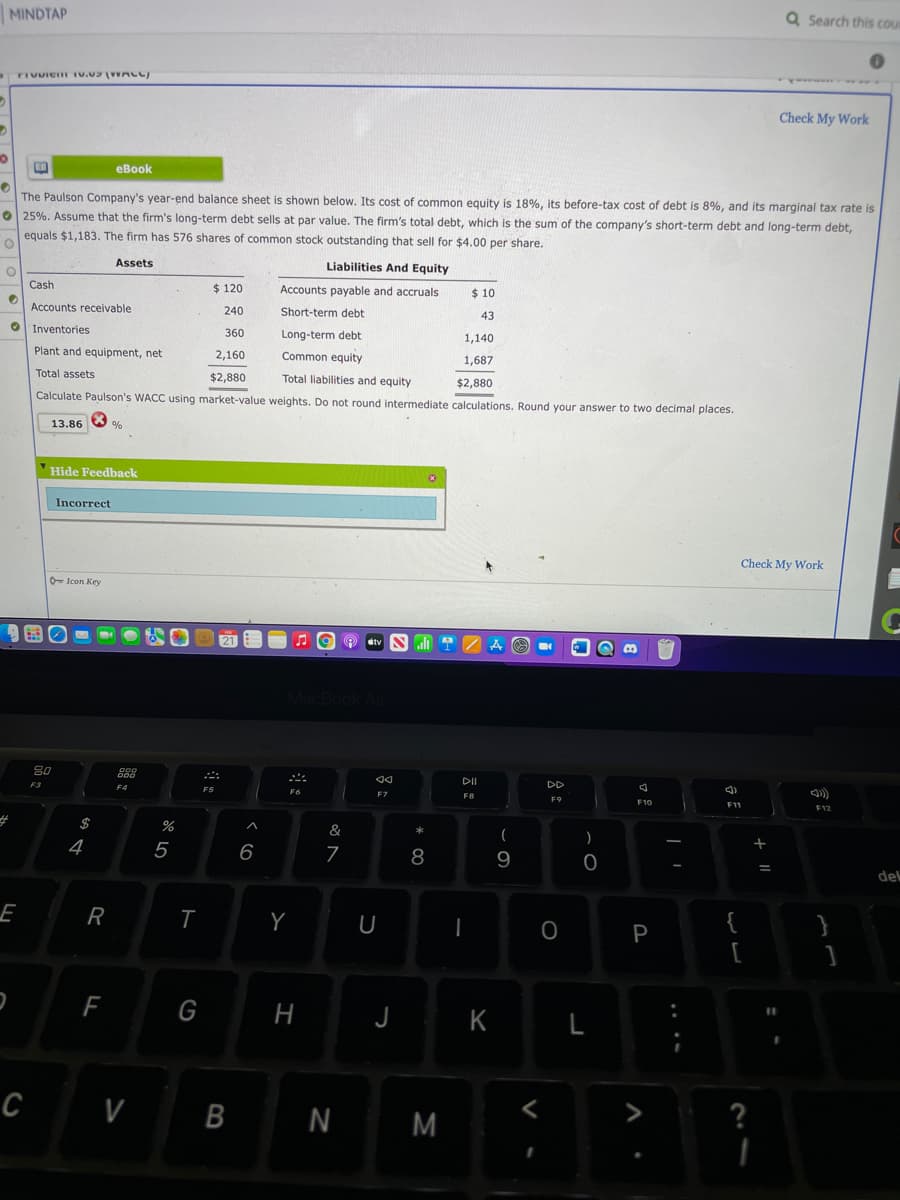

The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 18%, its before-tax cost of debt is 8%, and its marginal tax rate is 25%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,183. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Assets Liabilities And Equity Cash $ 120 Accounts payable and accruals $ 10 Accounts receivable 240 Short-term debt 43 O Inventories 360 Long-term debt 1,140 Plant and equipment, net 2,160 Common equity 1,687 Total assets $2,880 Total liabilities and equity $2,880 Calculate Paulson's WACC using market-value weights. Do not round intermediate calculations. Round your answer to two decimal places. 13.86 %

The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 18%, its before-tax cost of debt is 8%, and its marginal tax rate is 25%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,183. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Assets Liabilities And Equity Cash $ 120 Accounts payable and accruals $ 10 Accounts receivable 240 Short-term debt 43 O Inventories 360 Long-term debt 1,140 Plant and equipment, net 2,160 Common equity 1,687 Total assets $2,880 Total liabilities and equity $2,880 Calculate Paulson's WACC using market-value weights. Do not round intermediate calculations. Round your answer to two decimal places. 13.86 %

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter12: Valuation: Cash-flow Based Approaches

Section: Chapter Questions

Problem 1LIC

Related questions

Question

100%

Transcribed Image Text:MINDTAP

Q Search this cou

Check My Work

еВook

The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 18%, its before-tax cost of debt is 8%, and its marginal tax rate is

O 25%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt,

equals $1,183. The firm has 576 shares of common stock outstanding that sell for $4.00 per share.

Assets

Liabilities And Equity

Cash

$ 120

Accounts payable and accruals

$ 10

Accounts receivable

240

Short-term debt

43

Inventories

360

Long-term debt

1,140

Plant and equipment, net

2,160

Common equity

1,687

Total assets

$2,880

Total liabilities and equity

$2,880

Calculate Paulson's WACC using market-value weights. Do not round intermediate calculations. Round your answer to two decimal places.

13.86

%

Hide Feedback

Incorrect

Check My Work

O- Icon Key

80

DII

DD

E3

F4

F6

F7

F10

F12

%23

$

&

*

4

5

6

7

8

9

del

E

R

Y

{

P

G

H

K

V

B

N M

-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning