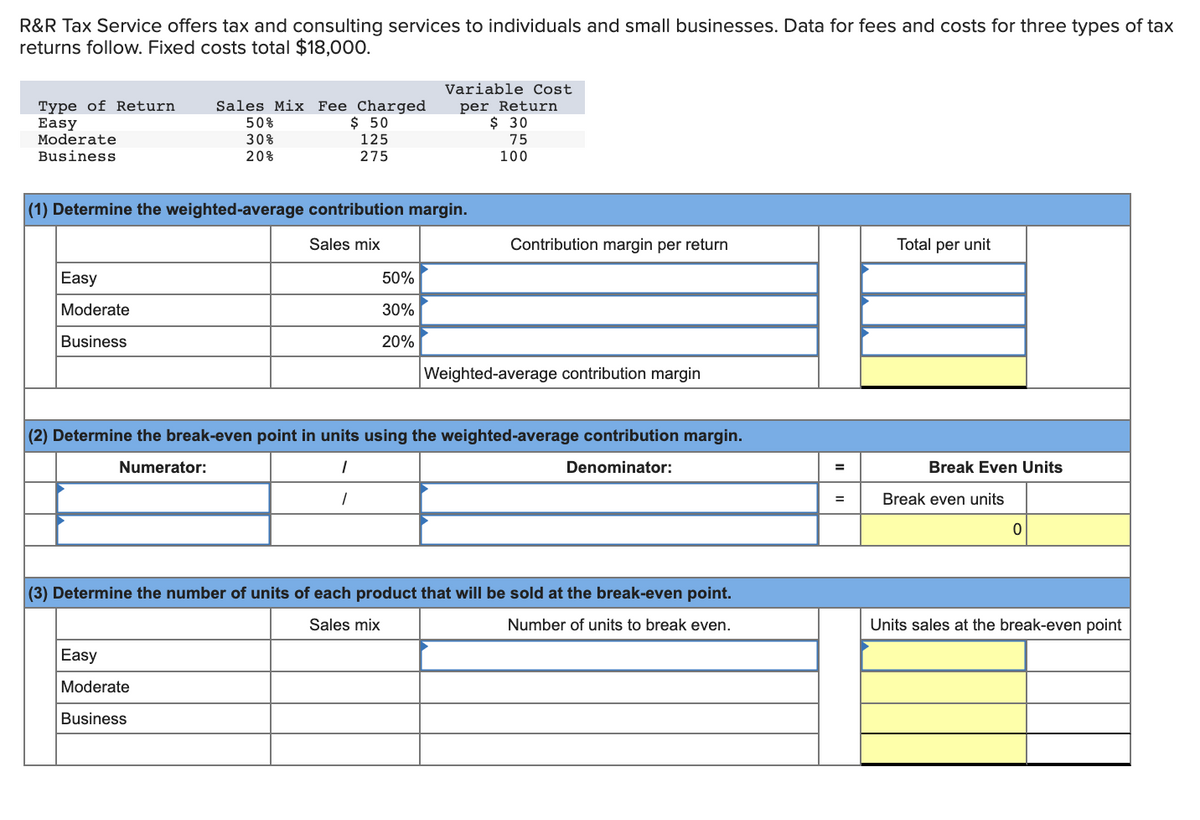

R&R Tax Service offers tax and consulting services to individuals and small businesses. Data for fees and costs for three types of tax returns follow. Fixed costs total $18,000. Variable Cost Type of Return Easy Moderate Business Sales Mix Fee Charged $ 50 125 275 per Return $ 30 50% 30% 20% 75 100 (1) Determine the weighted-average contribution margin. Sales mix Contribution margin per return Total per unit Easy 50% Moderate 30% Business 20% Weighted-average contribution margin (2) Determine the break-even point in units using the weighted-average contribution margin. Numerator: Denominator: Break Even Units %3D Break even units %3D (3) Determine the number of units of each product that will be sold at the break-even point. Sales mix Number of units to break even. Units sales at the break-even point Easy Moderate Business

R&R Tax Service offers tax and consulting services to individuals and small businesses. Data for fees and costs for three types of tax returns follow. Fixed costs total $18,000. Variable Cost Type of Return Easy Moderate Business Sales Mix Fee Charged $ 50 125 275 per Return $ 30 50% 30% 20% 75 100 (1) Determine the weighted-average contribution margin. Sales mix Contribution margin per return Total per unit Easy 50% Moderate 30% Business 20% Weighted-average contribution margin (2) Determine the break-even point in units using the weighted-average contribution margin. Numerator: Denominator: Break Even Units %3D Break even units %3D (3) Determine the number of units of each product that will be sold at the break-even point. Sales mix Number of units to break even. Units sales at the break-even point Easy Moderate Business

Chapter22: S Corporations

Section: Chapter Questions

Problem 16CE

Related questions

Question

Can you assist me with this question please and thank you.

Transcribed Image Text:R&R Tax Service offers tax and consulting services to individuals and small businesses. Data for fees and costs for three types of tax

returns follow. Fixed costs total $18,000.

Variable Cost

per Return

$ 30

Type of Return

Easy

Moderate

Business

Sales Mix Fee Charged

$ 50

125

275

50%

30%

75

20%

100

(1) Determine the weighted-average contribution margin.

Sales mix

Contribution margin per return

Total per unit

Easy

50%

Moderate

30%

Business

20%

Weighted-average contribution margin

(2) Determine the break-even point in units using the weighted-average contribution margin.

Numerator:

Denominator:

Break Even Units

Break even units

(3) Determine the number of units of each product that will be sold at the break-even point.

Sales mix

Number of units to break even.

Units sales at the break-even point

Easy

Moderate

Business

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you