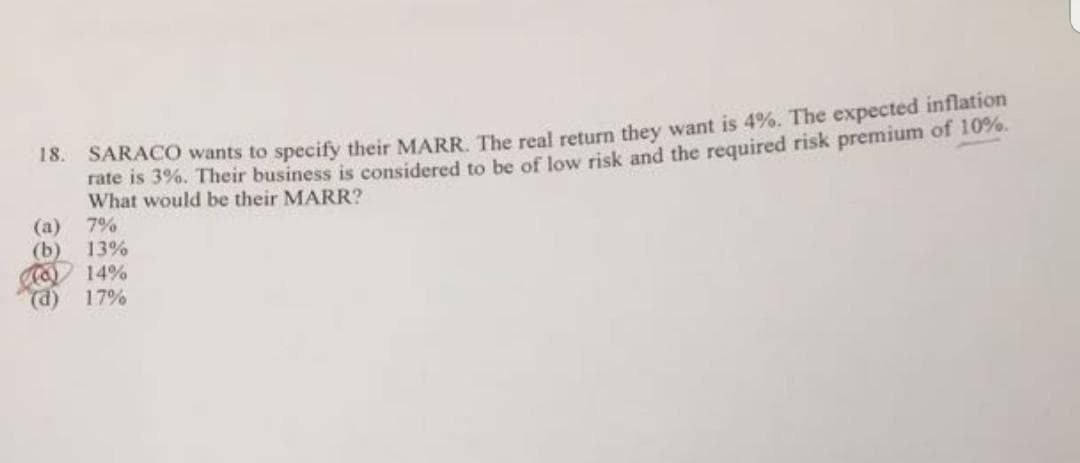

rate is 3%. Their business is considered to be of low risk and the required risk premium of 10%. What would be their MARR? 13. SARAC0 wants to specify their MARR. The real return they want is 4%. The expected inflation (a) 7% (b) 13% 14% d) 17%

Q: The investors expect a 5 % rate of inflation in the future. The real risk-free rate is 3 % and the…

A: Real risk free rate = 3% Market risk premium = 5% Beta = 2 Inflation rate = 5%

Q: The real risk-free rate is 2.36%, inflation is expected to be 4.75% this year, and the maturity risk…

A: Risk free rate = 2.36% Inflation rate = 4.75% Maturity risk premium = 0%

Q: An investment offers a total return of 12 percent over the coming year. Janice Yellen thinks the…

A: Formulas: (1+Nominal return) = (1+Real return) *(1+Inflation rate)

Q: The following questions are about TIPS. a. What is meant by the “real rate”? b. What is meant by the…

A: Note: Since you have posted a question with multiple subparts, we will solve the first three…

Q: Assume the current 1-year interest rate is 4%, and you expect the 1-year rate to be 5% next year and…

A:

Q: You have surplus funds to lend for a 3-year period. Current coupon rates are as follows: a. 10.0%…

A: Forward rate of return is the balance of the return from the consecutive year to that of the current…

Q: You are given the following information for Wine and Cork Enterprises (WCE): rRF = 4%; rM = 8%; RPM…

A: Given the following information: Risk free rate (rRF): 4% Market rate of return (rM): 8% Risk…

Q: uppose the real risk-free rate is 3.00%, the average expected future inflation rate is 6.60%, and a…

A: Here, Details of Ques-A: Real Risk Free Interest Rate is 3% Inflation Rate is 6.60% Maturity Risk…

Q: What is Rewind's beta if the risk-free rate is 6 percent?

A: Expected Return: It is the minimum return for the equity share holders for investing in the…

Q: Danica Tribbiano believes expected inflation is 2.25% and the real rate of return is 2.75%. Based on…

A: Here, Inflation rate = 2.25% Real rate of return = 2.75% To Find: Risk-free rate of return =?

Q: Calculate the required rate of return for Manning Enterprises assuming that investors expect a 3.5%…

A: Required return is calculated using the CAPM model capital asset pricing model according to which…

Q: Suppose the real risk-free rate is 4.20%, the average expected future inflation rate is 4.20%, and a…

A: Required Rate of Return: It is the rate which should be the minimum earning on an investment to keep…

Q: ou read in The Wall Street Journal that 30-day T-bills are currently yielding 4.5%. Your…

A: The real risk-free rate of return is the return that is received on the risk free assets over the…

Q: Action Probability Expected Return Invest in equities .6 $50,000 .4 - $30,000 $ 5,000 Note that…

A: Investing in equities has two scenarios with 60% an 40% probabilities, and $50000 and - $30000…

Q: Furniture Inc. has a beta coefficient of 0.7 and a required rate of return of 15%. The market risk…

A: We need to use CAPM to calculate required rate of return. The equation is Required rate of return…

Q: what is the real risk-free rate of return? Round your answer to two decimal places.

A: Risk free rate of return is the return which an investor earns by investing the money in risk free…

Q: interest is 6 percent and the expected retun on the market is 11 percent. What is the market risk…

A: Market risk premium is the difference between expected return from market and risk free rate. Market…

Q: Jersey Jewel Mining has a beta coefficient of 1.1. Currently the risk-free rate is 4 percent and the…

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: You read in The Wall Street Journal that 30-day T-bills are currentlyyielding 5.8%. Your…

A: A rate of minimum return that is required by an investor without any risk of losing the money due to…

Q: The following table shows the option of a Business in which the value at time zero means the…

A: Internal Rate of Return (IRR) is the rate at which the net present value of the cash flows is zero.…

Q: Explain why FV of each given problem is valued as 1,000. If the current price is $900; 10% coupon;…

A: The anticipated return earned by holding the bond till maturity is referred to as yield to…

Q: Suppose you have $1 short $5000 worth of Kinston stock and invest the proceeds from your short sale,…

A: Solution:- Return of the portfolio means the return earned on the total money invested. So, return…

Q: The risk-free rate is 3.7% and you believe that the S&P 500's excess return will be 11% over the…

A: CAPM or Capital Asset Pricing Model is the formula that represents the relationship between the…

Q: You read in The Wall Street Journal that 30-day T-bills are currently yielding 4.7%. Your…

A: The current yield on 30-day T-bills is 4.7% and real risk-free rate of return is the rate after…

Q: You read in The Wall Street Journal that 60-day T-bills are currently yielding 9.5%. Your…

A: As there is no probability of loss in these type of risk free rate thus it is free from any kind of…

Q: Investors expect a 2.0% rate of inflation in the future. The real risk-free rate is 1.0%, and the…

A: The minimal profit or return an investor will seek or expect in exchange for taking on the risk of…

Q: On the basis of these data, the real risk-free rate of return is 3% 2% 0% 1%

A: Real risk-free rate refers to the rate of interest that is expected by the investors on the…

Q: the real risk-free rate is 3.50% and the future rate of inflation is expected to be constant at…

A: The below answer is given by two methods , but the appropriate is fist method which is simple rate…

Q: portfolio's expected return

A: 1. Formula to calculate the standard deviation is given by: Variance = probability*Return 1 -…

Q: An investment offers a total return of 11 percent over the coming year. Janice Yellen thins the…

A: Nominal return = 11% Real return = 7%

Q: money supply M is 2,000, and the price level P is 2. If the price level is fixed an money is raised…

A: With change in money supply there will be change in interest rate and there may be increase in…

Q: What is the return of the portfolio will be?

A: Note: Since you have asked multiple questions, we will solve the first question for you. If you want…

Q: A Treasury bill has a bid yield of 5.44% and an ask yield of 5.29%. The bill matures in 69 days.…

A: Given, The face value is $10,000 Time to maturity is 69 days

Q: Uranus has debt is 14 percent tax rate is 35% what is WACc

A: A firm’s Weighted Average Cost of Capital (WACC) represents its total cost of capital from all the…

Q: You are given the following information for Wine and Cork Enterprises (WCE): rRF = 4%; rM = 8%; RPM…

A: Given the following information: Risk free rate (rRF): 4% Market rate of return (rM): 8% Risk…

Q: What's the sharp ratio

A: A person invests his fund in a combination of stocks. The total return and risk of a person is that…

Q: Consider the equity linked note again. If we assume the current stock price is So = $100, the strike…

A: Solution- Given that Current stock price=$100 Strike price=93%* S0 Risk free interest rate=10%…

Q: Assuming you have an inflation linker that pays an annual coupon of 2.5% every half a year and the…

A: Principal = 100 Coupon rate = 2.5% Semi annual coupon amount = 100*0.025/2 = 1.25 Real yield = 3%…

Q: You read in The Wall Street Journal that 30-day T-bills are currently yielding 4%. Your…

A: Treasury bills (T-bills) are a kind of short term debt that is issued by the government with the aim…

Q: The call has a premium of $10 and a strike price of $60. You decide to go on margin, meaning that…

A: Call premium is the price paid by the investor for purchasing each single call option. Call option…

Q: The real risk-free rate, r*, is 1.7%. Inflation is expected toaverage 1.5% a year for the next 4…

A: The question is based on the concept of quoted nominal interest rate on a debt security, the nominal…

Step by step

Solved in 3 steps

- 1. Your investment has a 20% chance of earning a 10% rate of return, a 70% chance of earning a 30% rate of return, and a 10% chance of losing 15%. What is the standard deviation on this investment? 2. If you are promised a nominal return of 12.5% on a 1-year investment, and you expect the rate of inflation to be 8.5%, what real rate do you expect to earn? 3. Treasury bills are paying a 2.5% rate of return. A risk-averse investor with a risk aversion of A = 1.9 should invest entirely in a risky portfolio with a standard deviation of 5% only if the risky portfolio's expected return is at least NOTE: All answers should be express in strictly numerical terms. For example, if the answer is 5%, write 0.05#39 Kara Zor-El has been advised that the Build Up Method is the most appropriate for determining a required rate of return for Steel, Inc. Currently, the Treasury band rate is 2.50%, the equity risk premium is 6.75%, the correlation risk premium is 5.75%, the micro-cap risk premium is 4.50%, the earnings risk premium is 3.25%, the start-up risk premium is 5.50%, and the seasonal risk premium is 3.75%. Using the Build-Up Method for determining the cost of capital, what is the required rate of return for Steel, Inc.? O A 13.75% O B. 17.00% O C. 18.25% O D. 19.25% O E. 20.50%HR Industries (HRI) has a beta of 1.6; LR Industries’s(LRI) beta is 0.8. The risk-free rate is 6%, and the required rate of return on an averagestock is 13%. The expected rate of inflation built into rRF falls by 1.5 percentage points, thereal risk-free rate remains constant, the required return on the market falls to 10.5%, and allbetas remain constant. After all of these changes, what will be the difference in the requiredreturns for HRI and LRI?

- Investors expect a 2.0% rate of inflation in the future. The real risk-free rate is 1.0%, and the market risk premium is 6.0%. Isbell Enterprises has a beta of 1.1. Calculate the required rate of return for Isbell Enterprises. (Answer as a percent with 2 decimal places. For example, 10 percent should be entered as 10.00. Do not use the % sign.)Paycheck, Inc. has a beta of 1.19. If the market return is expected to be 13.50 percent and the risk-free rate is 6.70 percent, what is Paycheck’s risk premium? (Round your answer to 2 decimal places.)Okik Inc. has a beta coefficient of 1.0 and a required rate of return of 12 percent. The market risk premium is currently 8 percent. If the risk free rate increases by 2 percentage points, and Okik Inc. acquires new assets which increase its beta by 50 percent, what will be Okik’s new required rate of return? Give your answer in whole number, disregard the % sign e.g. 25% should be written as 25.

- Treasury bill yield is 10%, ABC company’s expected return for the next year is 18%, beta of ABC company is 2. If everything is in equilibrium as required by CAPM, what is the market’s expected return for the next year? a. 14% b. 8.5% c. 11% d. 21%Kollo Enterprises has a beta of 0.70, the real risk-free rate is 2.00%, investors expect a 3.00% future inflation rate, and the market risk premium is 4.70%. What is Kollo's required rate of return? Do not round your intermediate calculations.Suppose 1-year T-bills currently yield 7.40% and the future inflation rate is expected to be constant at 3.00% per year. What is the real risk-free rate of return, r*? Disregard any cross-product terms, i.e., if averaging is required, use the arithmetic average. a. 4.40% b. 7.40% c. 10.40% d. 7.62% e. 5.20%

- Currently, the nominal risk-free rate is 1.64 percent, the market risk premium is 8 percent, and the beta for Starbucks stock is 0.52. Inflation is expected to decrease by 0.3 percentage points and investors' risk aversion is expected to increase by 3.2 percentage points. If these changes happen, what would investors require as a return on Starbucks' stock?Dhofar Energy Services has a Beta = 1.18 The risk-free rate on a treasury bill is currently 4.4% and the cost of equity has 20.70%. What is the market return? Select one: a. 0.2149 b. 0.1821 c. 0.2169 d. 1.1381 e. All the given choices are not correctTreasury bill yield is 10%, ABC company’s expected return for the next year is 18%, beta of ABC company is 2. If everything is in equilibrium as required by CAPM, what is the market’s expected return for the next year? 14% 8.5% 11% 21%