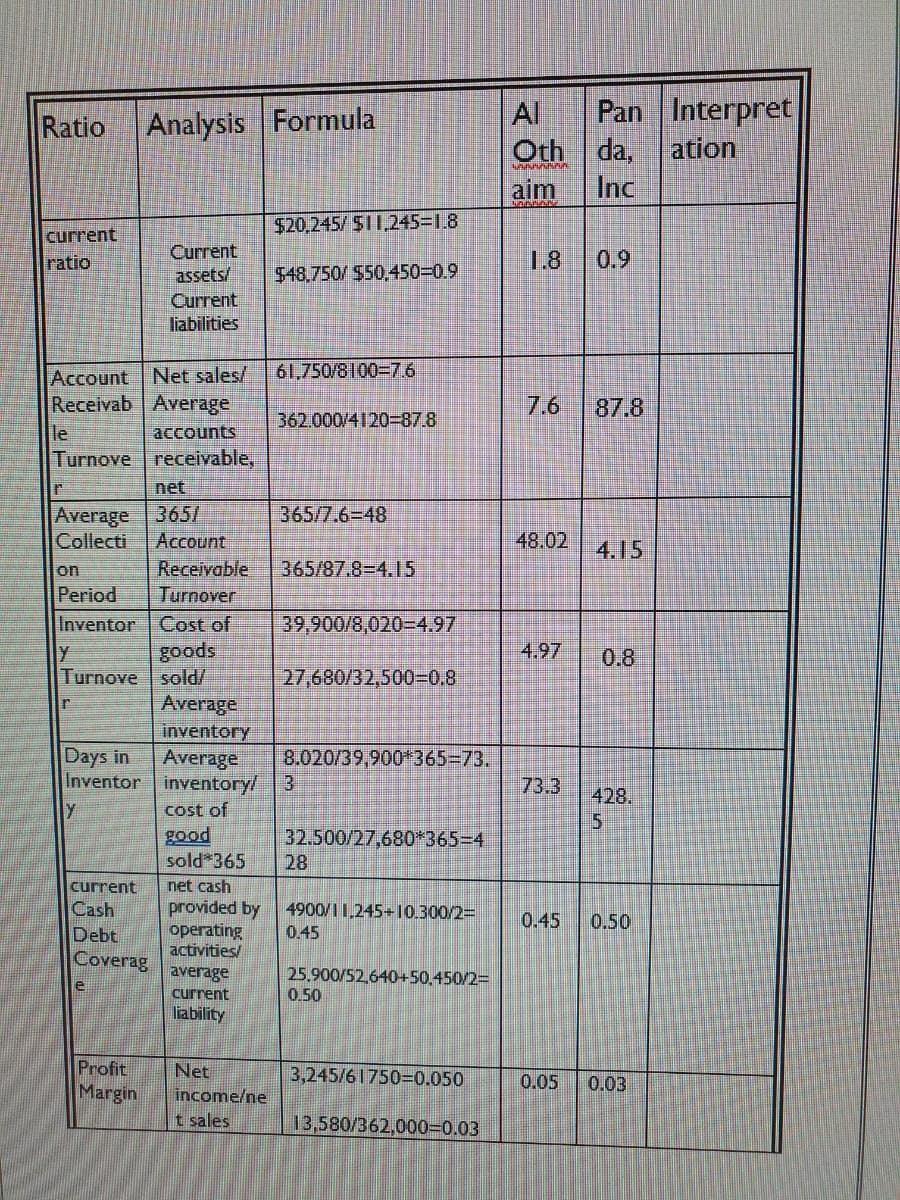

Ratio Analysis Formula current Current ratio assets/ Current liabilities Account Net sales/ Receivab Average le accounts Turnove receivable, net Average 3651 Collecti Account on Receivable Period Turnover Inventor Cost of goods y Turnove sold/ Average inventory Days in Average Inventor inventory/3 cost of good sold 365 current net cash Cash provided by Debt operating activities/ Coverag average e current liability Profit Net Margin income/ne t sales $20,245/ $11,245=1.8 $48,750/ $50,450=0.9 61,750/8100=7.6 362.000/4120=87.8 365/7.6-48 365/87.8-4.15 39,900/8,020-4.97 27,680/32,500=0.8 8.020/39,900*365=73. 32.500/27,680*365=4 28 4900/11,245+10.300/2= 0.45 25,900/52,640+50,450/2= 0.50 3,245/61750=0.050 13,580/362,000=0.03 Al Pan Interpret Oth da, ation wwwnnn aim Inc 00000 0.9 7.6 87.8 48.02 4.15 4.97 0.8 73.3 428. 5 0.45 0.50 0.03 0.05

Ratio Analysis Formula current Current ratio assets/ Current liabilities Account Net sales/ Receivab Average le accounts Turnove receivable, net Average 3651 Collecti Account on Receivable Period Turnover Inventor Cost of goods y Turnove sold/ Average inventory Days in Average Inventor inventory/3 cost of good sold 365 current net cash Cash provided by Debt operating activities/ Coverag average e current liability Profit Net Margin income/ne t sales $20,245/ $11,245=1.8 $48,750/ $50,450=0.9 61,750/8100=7.6 362.000/4120=87.8 365/7.6-48 365/87.8-4.15 39,900/8,020-4.97 27,680/32,500=0.8 8.020/39,900*365=73. 32.500/27,680*365=4 28 4900/11,245+10.300/2= 0.45 25,900/52,640+50,450/2= 0.50 3,245/61750=0.050 13,580/362,000=0.03 Al Pan Interpret Oth da, ation wwwnnn aim Inc 00000 0.9 7.6 87.8 48.02 4.15 4.97 0.8 73.3 428. 5 0.45 0.50 0.03 0.05

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.1E

Related questions

Question

Compare the Solvency, Liquidity and Profitability for the two companies

Transcribed Image Text:Ratio Analysis Formula

current

Current

ratio

assets/

Current

liabilities

Account

Net sales/

Receivab Average

le

accounts

Turnove

receivable,

T

net

Average

365/

Collecti

Account

on

Receivable

Period Turnover

Inventor Cost of

goods

y

Turnove

sold/

r

Average

inventory

Days in

Average

Inventor

inventory/

cost of

good

sold 365

current

net cash

Cash

provided by

Debt

operating

activities/

Coverag

average

current

liability

Profit

Net

Margin

income/ne

t sales

$20,245/$11,245=1.8

$48,750/ $50,450=0.9

61,750/8100=7.6

362.000/4120-87.8

365/7.6-48

365/87.8-4.15

39,900/8,020-4.97

27,680/32,500=0.8

8.020/39,900*365-73.

3

32.500/27,680*365-4

28

4900/11,245+10.300/2=

0.45

25,900/52,640+50,450/2=

0.50

3,245/61750=0.050

13,580/362,000=0.03

AI Pan Interpret

Oth

da,

ation

aim

Inc

1.8 0.9

7.6 87.8

48.02

4.15

4.97 0.8

73.3

428.

5

0.45 0.50

0.03

0.05

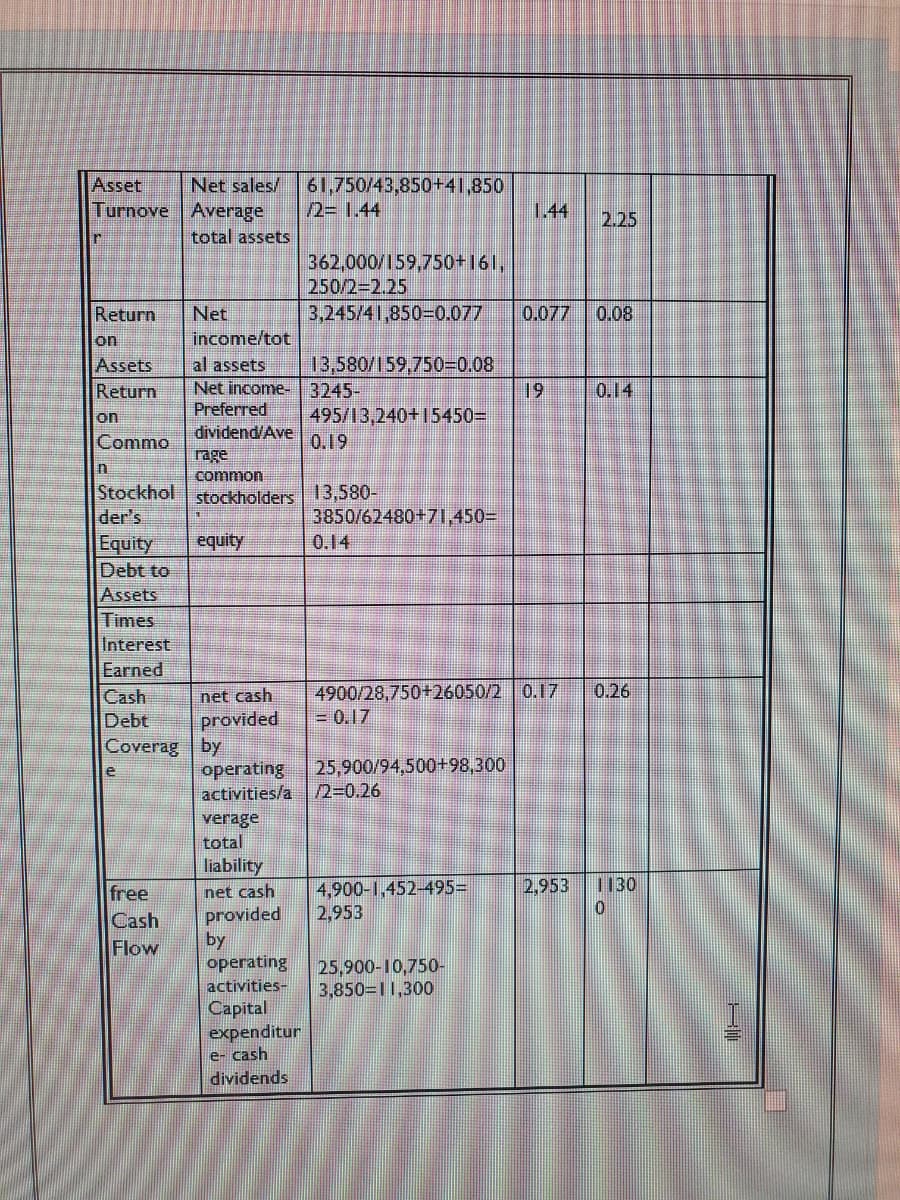

Transcribed Image Text:Net sales/

Asset

Turnove

61,750/43,850+41,850

/2=1.44

Average

1.44

2.25

r

total assets

362,000/159,750+161,

250/2=2.25

Return

Net

3,245/41,850-0.077 0.077 0.08

on

income/tot

Assets

al assets

13,580/159,750=0.08

Return

3245-

19

0.14

Net income-

Preferred

dividend/Ave

on

495/13,240+15450=

Commo

0.19

rage

n

common

Stockhol stockholders 13,580-

der's

3850/62480+71,450=

Equity equity

0.14

Debt to

Assets

Times

Interest

Earned

Cash

4900/28,750+26050/2 0.17 0.26

= 0.17

Debt

Coverag by

2,953 1130

free

0

Cash

Flow

net cash

provided

operating 25,900/94,500+98,300

activities/a /2=0.26

verage

total

liability

net cash

4,900-1,452-495=

provided

2,953

by

operating 25,900-10,750-

activities- 3,850-11,300

Capital

expenditur

e- cash

dividends

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning