Ratios For Amazon.com, Inc. (AMZN) 2018 2019 Current Ratio Acid test Ratio Ave. Days Collection Total Debt to Total Assets Return on Equity Asset Turnover Profit Margin on net Sales Inventory Turnover***

Ratios For Amazon.com, Inc. (AMZN) 2018 2019 Current Ratio Acid test Ratio Ave. Days Collection Total Debt to Total Assets Return on Equity Asset Turnover Profit Margin on net Sales Inventory Turnover***

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

Ratios For Amazon.com, Inc. (AMZN)

2018 2019

| Current Ratio | ||||

| Acid test Ratio | ||||

| Ave. Days Collection | ||||

| Total Debt to Total Assets | ||||

| Asset Turnover | ||||

| Profit Margin on net Sales | ||||

| Inventory Turnover*** |

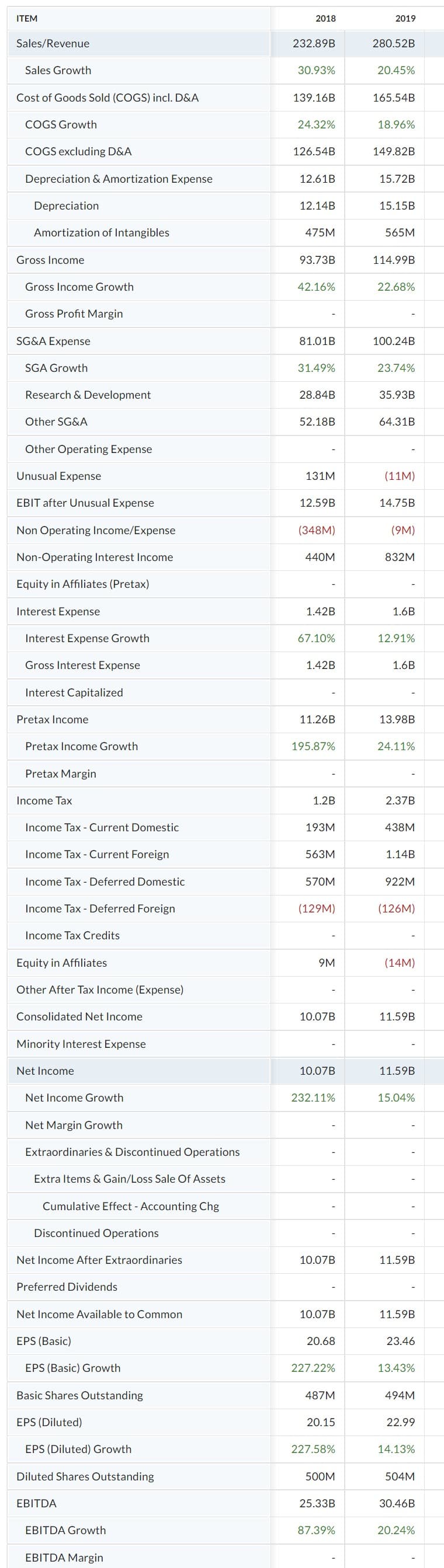

Transcribed Image Text:ITEM

2018

2019

Sales/Revenue

232.89B

280.52B

Sales Growth

30.93%

20.45%

Cost of Goods Sold (COGS) incl. D&A

139.16B

165.54B

COGS Growth

24.32%

18.96%

COGS excluding D&A

126.54B

149.82B

Depreciation & Amortization Expense

12.61B

15.72B

Depreciation

12.14B

15.15B

Amortization of Intangibles

475M

565M

Gross Income

93.73B

114.99B

Gross Income Growth

42.16%

22.68%

Gross Profit Margin

SG&A Expense

81.01B

100.24B

SGA Growth

31.49%

23.74%

Research & Development

28.84B

35.93B

Other SG&A

52.18B

64.31B

Other Operating Expense

Unusual Expense

131M

(11M)

EBIT after Unusual Expense

12.59B

14.75B

Non Operating Income/Expense

(348M)

(9M)

Non-Operating Interest Income

440M

832M

Equity in Affiliates (Pretax)

Interest Expense

1.42B

1.6B

Interest Expense Growth

67.10%

12.91%

Gross Interest Expense

1.42B

1.6B

Interest Capitalized

Pretax Income

11.26B

13.98B

Pretax Income Growth

195.87%

24.11%

Pretax Margin

Income Tax

1.2B

2.37B

Income Tax - Current Domestic

193M

438M

Income Tax - Current Foreign

563M

1.14B

Income Tax - Deferred Domestic

570M

922M

Income Tax - Deferred Foreign

(129M)

(126M)

Income Tax Credits

Equity in Affiliates

9M

(14M)

Other After Tax Income (Expense)

Consolidated Net Income

10.07B

11.59B

Minority Interest Expense

Net Income

10.07B

11.59B

Net Income Growth

232.11%

15.04%

Net Margin Growth

Extraordinaries & Discontinued Operations

Extra Items & Gain/Loss Sale Of Assets

Cumulative Effect - Accounting Chg

Discontinued Operations

Net Income After Extraordinaries

10.07B

11.59B

Preferred Dividends

Net Income Available to Common

10.07B

11.59B

EPS (Basic)

20.68

23.46

EPS (Basic) Growth

227.22%

13.43%

Basic Shares Outstanding

487M

494M

EPS (Diluted)

20.15

22.99

EPS (Diluted) Growth

227.58%

14.13%

Diluted Shares Outstanding

500M

504M

EBITDA

25.33B

30.46B

EBITDA Growth

87.39%

20.24%

EBITDA Margin

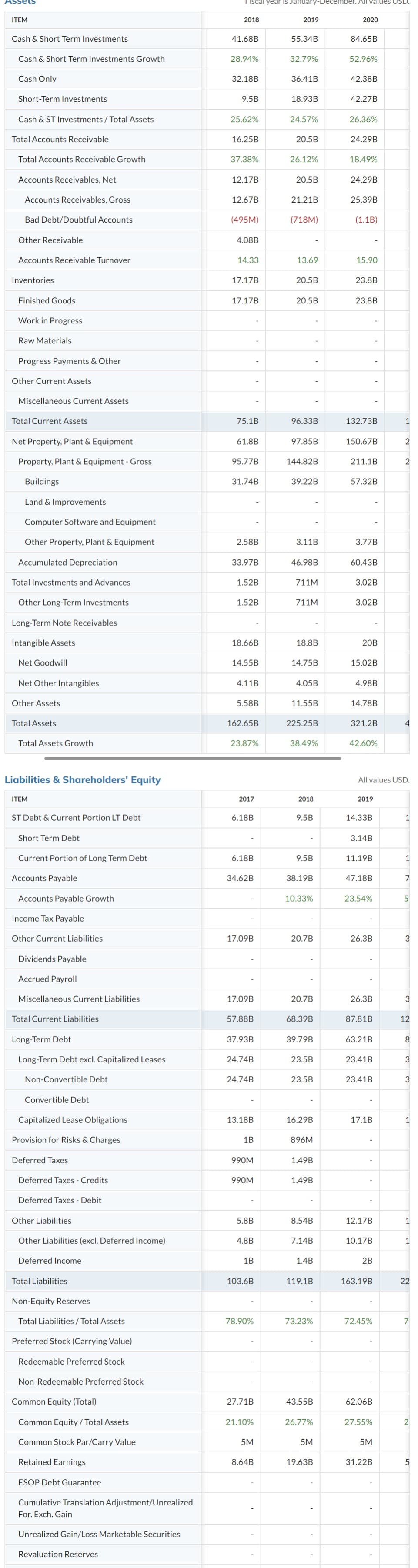

Transcribed Image Text:Assets

Fiscal year is January-December. All Values USD.

ITEM

2018

2019

2020

Cash & Short Term Investments

41.68B

55.34B

84.65B

Cash & Short Term Investments Growth

28.94%

32.79%

52.96%

Cash Only

32.18B

36.41B

42.38B

Short-Term Investments

9.5B

18.93B

42.27B

Cash & ST Investments / Total Assets

25.62%

24.57%

26.36%

Total Accounts Receivable

16.25B

20.5B

24.29B

Total Accounts Receivable Growth

37.38%

26.12%

18.49%

Accounts Receivables, Net

12.17B

20.5B

24.29B

Accounts Receivables, Gross

12.67B

21.21B

25.39B

Bad Debt/Doubtful Accounts

(495M)

(718M)

(1.1B)

Other Receivable

4.08B

Accounts Receivable Turnover

14.33

13.69

15.90

Inventories

17.17B

20.5B

23.8B

Finished Goods

17.17B

20.5B

23.8B

Work in Progress

Raw Materials

Progress Payments & Other

Other Current Assets

Miscellaneous Current Assets

Total Current Assets

75.1B

96.33B

132.73B

1

Net Property, Plant & Equipment

61.8B

97.85B

150.67B

Property, Plant & Equipment - Gross

95.77B

144.82B

211.1B

Buildings

31.74B

39.22B

57.32B

Land & Improvements

Computer Software and Equipment

Other Property, Plant & Equipment

2.58B

3.11B

3.77B

Accumulated Depreciation

33.97B

46.98B

60.43B

Total Investments and Advances

1.52B

711M

3.02B

Other Long-Term Investments

1.52B

711M

3.02B

Long-Term Note Receivables

Intangible Assets

18.66B

18.8B

20B

Net Goodwill

14.55B

14.75B

15.02B

Net Other Intangibles

4.11B

4.05B

4.98B

Other Assets

5.58B

11.55B

14.78B

Total Assets

162.65B

225.25B

321.2B

Total Assets Growth

23.87%

38.49%

42.60%

Liabilities & Shareholders' Equity

All values USD.

ITEM

2017

2018

2019

ST Debt & Current Portion LT Debt

6.18B

9.5B

14.33B

1

Short Term Debt

3.14B

Current Portion of Long Term Debt

6.18B

9.5B

11.19B

1

Accounts Payable

34.62B

38.19B

47.18B

7

Accounts Payable Growth

10.33%

23.54%

50

Income Tax Payable

Other Current Liabilities

17.09B

20.7B

26.3B

3

Dividends Payable

Accrued Payroll

Miscellaneous Current Liabilities

17.09B

20.7B

26.3B

Total Current Liabilities

57.88B

68.39B

87.81B

12

Long-Term Debt

37.93B

39.79B

63.21B

8

Long-Term Debt excl. Capitalized Leases

24.74B

23.5B

23.41B

Non-Convertible Debt

24.74B

23.5B

23.41B

3

Convertible Debt

Capitalized Lease Obligations

13.18B

16.29B

17.1B

1

Provision for Risks & Charges

1B

896M

Deferred Taxes

990M

1.49B

Deferred Taxes - Credits

990M

1.49B

Deferred Taxes - Debit

Other Liabilities

5.8B

8.54B

12.17B

Other Liabilities (excl. Deferred Income)

4.8B

7.14B

10.17B

1

Deferred Income

1B

1.4B

2B

Total Liabilities

103.6B

119.1B

163.19B

22

Non-Equity Reserves

Total Liabilities / Total Assets

78.90%

73.23%

72.45%

7

Preferred Stock (Carrying Value)

Redeemable Preferred Stock

Non-Redeemable Preferred Stock

Common Equity (Total)

27.71B

43.55B

62.06B

Common Equity/Total Assets

21.10%

26.77%

27.55%

Common Stock Par/Carry Value

5M

5M

5M

Retained Earnings

8.64B

19.63B

31.22B

ESOP Debt Guarantee

Cumulative Translation Adjustment/Unrealized

For. Exch. Gain

Unrealized Gain/Loss Marketable Securities

Revaluation Reserves

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning