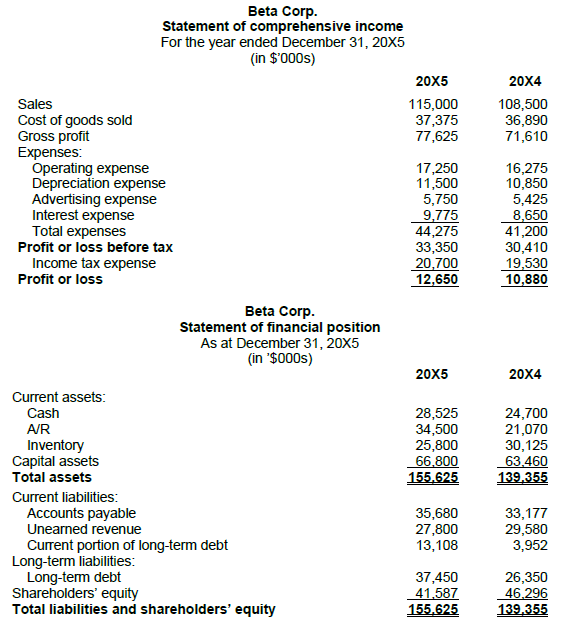

Select financial information for Beta Corp. for the fiscal years ending December 20X4 and 20X5 is as follows:

please find the attached image 1 and 2

5. Beta Corp. has calculated the following asset management ratios:

Asset management 20X5 20X4

A/R turnover 3.3 5.1

Inventory turnover 1.4 1.2

Based on the above ratios, which of the following statements is true?

a) Beta was more efficient in collecting its credit sales from customers in 20X5 than in the prior year. It was also more efficient in turning inventory into sales than in the prior year.

b) Beta was less efficient in collecting its credit sales from customers in 20X5 than in the prior year. It was also less efficient in turning inventory into sales than in the prior year.

c) Beta was less efficient in collecting its credit sales from customers in 20X5 than in the prior year. However, it was more efficient in turning inventory into sales than in the prior year.

d) Beta was more efficient in collecting its credit sales from customers in 20X5 than in the prior year. However, it was less efficient in turning inventory into sales than in the prior year.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps