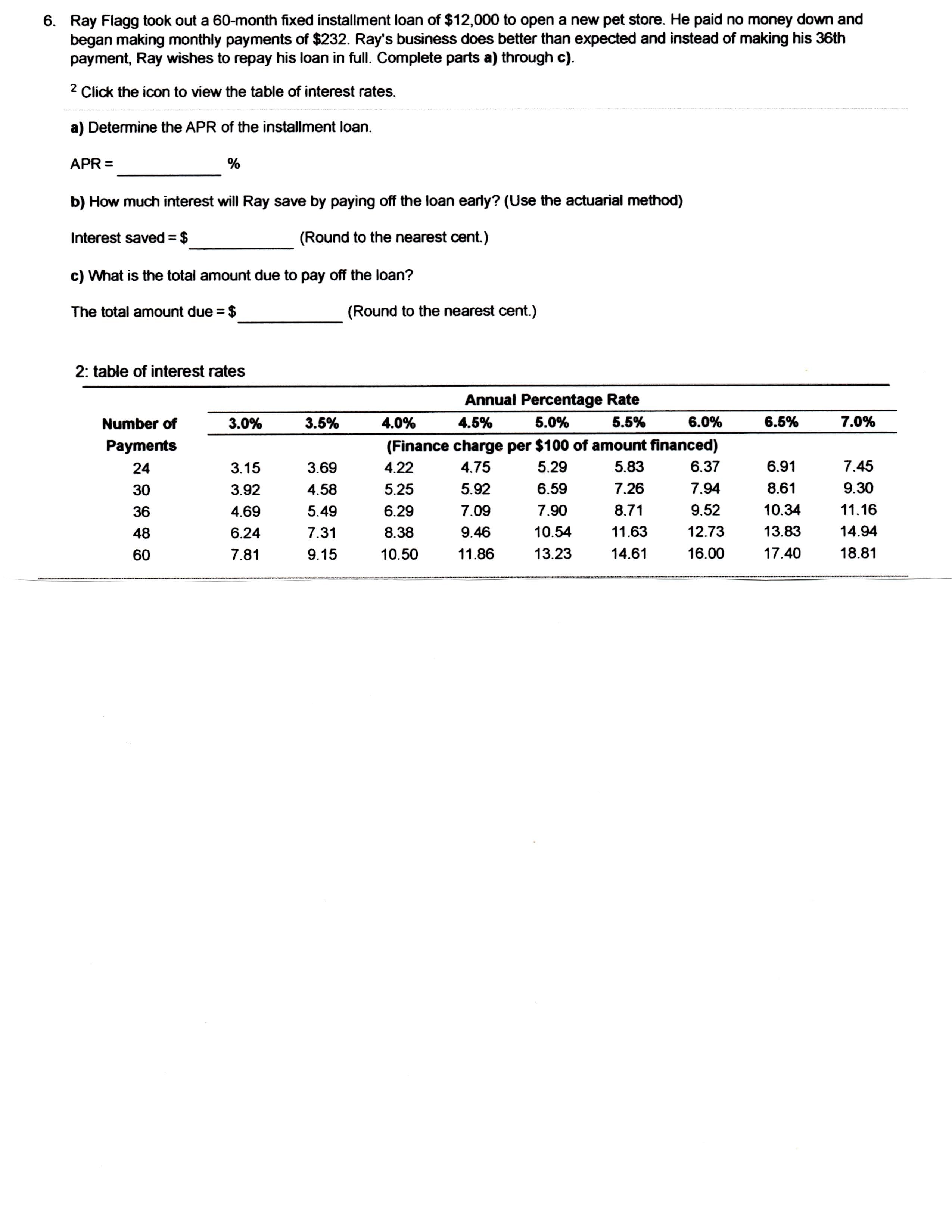

Ray Flagg took out a 60-month fixed installment loan of $12,000 to open a new pet store. He paid no money down and began making monthly payments of $232. Ray's business does better than expected and instead of making his 36th payment, Ray wishes to repay his loan in full. Complete parts a) through c). 6. 2 Click the icon to view the table of interest rates. a) Determine the APR of the installment loan APR= b) How much interest will Ray save by paying off the loan early? (Use the actuarial method) (Round to the nearest cent.) Interest saved $ c) What is the total amount due to pay off the loan? The total amount due $ (Round to the nearest cent.) 2: table of interest rates Annual Percemntage Rate 7.0% 6.0% 5.5% 6.5% 4.5% 5.0% 3.5% 4.0% 3.0% Number of Payments (Finance charge per $100 of amount financed) 7.45 6.91 5.83 6.37 4.75 5.29 4.22 3.69 24 3.15 9.30 8.61 7.26 7.94 5.25 5.92 6.59 4.58 30 3.92 11.16 10.34 9.52 7.09 7.90 8.71 6.29 4.69 5.49 36 13.83 14.94 11.63 12.73 9.46 10.54 7.31 8.38 6.24 48 18.81 14.61 16.00 17.40 11.86 13.23 7.81 10.50 9.15 60

Ray Flagg took out a 60-month fixed installment loan of $12,000 to open a new pet store. He paid no money down and began making monthly payments of $232. Ray's business does better than expected and instead of making his 36th payment, Ray wishes to repay his loan in full. Complete parts a) through c). 6. 2 Click the icon to view the table of interest rates. a) Determine the APR of the installment loan APR= b) How much interest will Ray save by paying off the loan early? (Use the actuarial method) (Round to the nearest cent.) Interest saved $ c) What is the total amount due to pay off the loan? The total amount due $ (Round to the nearest cent.) 2: table of interest rates Annual Percemntage Rate 7.0% 6.0% 5.5% 6.5% 4.5% 5.0% 3.5% 4.0% 3.0% Number of Payments (Finance charge per $100 of amount financed) 7.45 6.91 5.83 6.37 4.75 5.29 4.22 3.69 24 3.15 9.30 8.61 7.26 7.94 5.25 5.92 6.59 4.58 30 3.92 11.16 10.34 9.52 7.09 7.90 8.71 6.29 4.69 5.49 36 13.83 14.94 11.63 12.73 9.46 10.54 7.31 8.38 6.24 48 18.81 14.61 16.00 17.40 11.86 13.23 7.81 10.50 9.15 60

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 2P: Cost of Bank Loan Mary Jones recently obtained an equipment loan from a local bank. The loan is for...

Related questions

Question

Transcribed Image Text:Ray Flagg took out a 60-month fixed installment loan of $12,000 to open a new pet store. He paid no money down and

began making monthly payments of $232. Ray's business does better than expected and instead of making his 36th

payment, Ray wishes to repay his loan in full. Complete parts a) through c).

6.

2

Click the icon to view the table of interest rates.

a) Determine the APR of the installment loan

APR=

b) How much interest will Ray save by paying off the loan early? (Use the actuarial method)

(Round to the nearest cent.)

Interest saved $

c) What is the total amount due to pay off the loan?

The total amount due

$

(Round to the nearest cent.)

2: table of interest rates

Annual Percemntage Rate

7.0%

6.0%

5.5%

6.5%

4.5%

5.0%

3.5%

4.0%

3.0%

Number of

Payments

(Finance charge per $100 of amount financed)

7.45

6.91

5.83

6.37

4.75

5.29

4.22

3.69

24

3.15

9.30

8.61

7.26

7.94

5.25

5.92

6.59

4.58

30

3.92

11.16

10.34

9.52

7.09

7.90

8.71

6.29

4.69

5.49

36

13.83

14.94

11.63

12.73

9.46

10.54

7.31

8.38

6.24

48

18.81

14.61

16.00

17.40

11.86

13.23

7.81

10.50

9.15

60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 3 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT