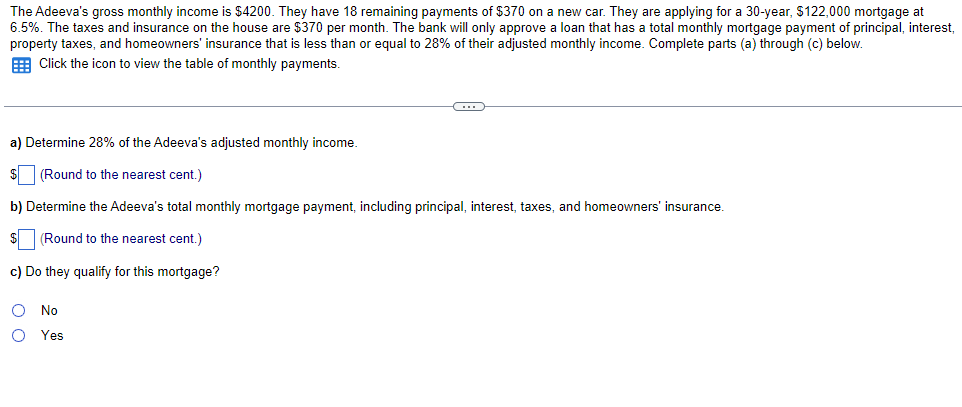

The Adeeva's gross monthly income is $4200. They have 18 remaining payments of $370 on a new car. They are applying for a 30-year, $122,000 mortgage at 6.5%. The taxes and insurance on the house are $370 per month. The bank will only approve a loan that has a total monthly mortgage payment of principal, interest, property taxes, and homeowners' insurance that is less than or equal to 28% of their adjusted monthly income. Complete parts (a) through (c) below. E Click the icon to view the table of monthly payments. ... a) Determine 28% of the Adeeva's adjusted monthly income. (Round to the nearest cent.) b) Determine the Adeeva's total monthly mortgage payment, including principal, interest, taxes, and homeowners' insurance. (Round to the nearest cent.) c) Do they qualify for this mortgage? O No O Yes

The Adeeva's gross monthly income is $4200. They have 18 remaining payments of $370 on a new car. They are applying for a 30-year, $122,000 mortgage at 6.5%. The taxes and insurance on the house are $370 per month. The bank will only approve a loan that has a total monthly mortgage payment of principal, interest, property taxes, and homeowners' insurance that is less than or equal to 28% of their adjusted monthly income. Complete parts (a) through (c) below. E Click the icon to view the table of monthly payments. ... a) Determine 28% of the Adeeva's adjusted monthly income. (Round to the nearest cent.) b) Determine the Adeeva's total monthly mortgage payment, including principal, interest, taxes, and homeowners' insurance. (Round to the nearest cent.) c) Do they qualify for this mortgage? O No O Yes

Chapter3: Income Sources

Section: Chapter Questions

Problem 41P

Related questions

Question

Transcribed Image Text:The Adeeva's gross monthly income is $4200. They have 18 remaining payments of $370 on a new car. They are applying for a 30-year, $122,000 mortgage at

6.5%. The taxes and insurance on the house are $370 per month. The bank will only approve a loan that has a total monthly mortgage payment of principal, interest,

property taxes, and homeowners' insurance that is less than or equal to 28% of their adjusted monthly income. Complete parts (a) through (c) below.

E Click the icon to view the table of monthly payments.

a) Determine 28% of the Adeeva's adjusted monthly income.

$ (Round to the nearest cent.)

b) Determine the Adeeva's total monthly mortgage payment, including principal, interest, taxes, and homeowners' insurance.

$ (Round to the nearest cent.)

c) Do they qualify for this mortgage?

O No

O Yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT