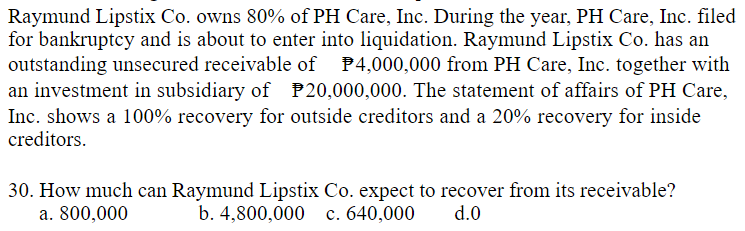

Raymund Lipstix Co. owns 80% of PH Care, Inc. During the year, PH Care, Inc. filed for bankruptcy and is about to enter into liquidation. Raymund Lipstix Co. has an outstanding unsecured receivable of P4,000,000 from PH Care, Inc. together with an investment in subsidiary of P20,000,000. The statement of affairs of PH Care, Inc. shows a 100% recovery for outside creditors and a 20% recovery for inside creditors. 30. How much can Raymund Lipstix Co. expect to recover from its receivable? a. 800,000 b. 4,800,000 c. 640,000 d.0

Raymund Lipstix Co. owns 80% of PH Care, Inc. During the year, PH Care, Inc. filed for bankruptcy and is about to enter into liquidation. Raymund Lipstix Co. has an outstanding unsecured receivable of P4,000,000 from PH Care, Inc. together with an investment in subsidiary of P20,000,000. The statement of affairs of PH Care, Inc. shows a 100% recovery for outside creditors and a 20% recovery for inside creditors. 30. How much can Raymund Lipstix Co. expect to recover from its receivable? a. 800,000 b. 4,800,000 c. 640,000 d.0

Chapter7: Corporations: Reorganizations

Section: Chapter Questions

Problem 37P

Related questions

Question

Transcribed Image Text:Raymund Lipstix Co. owns 80% of PH Care, Inc. During the year, PH Care, Inc. filed

for bankruptcy and is about to enter into liquidation. Raymund Lipstix Co. has an

outstanding unsecured receivable of P4,000,000 from PH Care, Inc. together with

an investment in subsidiary of P20,000,000. The statement of affairs of PH Care,

Inc. shows a 100% recovery for outside creditors and a 20% recovery for inside

creditors.

30. How much can Raymund Lipstix Co. expect to recover from its receivable?

a. 800,000

b. 4,800,000 c. 640,000

d.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you