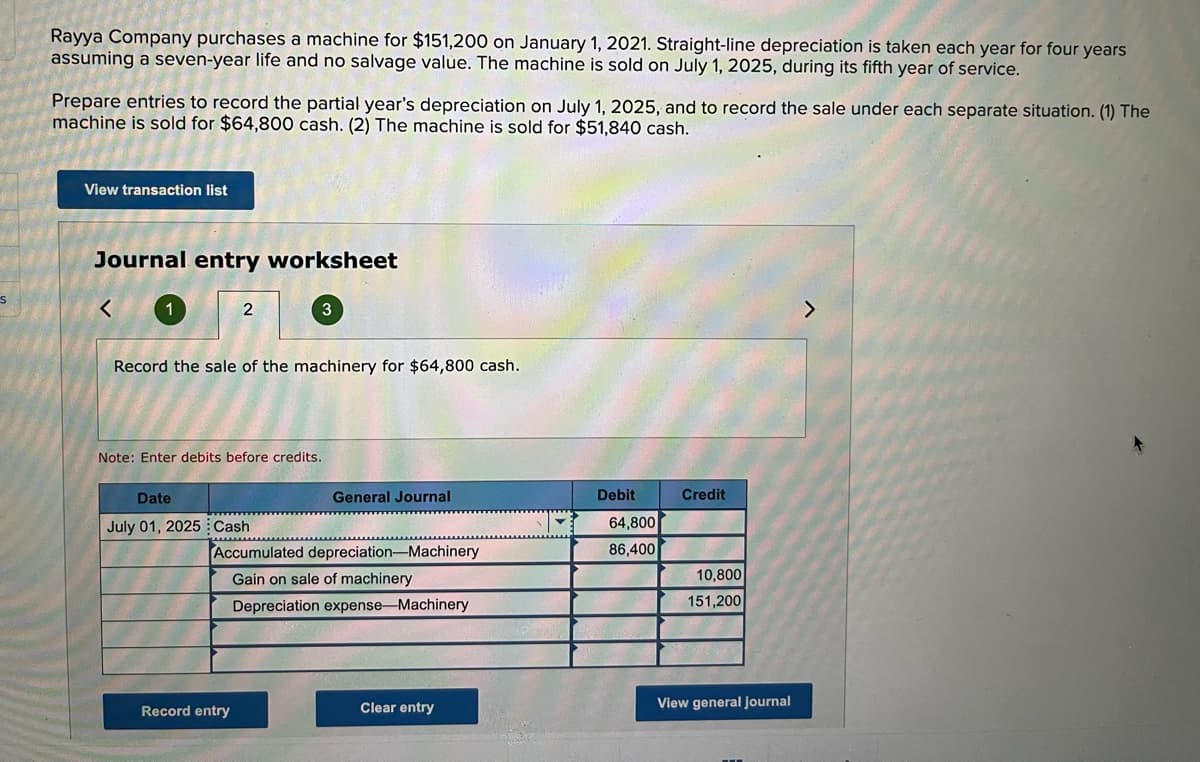

Rayya Company purchases a machine for $151,200 on January 1, 2021. Straight-line depreciation is taken each year for four years assuming a seven-year life and no salvage value. The machine is sold on July 1, 2025, during its fifth year of service. Prepare entries to record the partial year's depreciation on July 1, 2025, and to record the sale under each separate situation. (1) The machine is sold for $64,800 cash. (2) The machine is sold for $51,840 cash. View transaction list Journal entry worksheet 3 <> Record the sale of the machinery for $64,800 cash. Note: Enter debits before credits. Date General Journal Debit Credit July 01, 2025 Cash 64,800 Accumulated depreciation-Machinery 86,400 Gain on sale of machinery 10,800 Depreciation expense-Machinery 151,200

Rayya Company purchases a machine for $151,200 on January 1, 2021. Straight-line depreciation is taken each year for four years assuming a seven-year life and no salvage value. The machine is sold on July 1, 2025, during its fifth year of service. Prepare entries to record the partial year's depreciation on July 1, 2025, and to record the sale under each separate situation. (1) The machine is sold for $64,800 cash. (2) The machine is sold for $51,840 cash. View transaction list Journal entry worksheet 3 <> Record the sale of the machinery for $64,800 cash. Note: Enter debits before credits. Date General Journal Debit Credit July 01, 2025 Cash 64,800 Accumulated depreciation-Machinery 86,400 Gain on sale of machinery 10,800 Depreciation expense-Machinery 151,200

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 47P

Related questions

Question

Question 3

Transcribed Image Text:Rayya Company purchases a machine for $151,200 on January 1, 2021. Straight-line depreciation is taken each year for four years

assuming a seven-year life and no salvage value. The machine is sold on July 1, 2025, during its fifth year of service.

Prepare entries to record the partial year's depreciation on July 1, 2025, and to record the sale under each separate situation. (1) The

machine is sold for $64,800 cash. (2) The machine is sold for $51,840 cash.

View transaction list

Journal entry worksheet

く

2

Record the sale of the machinery for $64,800 cash.

Note: Enter debits before credits,

Date

General Journal

Debit

Credit

July 01, 2025 Cash

64,800

Accumulated depreciation-Machinery

86,400

Gain on sale of machinery

10,800

Depreciation expense-Machinery

151,200

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning