Read the article. The question is Remy is trying to decide if he should rent or buy. He is considering moving from his city in the next two years. Remy found a house he likes, but it would take 50% of his budget. Remy would like to start building equity. The apartments with amenities and features he likes are around 25%-35% of his budget. Given this information, do you think he should rent or b

Read the article. The question is Remy is trying to decide if he should rent or buy. He is considering moving from his city in the next two years. Remy found a house he likes, but it would take 50% of his budget. Remy would like to start building equity. The apartments with amenities and features he likes are around 25%-35% of his budget. Given this information, do you think he should rent or b

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Read the article. The question is Remy is trying to decide if he should rent or buy. He is considering moving from his city in the next two years. Remy found a house he likes, but it would take 50% of his budget. Remy would like to start building equity. The apartments with amenities and features he likes are around 25%-35% of his budget. Given this information, do you think he should rent or buy? Why?

Transcribed Image Text:How Much Should You Be Spending on Housing?

Here's how much of your income you should be spending on housing

Published Wed, Jun 6 201812:23 PM EDTUpdated Wed, Jun 6 20184:44 PM EDT

Kathleen Elkins @kathleen elk

Share

→

A sign advertises an apartment for rent along a row of brownstone townhouses in Brooklyn, New York.

Drew Angerer I Getty Images

Housing is likely your biggest monthly expense and, if you live in a city like San Francisco or New York City, it may eat up a good chunk, or even the majority of your paycheck Just

how much of your income should be going towards your home?

As a general rule, you want to spend no more than 30 percent of your monthly gross income on housing. If you're a renter, that 30 percent includes utilities, and if you're an owner, it

includes other home-ownership costs like mortgage interest, property taxes and maintenance.

$20,000

$30,000

Why 30 percent? It's a standard that the government has been using since 1981: Those who spend more than 30 percent of their income on housing have historically been said to

be "cost burdened. Those who spend 50 percent or more are considered "severely cost burdened."

Money expert David Bach offers a slightly different rule of thumb, which he outlines in his book, "The Automatic Millionaire": "According to the Federal Housing Association, a good

rule of thumb is that most people can afford to spend 29 percent of their gross income on housing expenses- as much as 41 percent if they have no debt."

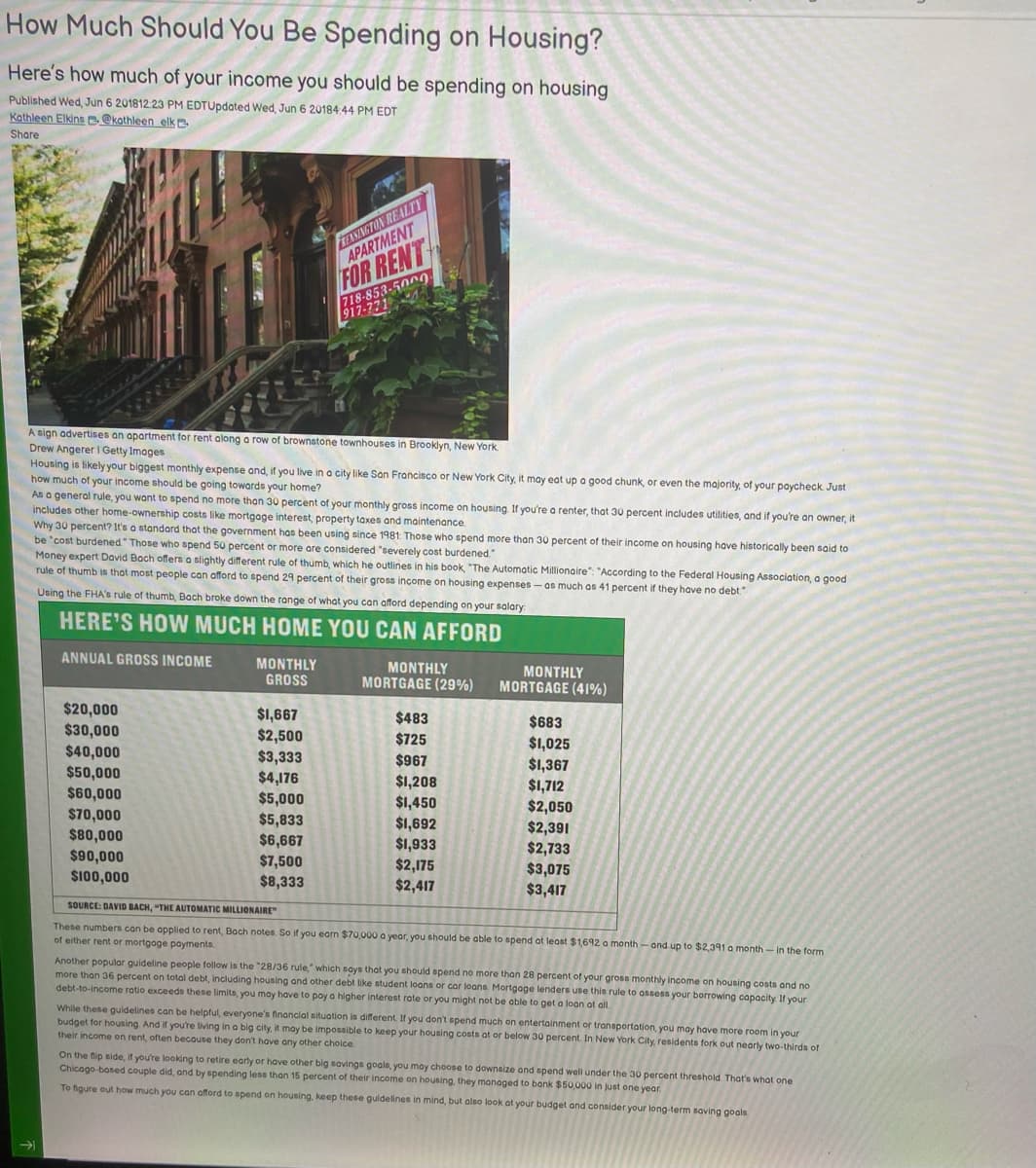

Using the FHA's rule of thumb, Bach broke down the range of what you can afford depending on your salary:

HERE'S HOW MUCH HOME YOU CAN AFFORD

ANNUAL GROSS INCOME

$40,000

$50,000

$60,000

$70,000

$80,000

$90,000

$100,000

MONTHLY

GROSS

$1,667

$2,500

FREASINGTON REALTY

APARTMENT

$3,333

$4,176

FOR RENT

718-853-5000.

917-771

$5,000

$5,833

$6,667

$7,500

$8,333

MONTHLY

MORTGAGE (29%)

$483

$725

$967

$1,208

$1,450

$1,692

$1,933

$2,175

$2,417

MONTHLY

MORTGAGE (41%)

$683

$1,025

$1,367

$1,712

$2,050

$2,391

$2,733

$3,075

$3,417

SOURCE: DAVID BACH, "THE AUTOMATIC MILLIONAIRE"

These numbers can be applied to rent, Bach notes. So if you earn $70,000 a year, you should be able to spend at least $1,692 a month - and up to $2,391 a month - in the form

of either rent or mortgage payments.

Another popular guideline people follow is the "28/36 rule," which says that you should spend no more than 28 percent of your gross monthly income on housing costs and no

more than 36 percent on total debt, including housing and other debt like student loans or car loans Mortgage lenders use this rule to assess your borrowing capacity. If your

debt-to-income ratio exceeds these limits, you may have to pay a higher interest rate or you might not be able to get a loan at all.

While these guidelines can be helpful, everyone's financial situation is different. If you don't spend much on entertainment or transportation, you may have more room in your

budget for housing. And if you're living in a big city, it may be impossible to keep your housing costs at or below 30 percent. In New York City, residents fork out nearly two-thirds of

their income on rent, often because they don't have any other choice.

On the flip side, if you're looking to retire early or have other big savings goals, you may choose to downsize and spend well under the 30 percent threshold. That's what one.

Chicago-based couple did, and by spending less than 15 percent of their income on housing, they managed to bank $50,000 in just one year.

To figure out how much you can afford to spend on housing, keep these guidelines in mind, but also look at your budget and consider your long-term saving goals.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education