Read the following case and answer the question that follows. Welles Fargo Bank, based in Los Angeles, California, has the ability to borrow 30 million U. (USD) at 5% annualized. It can then invest in either the euro (EUR), the Australian dollar (AUD Canadian dollar (CAD). For simplicity, suppose that the lending rate of all of the euro, the A dollar, and the Canadian dollar is 3% annualized over a 10-day time period. The spot rates expected rates of the euro, Australian dollar and the Canadian dollar are given in the table belo Spot Rate (01/06/2022, 09:00 PM) Expected Spot Rate After 5 days EUR-USD 1.1297 1.1410 1 EUR in USD AUD-USD 0.7166 0.7345 1 AUD in USD CAD-USD 0.7857 0.7936 1 CAD in USD

Read the following case and answer the question that follows. Welles Fargo Bank, based in Los Angeles, California, has the ability to borrow 30 million U. (USD) at 5% annualized. It can then invest in either the euro (EUR), the Australian dollar (AUD Canadian dollar (CAD). For simplicity, suppose that the lending rate of all of the euro, the A dollar, and the Canadian dollar is 3% annualized over a 10-day time period. The spot rates expected rates of the euro, Australian dollar and the Canadian dollar are given in the table belo Spot Rate (01/06/2022, 09:00 PM) Expected Spot Rate After 5 days EUR-USD 1.1297 1.1410 1 EUR in USD AUD-USD 0.7166 0.7345 1 AUD in USD CAD-USD 0.7857 0.7936 1 CAD in USD

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 49QA

Related questions

Question

Transcribed Image Text:Question Three: Speculation

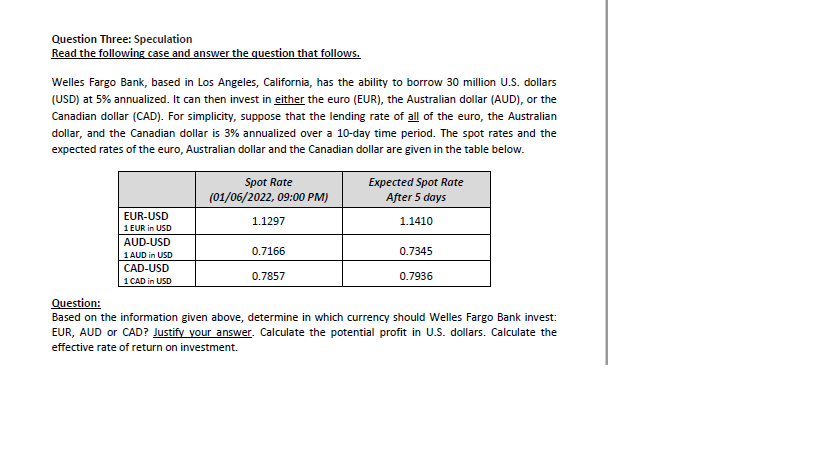

Read the following case and answer the question that follows.

Welles Fargo Bank, based in Los Angeles, California, has the ability to borrow 30 million U.S. dollars

(USD) at 5% annualized. It can then invest in either the euro (EUR), the Australian dollar (AUD), or the

Canadian dollar (CAD). For simplicity, suppose that the lending rate of all of the euro, the Australian

dollar, and the Canadian dollar is 3% annualized over a 10-day time period. The spot rates and the

expected rates of the euro, Australian dollar and the Canadian dollar are given in the table below.

Spot Rate

(01/06/2022, 09:00 PM)

Expected Spot Rate

After 5 days

EUR-USD

1.1297

1.1410

1 EUR in USD

AUD-USD

0.7166

0.7345

1 AUD in USD

CAD-USD

0.7857

0.7936

1 CAD in USD

Question:

Based on the information given above, determine in which currency should Welles Fargo Bank invest:

EUR, AUD or CAD? Justify your answer. Calculate the potential profit in U.S. dollars. Calculate the

effective rate of return on investment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT