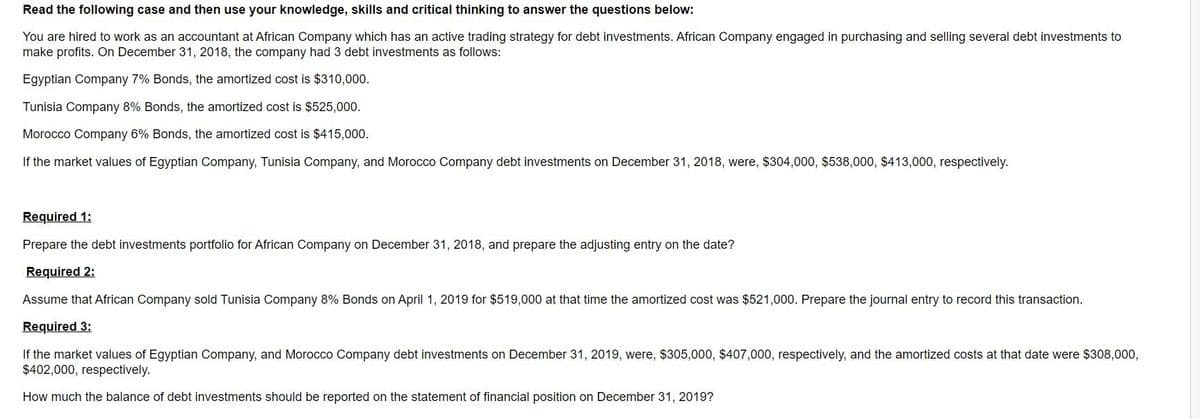

Read the following case and then use your knowledge, skills and critical thinking to answer the questions below: You are hired to work as an accountant at African Company which has an active trading strategy for debt investments. African Company engaged in purchasing and selling several debt investments to make profits. On December 31, 2018, the company had 3 debt investments as follows: Egyptian Company 7% Bonds, the amortized cost is $310,000. Tunisia Company 8% Bonds, the amortized cost is $525,000. Morocco Company 6% Bonds, the amortized cost is $415,000. If the market values of Egyptian Company, Tunisia Company, and Morocco Company debt investments on December 31, 2018, were, $304,000, $538,000, $413,000, respectively. Required 1: Prepare the debt investments portfolio for African Company on December 31, 2018, and prepare the adjusting entry on the date? Required 2: Assume that African Company sold Tunisia Company 8% Bonds on April 1, 2019 for $519,000 at that time the amortized cost was $521,000. Prepare the journal entry to record this transaction. Required 3: If the market values of Egyptian Company, and Morocco Company debt investments on December 31, 2019, were, $305,000, $407,000, respectively, and the amortized costs at that date were $308,000, $402,000, respectively. How much the balance of debt investments should be reported on the statement of financial position on December 31, 2019?

Read the following case and then use your knowledge, skills and critical thinking to answer the questions below: You are hired to work as an accountant at African Company which has an active trading strategy for debt investments. African Company engaged in purchasing and selling several debt investments to make profits. On December 31, 2018, the company had 3 debt investments as follows: Egyptian Company 7% Bonds, the amortized cost is $310,000. Tunisia Company 8% Bonds, the amortized cost is $525,000. Morocco Company 6% Bonds, the amortized cost is $415,000. If the market values of Egyptian Company, Tunisia Company, and Morocco Company debt investments on December 31, 2018, were, $304,000, $538,000, $413,000, respectively. Required 1: Prepare the debt investments portfolio for African Company on December 31, 2018, and prepare the adjusting entry on the date? Required 2: Assume that African Company sold Tunisia Company 8% Bonds on April 1, 2019 for $519,000 at that time the amortized cost was $521,000. Prepare the journal entry to record this transaction. Required 3: If the market values of Egyptian Company, and Morocco Company debt investments on December 31, 2019, were, $305,000, $407,000, respectively, and the amortized costs at that date were $308,000, $402,000, respectively. How much the balance of debt investments should be reported on the statement of financial position on December 31, 2019?

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 20P

Related questions

Question

Transcribed Image Text:Read the following case and then use your knowledge, skills and critical thinking to answer the questions below:

You are hired to work as an accountant at African Company which has an active trading strategy for debt investments. African Company engaged in purchasing and selling several debt investments to

make profits. On December 31, 2018, the company had 3 debt investments as follows:

Egyptian Company 7% Bonds, the amortized cost is $310,000.

Tunisia Company 8% Bonds, the amortized cost is $525,000.

Morocco Company 6% Bonds, the amortized cost is $415,000.

If the market values of Egyptian Company, Tunisia Company, and Morocco Company debt investments on December 31, 2018, were, $304,000, $538,000, $413,000, respectively.

Required 1:

Prepare the debt investments portfolio for African Company on December 31, 2018, and prepare the adjusting entry on the date?

Required 2:

Assume that African Company sold Tunisia Company 8% Bonds on April 1, 2019 for $519,000 at that time the amortized cost was $521,000. Prepare the journal entry to record this transaction.

Required 3:

If the market values of Egyptian Company, and Morocco Company debt investments on December 31, 2019, were, $305,000, $407,000, respectively, and the amortized costs at that date were $308,000,

$402,000, respectively.

How much the balance of debt investments should be reported on the statement of financial position on December 31, 2019?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT