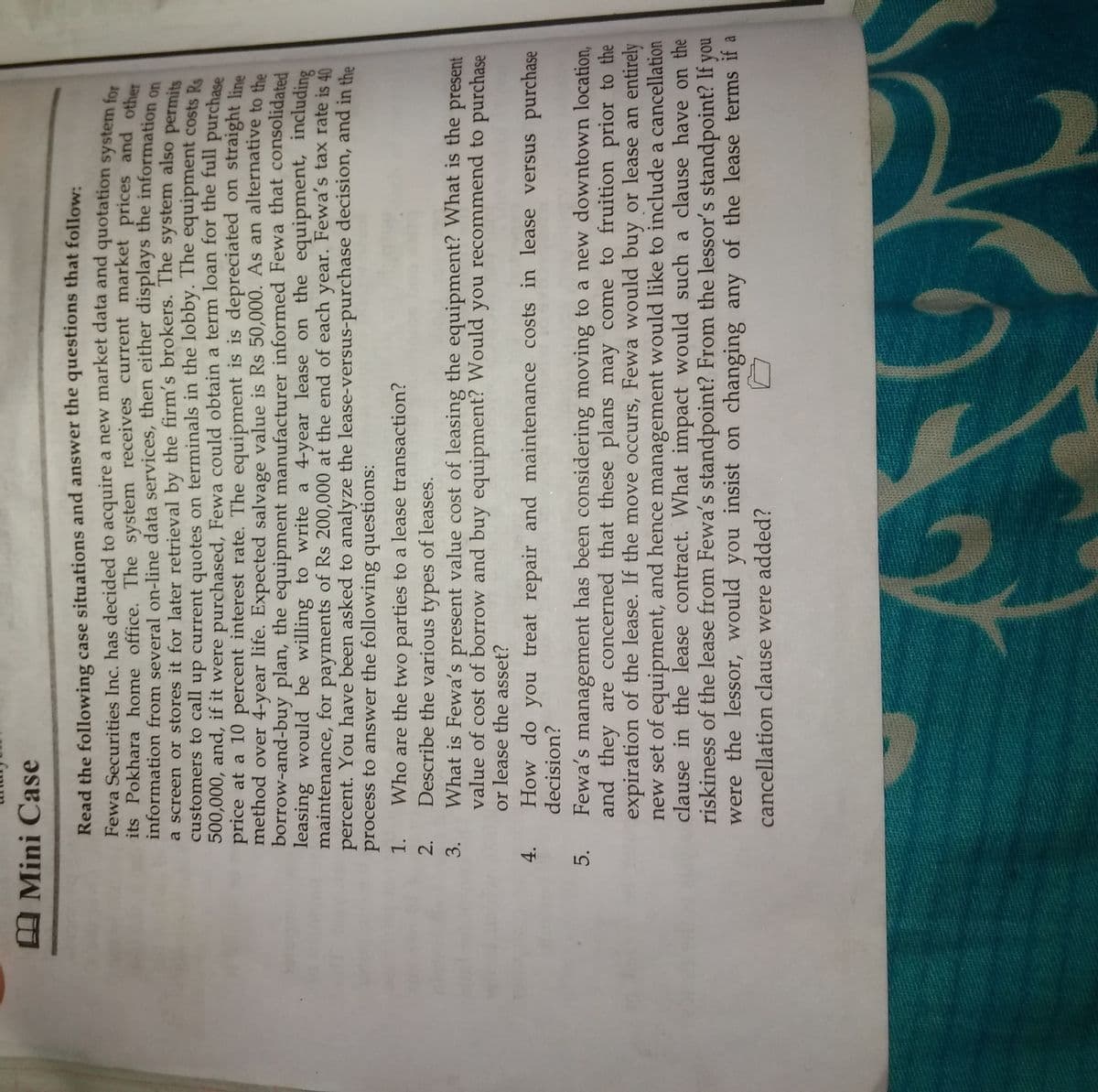

Read the following case situations and answer the questions that follow: Fewa Securities Inc. has decided to acquire a new market data and quotation system f its Pokhara home office. The system receives current market prices and oth information from several on-line data services, then either displays the information a screen or stores it for later retrieval by the firm's brokers. The system also permi customers to call up current quotes on terminals in the lobby. The equipment costs R 500,000, and, if it were purchased, Fewa could obtain a term loan for the full e price at a 10 percent interest rate. The equipment is is depreciated on straight line method over 4-year life. Expected salvage value is Rs 50,000. As an alternative to the borrow-and-buy plan, the equipment manufacturer informed Fewa that consolidated leasing would be willing to write a 4-year lease on the equipment, including maintenance, for payments of Rs 200,000 at the end of each year. Fewa's tax rate is 40 percent. You have been asked to analyze the lease-versus-purchase decision, and in the process to answer the following questions: purchase 1. Who are the two parties to a lease transaction? Describe the various types of leases. 3. What is Fewa's present value cost of leasing the equipment? What is the present value of cost of borrow and buy equipment? Would you recommend to purchase or lease the asset? How do you treat repair and maintenance costs in lease versus purchase decision? 2. 4. 5. Fewa's management has been considering moving to a new downtown location and they are concerned that these plans may come to fruition prior to the expiration of the lease. If the move occurs, Fewa would buy or lease an entirel new set of equipment, and hence management would like to include a cancellatio clause in the lease contract. What impact would such a clause have on th riskiness of the lease from Fewa's standpoint? From the lessor's standpoint? If yc were the lessor, would you insist on changing any of the lease terms if cancellation clause were added?

Read the following case situations and answer the questions that follow: Fewa Securities Inc. has decided to acquire a new market data and quotation system f its Pokhara home office. The system receives current market prices and oth information from several on-line data services, then either displays the information a screen or stores it for later retrieval by the firm's brokers. The system also permi customers to call up current quotes on terminals in the lobby. The equipment costs R 500,000, and, if it were purchased, Fewa could obtain a term loan for the full e price at a 10 percent interest rate. The equipment is is depreciated on straight line method over 4-year life. Expected salvage value is Rs 50,000. As an alternative to the borrow-and-buy plan, the equipment manufacturer informed Fewa that consolidated leasing would be willing to write a 4-year lease on the equipment, including maintenance, for payments of Rs 200,000 at the end of each year. Fewa's tax rate is 40 percent. You have been asked to analyze the lease-versus-purchase decision, and in the process to answer the following questions: purchase 1. Who are the two parties to a lease transaction? Describe the various types of leases. 3. What is Fewa's present value cost of leasing the equipment? What is the present value of cost of borrow and buy equipment? Would you recommend to purchase or lease the asset? How do you treat repair and maintenance costs in lease versus purchase decision? 2. 4. 5. Fewa's management has been considering moving to a new downtown location and they are concerned that these plans may come to fruition prior to the expiration of the lease. If the move occurs, Fewa would buy or lease an entirel new set of equipment, and hence management would like to include a cancellatio clause in the lease contract. What impact would such a clause have on th riskiness of the lease from Fewa's standpoint? From the lessor's standpoint? If yc were the lessor, would you insist on changing any of the lease terms if cancellation clause were added?

Essentials Of Business Analytics

1st Edition

ISBN:9781285187273

Author:Camm, Jeff.

Publisher:Camm, Jeff.

Chapter6: Data Mining

Section: Chapter Questions

Problem 8P

Related questions

Question

Transcribed Image Text:Mini Case

Read the following case situations and answer the questions that follow:

Fewa Securities Inc. has decided to acquire a new market data and quotation svstem

its Pokhara home office. The system receives current market prices and o

information from several on-line data services, then either displays the information

a screen or stores it for later retrieval by the firm's brokers. The system also permi

customers to call up current quotes on terminals in the lobby. The equipment costs R.

500,000, and, if it were purchased, Fewa could obtain a term loan for the full purchase

price at a 10 percent interest rate. The equipment is is depreciated on straight line

method over 4-year life. Expected salvage value is Rs 50,000. As an alternative to the

borrow-and-buy plan, the equipment manufacturer informed Fewa that consolidated

leasing would be willing to write a 4-year lease on the equipment, including

maintenance, for

percent. You have been asked to analyze the lease-versus-purchase decision, and in the

process to answer the following questions:

payments of Rs 200,000 at the end of each year. Fewa's tax rate is 40

1.

Who are the two parties to a lease transaction?

Describe the various types of leases.

What is Fewa's present value cost of leasing the equipment? What is the present

value of cost of borrow and buy equipment? Would you recommend to purchase

or lease the asset?

2.

3.

How do you treat repair and maintenance costs in lease versus purchase

decision?

4.

Fewa's management has been considering moving to a new downtown location,

and they are concerned that these plans may come to fruition prior to the

expiration of the lease. If the move occurs, Fewa would buy or lease an entirely

new set of equipment, and hence management would like to include a cancellation

clause in the lease contract. What impact would such a clause have on the

riskiness of the lease from Fewa's standpoint? From the lessor's standpoint? If you

were the lessor, would you insist on changing any of the lease terms if a

5.

cancellation clause were added?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT