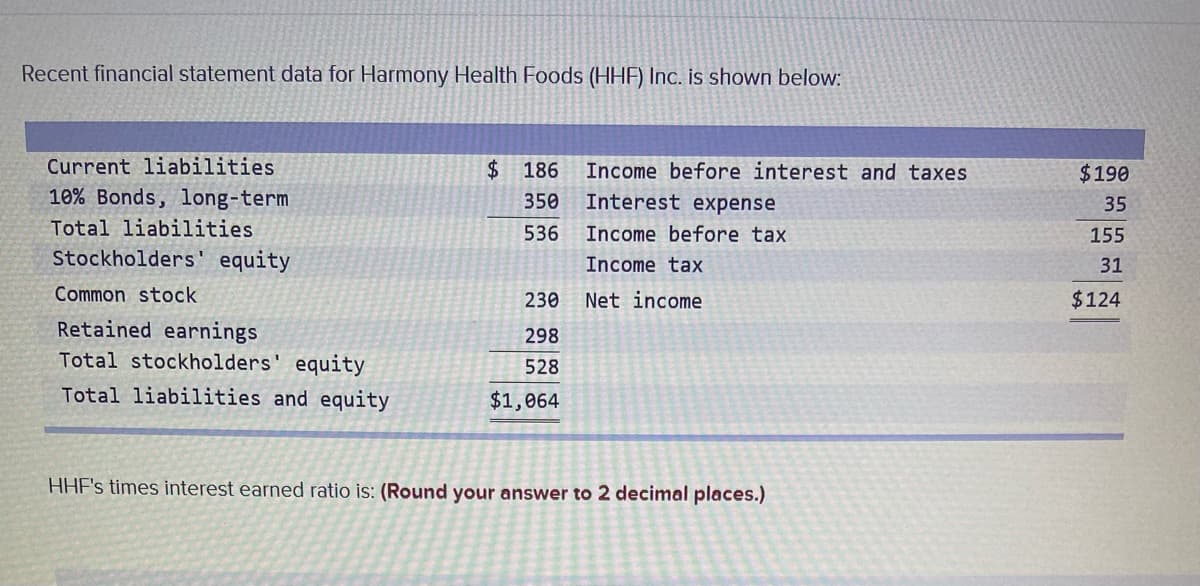

Recent financial statement data for Harmony Health Foods (HHF) Inc. is shown below: Current liabilities $186 Income before interest and taxes $190 10% Bonds, long-term 350 Interest expense 35 Total liabilities 536 Income before tax 155 Stockholders' equity Income tax 31 Common stock 230 Net income $124 Retained earnings 298 Total stockholders' equity 528 Total liabilities and equity $1,064 HHE's times interest earned ratio is: (Round your answer to 2 decimal places.)

Recent financial statement data for Harmony Health Foods (HHF) Inc. is shown below: Current liabilities $186 Income before interest and taxes $190 10% Bonds, long-term 350 Interest expense 35 Total liabilities 536 Income before tax 155 Stockholders' equity Income tax 31 Common stock 230 Net income $124 Retained earnings 298 Total stockholders' equity 528 Total liabilities and equity $1,064 HHE's times interest earned ratio is: (Round your answer to 2 decimal places.)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 20BEA: The income statement, statement of retained earnings, and balance sheet for Somerville Company are...

Related questions

Question

This is part a and b please answer both

Transcribed Image Text:Recent financial statement data for Harmony Health Foods (HHF) Inc. is shown below:

Current liabilities

2$

186

Income before interest and taxes

$190

10% Bonds, long-term

350

Interest expense

35

Total liabilities

536

Income before tax

155

Stockholders' equity

Income tax

31

Common stock

230

Net income

$124

Retained earnings

Total stockholders' equity

298

528

Total liabilities and equity

$1,064

HHE's times interest earned ratio is: (Round your answer to 2 decimal places.)

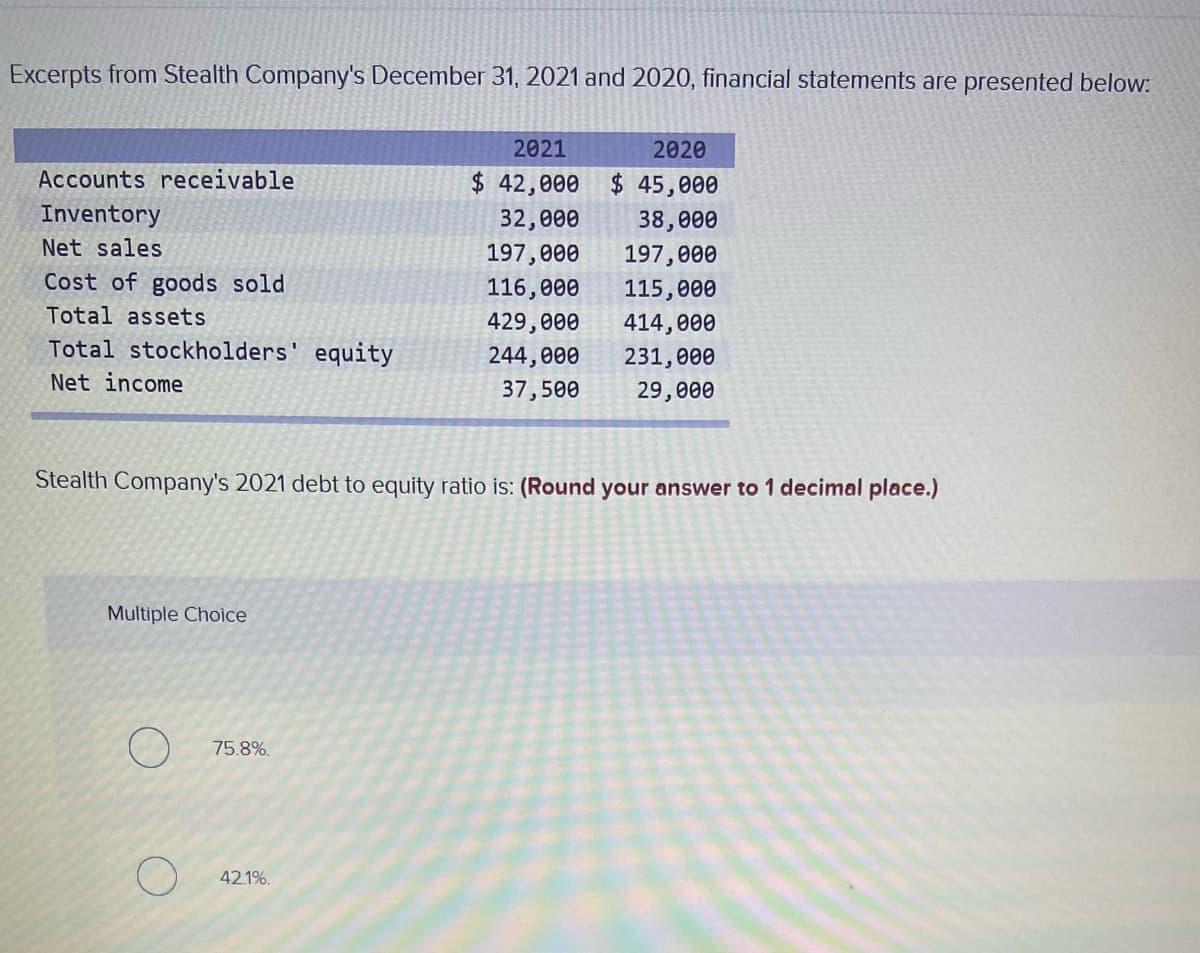

Transcribed Image Text:Excerpts from Stealth Company's December 31, 2021 and 2020, financial statements are presented below:

2021

2020

Accounts receivable

$ 42,000 $ 45,000

Inventory

32,000

38,000

Net sales

197,000

197,000

Cost of goods sold

116,000

115,000

Total assets

429,000

414,000

Total stockholders' equity

244,000

231,000

Net income

37,500

29,000

Stealth Company's 2021 debt to equity ratio is: (Round your answer to 1 decimal place.)

Multiple Choice

75.8%.

42.1%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning