Record the closing entry for revenue accounts. Note: Enter debits before credits. Date General Journal Debit Credit January 31 Sales Revenue 288,000 Income Tax Expense 288,000 Record entry Clear entry View general journal

Record the closing entry for revenue accounts. Note: Enter debits before credits. Date General Journal Debit Credit January 31 Sales Revenue 288,000 Income Tax Expense 288,000 Record entry Clear entry View general journal

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter5: Accounting For Retail Businesses

Section: Chapter Questions

Problem 6PB: Single-step income Statement and balance sheet Selected accounts and related amounts for Kanpur Co....

Related questions

Question

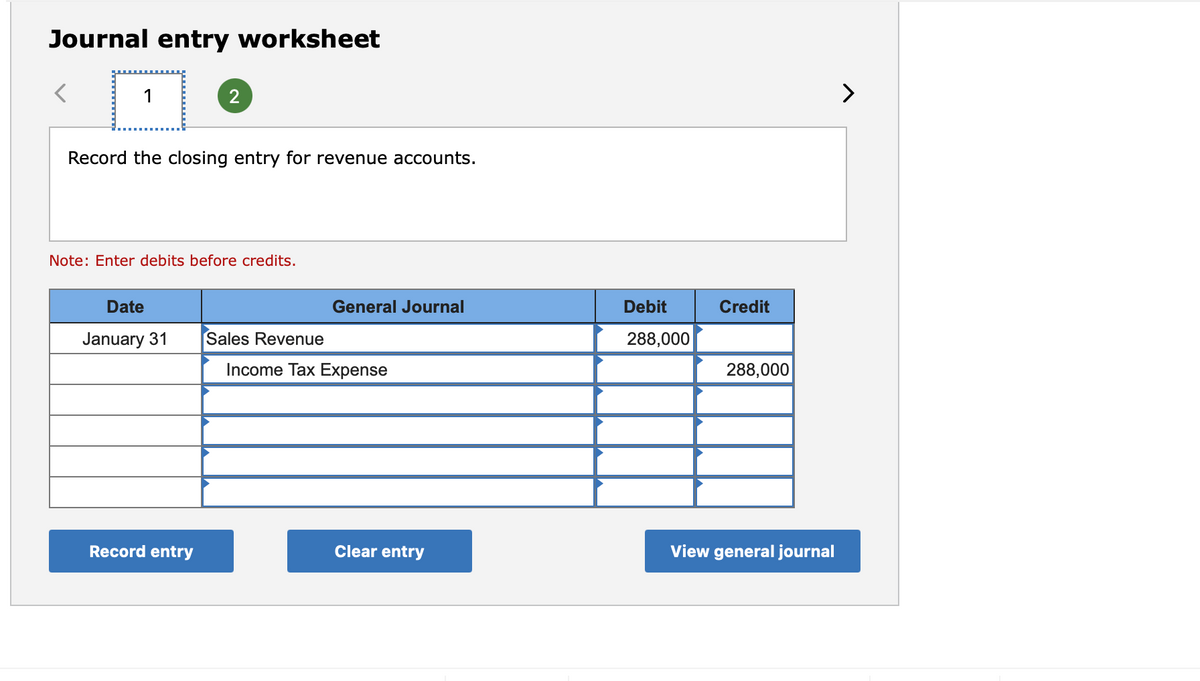

Transcribed Image Text:Journal entry worksheet

1

2

>

Record the closing entry for revenue accounts.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

January 31

Sales Revenue

288,000

Income Tax Expense

288,000

Record entry

Clear entry

View general journal

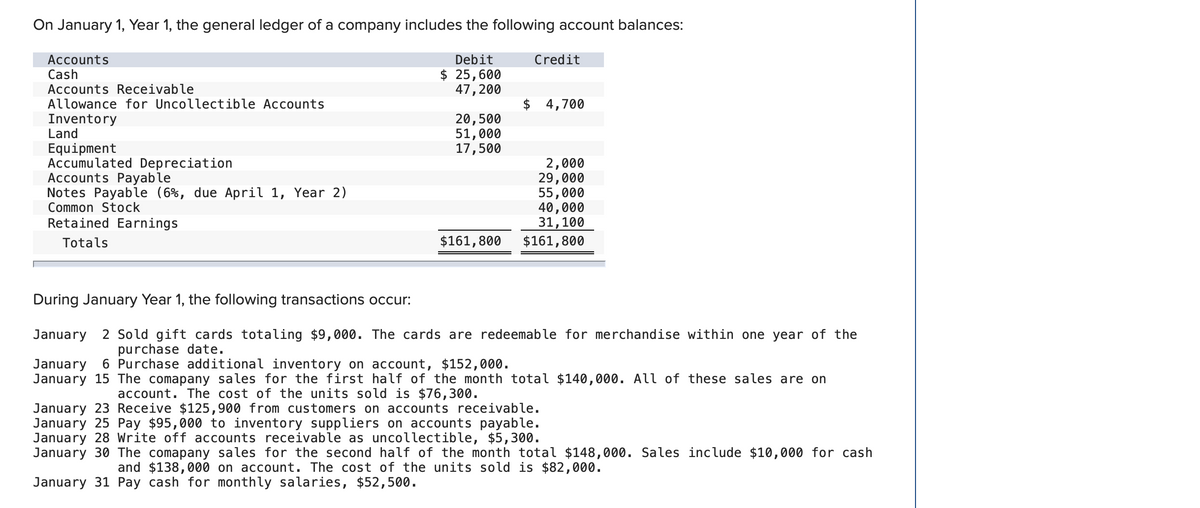

Transcribed Image Text:On January 1, Year 1, the general ledger of a company includes the following account balances:

Accounts

Debit

Credit

Cash

Accounts Receivable

Allowance for Uncollectible Accounts

$ 25,600

47,200

$ 4,700

Inventory

Land

20,500

51,000

17,500

Equipment

Accumulated Depreciation

Accounts Payable

Notes Payable (6%, due April 1, Year 2)

Common Stock

2,000

29,000

55,000

40,000

31,100

$161,800

Retained Earnings

Totals

$161,800

During January Year 1, the following transactions occur:

2 Sold gift cards totaling $9,000. The cards are redeemable for merchandise within one year of the

purchase date.

6 Purchase additional inventory on account, $152,000.

January

January

January 15 The comapany sales for the first half of the month total $140,000. All of these sales are on

account. The cost of the units sold is $76,300.

January 23 Receive $125,900 from customers on accounts receivable.

January 25 Pay $95,000 to inventory suppliers on accounts payable.

January 28 Write off accounts receivable as uncollectible, $5,300.

January 30 The comapany sales for the second half of the month total $148,000. Sales include $10,000 for cash

and $138,000 on account. The cost of the units sold is $82,000.

January 31 Pay cash for monthly salaries, $52,500.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning