Concept explainers

Payroll accounts and year-end entries

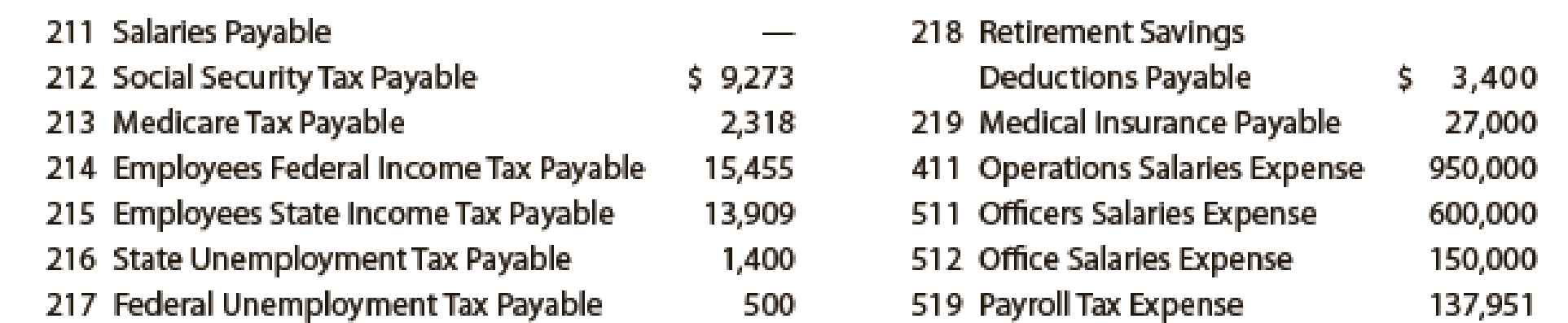

The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year:

The following transactions relating to payroll, payroll deductions, and payroll taxes Occurred during December:

Dec. 2. Issued Check No. 410 for $3,400 to Jay Bank to invest in a retirement savings account for employees.

2. Issued Check No. 411 to Jay Bank for $27,046, in payment of $9,273 of social security tax, $2,318 of Medicare tax, and $15,455 of employees’ federal income tax due.

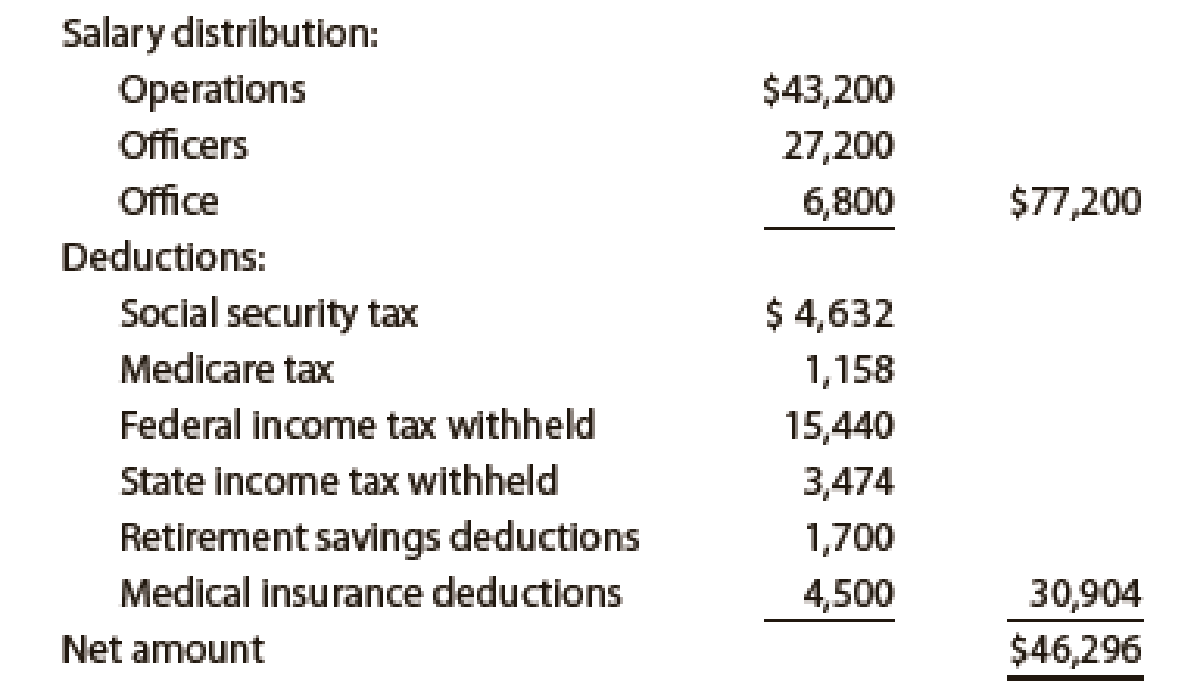

13.

Dec. 13. Issued Check No. 420 in payment of the net amount of the biweekly payroll to fund the payroll bank account.

13. Journalized the entry to record payroll taxes on employees’ earnings of December13: social security tax, $4,632; Medicare tax, $1,158; state

16. Issued Check No. 424 to Jay Bank for $27,020, in payment of $9,264 of social security tax, $2,316 of Medicare tax, and $15,440 of employees’ federal income tax due.

19. Issued Check No. 429 to Sims-Walker Insurance Company for $31,500, in payment of the semiannual premium on the group medical insurance policy.

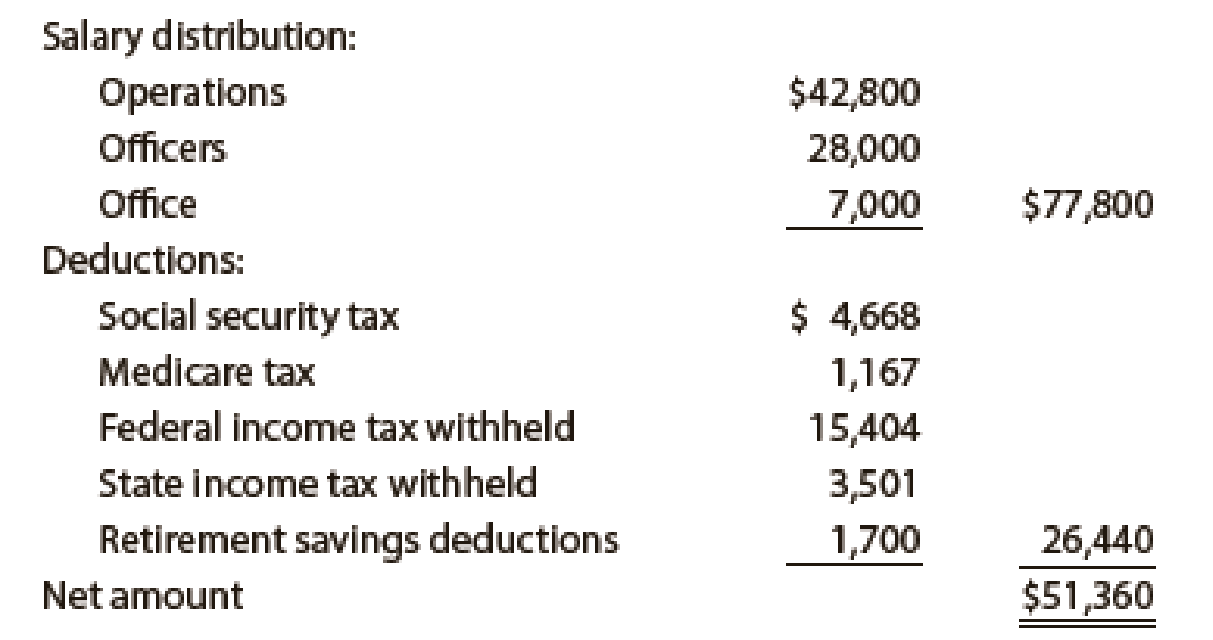

27. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows:

27. Issued Check No. 541 in payment of the net amount of the biweekly payroll to fund the payroll bank account.

27. Journalized the entry to record payroll taxes on employees’ earnings of December27: social security tax, $4,668; Medicare tax, $1,167; state unemployment tax, $225; federal unemployment tax, $75.

27. Issued Check No. 543 for $20,884 to State Department of Revenue in payment of employees’ state income tax due on December 31.

31. Issued Check No. 545 to Jay Bank for $3,400 to invest in a retirement savings account for employees.

31. Paid $45,000 to the employee pension plan. The annual pension cost is $60,000. (Record both the payment and unfunded pension liability.)

Instructions

- 1. Journalize the transactions.

- 2. Journalize the following

adjusting entries on December 31:- a. Salaries accrued: operations salaries, $8,560; officers salaries, $5,600; office salaries,$1,400. The payroll taxes are immaterial and are not accrued.

- b. Vacation pay, $15,000.

Trending nowThis is a popular solution!

Chapter 11 Solutions

Financial Accounting

- Payroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Codigo Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes Occurred during December: Dec. 1. Issued Check No. 815 to Aberderas Insurance Company for 2,520, in payment of the semiannual premium on the group medical insurance policy. 1. Issued Check No. 816 to Alvarez Bank for 8,131, in payment for 2,913 of social security tax, 728 of Medicare tax, and 4,490 of employees federal income tax due. 2. Issued Check No. 817 for 2,300 to Alvarez Bank to invest in a retirement savings account for employees. 12. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: The following transactions relating to payroll, payroll deductions, and payroll taxes Occurred during December: Dec. 1. Issued Check No. 815 to Aberderas Insurance Company for 2,520, in payment of the semiannual premium on the group medical insurance policy. 1. Issued Check No. 816 to Alvarez Bank for 8,131, in payment for 2,913 of social security tax, 728 of Medicare tax, and 4,490 of employees federal income tax due. 2. Issued Check No. 817 for 2,300 to Alvarez Bank to invest in a retirement savings account for employees. 12. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: 12. Issued Check No. 822 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 12. Journalized the entry to record payroll taxes on employees earnings of December12: social security tax, 1,452; Medicare tax, 363; state unemployment tax, 315; federal unemployment tax, 90. 15. Issued Check No. 830 to Alvarez Bank for 7,938, in payment of 2,904 of social security tax, 726 of Medicare tax, and 4,308 of employees federal income tax due. 26. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: 26. Issued Check No. 840 for the net amount of the biweekly payroll to fund the payroll bank account. Dec. 26. Journalized the entry to record payroll taxes on employees earnings of December 26: social security tax, 1,455; Medicare tax, 364; state unemployment tax, 150; federal unemployment tax, 40. 30. Issued Check No. 851 for 6,258 to State Department of Revenue, in payment of employees state income tax due on December 31. 30. Issued Check No. 852 to Alvarez Bank for 2,300 to invest in a retirement savings account for employees. 31. Paid 55,400 to the employee pension plan. The annual pension cost is 65,500. (Record both the payment and the unfunded pension liability.) Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: sales salaries, 4,275; officers salaries, 2,175; office salaries, 825. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 13,350.arrow_forwardPayroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: operations salaries, 8,560; officers salaries, 5,600; office salaries, 1,400. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 15,000.arrow_forwardPayroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Codigo Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: sales salaries, 4,275; officers salaries, 2,175; office salaries, 825. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 13,350.arrow_forward

- JOURNALIZING AND POSTING PAYROLL ENTRIES Oxford Company has five employees, All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31. The accounts kept by Oxford Company include the following: The following transactions relating to payrolls and payroll taxes occurred during June and July: REQURED 1. Journalize the preceding transactions using a general journal. 2. Open accounts for the payroll expenses and liabilities. Enter the beginning balances and post the transactions recorded in the journal.arrow_forwardJOURNALIZING AND POSTING PAYROLL ENTRIES Oxford Company has five employees. All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31. The accounts kept by Oxford Company include the following: The following transactions relating to payrolls and payroll taxes occurred during June and July: REQUIRED 1. Journalize the preceding transactions using a general journal. 2. Open T accounts for the payroll expenses and liabilities. Enter the beginning balances and post the transactions recorded in the journal.arrow_forwardPayment and distribution of payroll The general ledger of Berskshire Mountain Manufacturing Inc. showed the following credit balances on January 15: Direct labor earnings amounted to 10,500 from January 16 to 31. Indirect labor was 5,700, and sales and administrative salaries for the same period amounted to 3,800. All wages are subject to FICA, FUTA, state unemployment taxes, and 10% income tax withholding. Required: 1. Prepare the journal entries for the following: a. Recording the payroll. b. Paying the payroll. c. Recording the employers payroll tax liability. d. Distributing the payroll costs for January 1631. 2. Prepare the journal entry to record the payment of the amounts due for the month to the government for FICA and income tax withholdings. 3. Calculate the amount of total earnings for the period from January 1 to 15. 4. Should the same person be responsible for computing the payroll, paying the payroll and making the entry to distribute the payroll? Why or why not?arrow_forward

- CALCULATING PAYROLL TAXES EXPENSE AND PREPARING JOURNAL ENTRY Selected information from the payroll register of Wrays Drug Store for the week ended July 14,20--, is shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both on the first 7,000 of earnings. Social Security tax on the employer is 6.2% on the first 118,500 of earnings, and Medicare tax is 1.45% on gross earnings. REQUIRED 1. Calculate the total employer payroll taxes for these employees. 2. Prepare the journal entry to record the employer payroll taxes as of July 14,20--.arrow_forwardPayroll Accounting and Discussion of Labor Costs Blitzen Marketing Research paid its weekly and monthly payroll on January 31. The following information is available about the payroll: Blitzen will pay both the employers taxes and the taxes withheld on April 15. Required: 1. Prepare the journal entries to record the payroll payment and the incurrence of the associated expenses and liabilities. ( Note: Round to nearest penny.) 2. What is the employees' gross pay? What amount does Blitzen pay in excess of gross pay as a result of taxes? ( Note: Provide both an absolute dollar amount and as a percentage of gross pay, rounding to two decimal places.) 3. How much is the employees' net pay as a percentage of total payroll related expenses? ( Note: Round answer to two decimal places.) 4. CONCEPTUAL CONNECTION If another employee can be hired for $60,000 per year, what would be the total cost of this employee to Blitzen?arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning