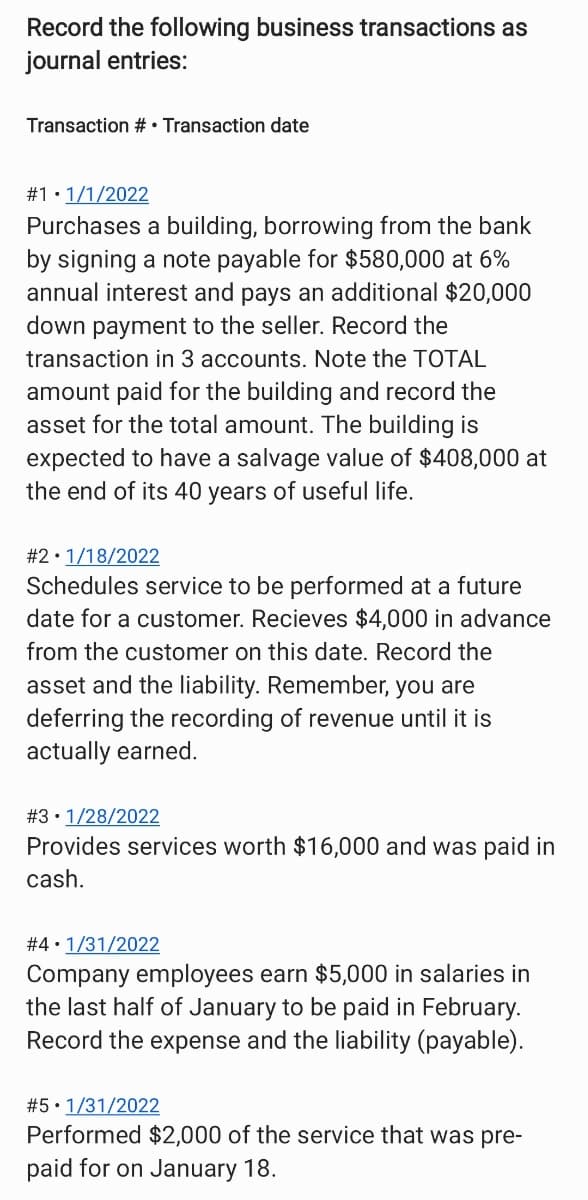

Record the following business transactions as journal entries: Transaction # Transaction date #1.1/1/2022 Purchases a building, borrowing from the bank by signing a note payable for $580,000 at 6% annual interest and pays an additional $20,000 down payment to the seller. Record the transaction in 3 accounts. Note the TOTAL amount paid for the building and record the asset for the total amount. The building is expected to have a salvage value of $408,000 at the end of its 40 years of useful life. # 21/18/2022 Schedules service to be performed at a future date for a customer. Recieves $4,000 in advance from the customer on this date. Record the asset and the liability. Remember, you are deferring the recording of revenue until it is actually earned. # 3 1/28/2022 Provides services worth $16,000 and was paid in cash. #41/31/2022 Company employees earn $5,000 in salaries in the last half of January to be paid in February. Record the expense and the liability (payable). # 5 1/31/2022 Performed $2,000 of the service that was pre- paid for on January 18.

Record the following business transactions as journal entries: Transaction # Transaction date #1.1/1/2022 Purchases a building, borrowing from the bank by signing a note payable for $580,000 at 6% annual interest and pays an additional $20,000 down payment to the seller. Record the transaction in 3 accounts. Note the TOTAL amount paid for the building and record the asset for the total amount. The building is expected to have a salvage value of $408,000 at the end of its 40 years of useful life. # 21/18/2022 Schedules service to be performed at a future date for a customer. Recieves $4,000 in advance from the customer on this date. Record the asset and the liability. Remember, you are deferring the recording of revenue until it is actually earned. # 3 1/28/2022 Provides services worth $16,000 and was paid in cash. #41/31/2022 Company employees earn $5,000 in salaries in the last half of January to be paid in February. Record the expense and the liability (payable). # 5 1/31/2022 Performed $2,000 of the service that was pre- paid for on January 18.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 16EA: Discuss how each of the following transactions for Watson, International, will affect assets,...

Related questions

Question

Hi,

I need help assembling the following journal entries.

Thank you.

Transcribed Image Text:Record the following business transactions as

journal entries:

Transaction # Transaction date

#1.1/1/2022

Purchases a building, borrowing from the bank

by signing a note payable for $580,000 at 6%

annual interest and pays an additional $20,000

down payment to the seller. Record the

transaction in 3 accounts. Note the TOTAL

amount paid for the building and record the

asset for the total amount. The building is

expected to have a salvage value of $408,000 at

the end of its 40 years of useful life.

# 21/18/2022

Schedules service to be performed at a future

date for a customer. Recieves $4,000 in advance

from the customer on this date. Record the

asset and the liability. Remember, you are

deferring the recording of revenue until it is

actually earned.

# 3 1/28/2022

Provides services worth $16,000 and was paid in

cash.

#4 1/31/2022

Company employees earn $5,000 in salaries in

the last half of January to be paid in February.

Record the expense and the liability (payable).

# 5 1/31/2022

Performed $2,000 of the service that was pre-

paid for on January 18.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning