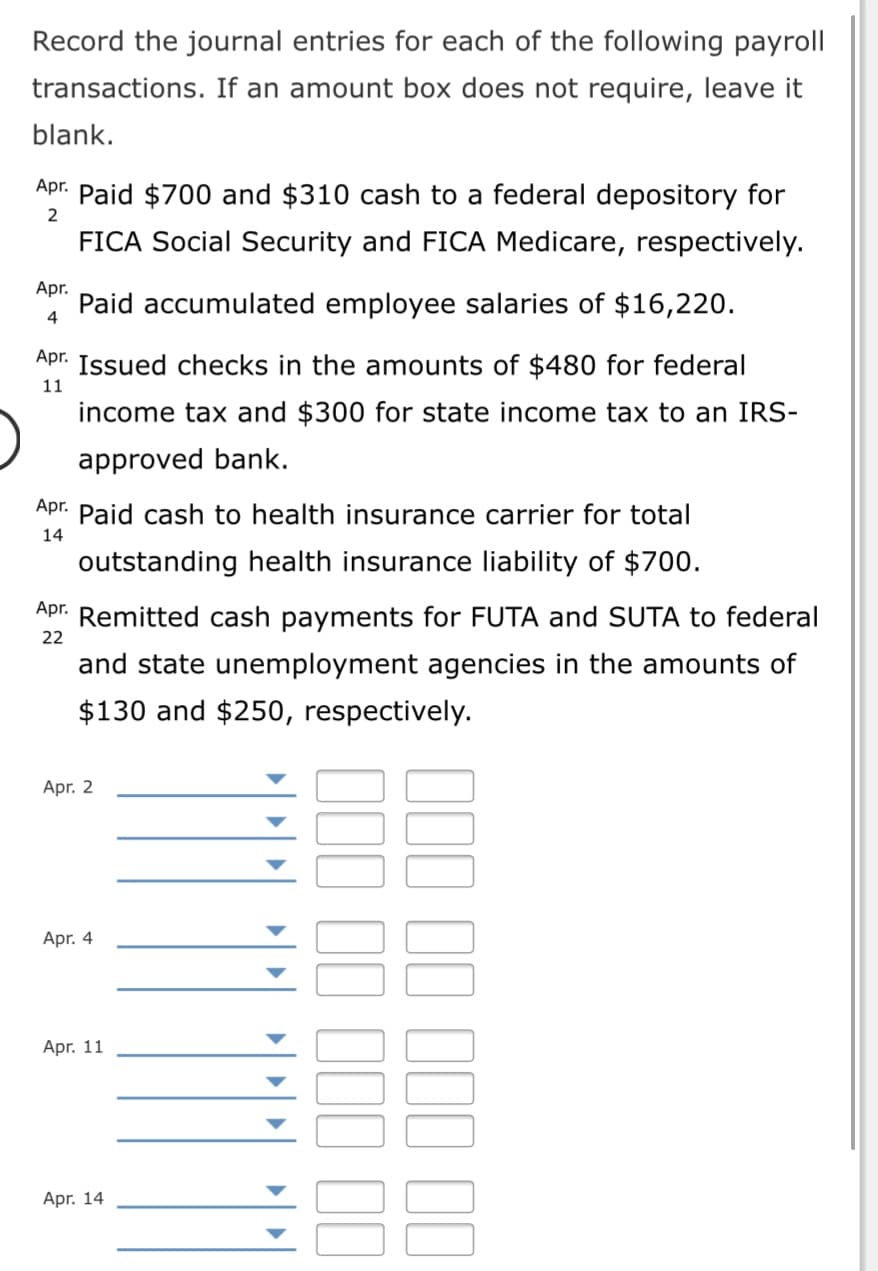

Record the journal entries for each of the following payroll transactions. If an amount box does not require, leave it blank. Apr. Paid $700 and $310 cash to a federal depository for 2 FICA Social Security and FICA Medicare, respectively. Apr. Paid accumulated employee salaries of $16,220. 4 Apr. Issued checks in the amounts of $480 for federal 11 income tax and $300 for state income tax to an IRS- approved bank. Apr. Paid cash to health insurance carrier for total 14 outstanding health insurance liability of $700. Apr. Remitted cash payments for FUTA and SUTA to federal 22 and state unemployment agencies in the amounts of $130 and $250, respectively.

Record the journal entries for each of the following payroll transactions. If an amount box does not require, leave it blank. Apr. Paid $700 and $310 cash to a federal depository for 2 FICA Social Security and FICA Medicare, respectively. Apr. Paid accumulated employee salaries of $16,220. 4 Apr. Issued checks in the amounts of $480 for federal 11 income tax and $300 for state income tax to an IRS- approved bank. Apr. Paid cash to health insurance carrier for total 14 outstanding health insurance liability of $700. Apr. Remitted cash payments for FUTA and SUTA to federal 22 and state unemployment agencies in the amounts of $130 and $250, respectively.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section13.4: Paying Withholding And Payroll Taxes

Problem 1OYO

Related questions

Question

Transcribed Image Text:Record the journal entries for each of the following payroll

transactions. If an amount box does not require, leave it

blank.

Apr. Paid $700 and $310 cash to a federal depository for

2

FICA Social Security and FICA Medicare, respectively.

Apr.

Paid accumulated employee salaries of $16,220.

4

Apr. Issued checks in the amounts of $480 for federal

11

income tax and $300 for state income tax to an IRS-

approved bank.

Apr. Paid cash to health insurance carrier for total

14

outstanding health insurance liability of $700.

Apr.

Remitted cash payments for FUTA and SUTA to federal

22

and state unemployment agencies in the amounts of

$130 and $250, respectively.

Apr. 2

Apr. 4

Apr. 11

Apr. 14

III II 1II I1

1II II III II

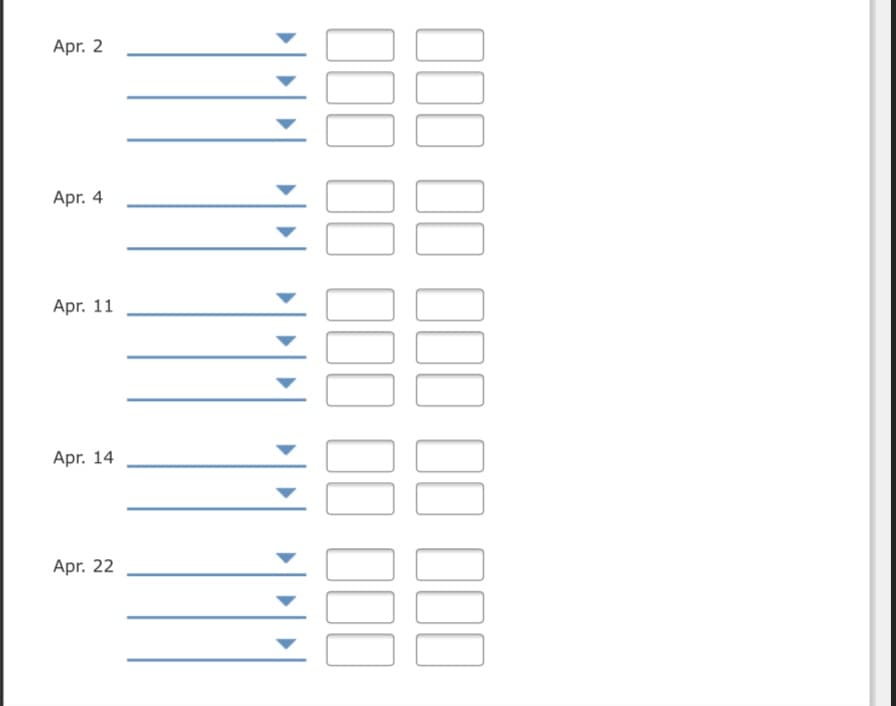

Transcribed Image Text:Apr. 2

Apr. 4

Apr. 11

Apr. 14

Apr. 22

III II 1II I1 II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning