Record (write out in proper journal entry format) each of the adjusting entries. Adjusting & other entries: A) December 31: In reviewing the bank statement, we find that during December, $2,100 in revenue was incorrectly debited to inventory instead of cash (the credit was correct). B) December 31: Determine that we earned (but haven't received) $11,300 in interest revenue on our savings account during the year. C) December 31: We earned $10,900 in sweets sales revenue during December 2025 that was paid for in advance by our customers. The cost of those sweets was $4,900. Prepare entries to record both the sales and cost of goods sold. Record both entries.

Record (write out in proper journal entry format) each of the adjusting entries. Adjusting & other entries: A) December 31: In reviewing the bank statement, we find that during December, $2,100 in revenue was incorrectly debited to inventory instead of cash (the credit was correct). B) December 31: Determine that we earned (but haven't received) $11,300 in interest revenue on our savings account during the year. C) December 31: We earned $10,900 in sweets sales revenue during December 2025 that was paid for in advance by our customers. The cost of those sweets was $4,900. Prepare entries to record both the sales and cost of goods sold. Record both entries.

Business/Professional Ethics Directors/Executives/Acct

8th Edition

ISBN:9781337485913

Author:BROOKS

Publisher:BROOKS

Chapter8: Subprime Lending Fiasco-ethics Issues

Section: Chapter Questions

Problem 3.7EC

Related questions

Question

Record (write out in proper

Adjusting & other entries:

A) December 31: In reviewing the bank statement, we find that during December, $2,100 in revenue was incorrectly debited to inventory instead of cash (the credit was correct).

B) December 31: Determine that we earned (but haven't received) $11,300 in interest revenue on our savings account during the year.

C) December 31: We earned $10,900 in sweets sales revenue during December 2025 that was paid for in advance by our customers. The cost of those sweets was $4,900. Prepare entries to record both the sales and cost of goods sold. Record both entries.

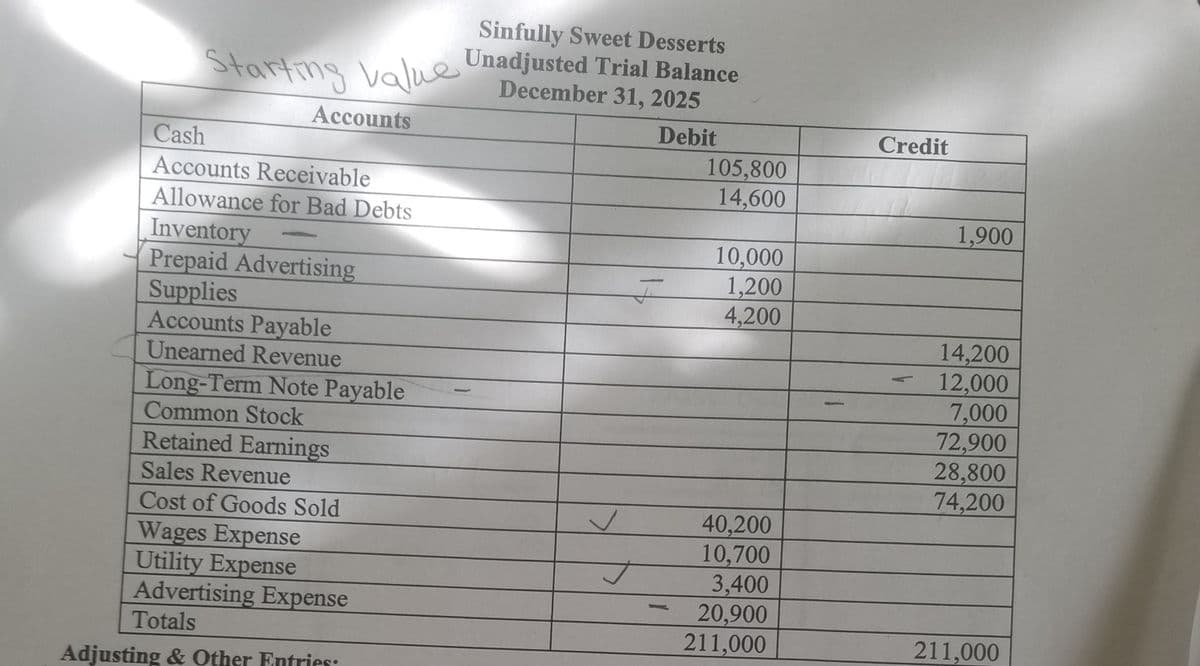

Transcribed Image Text:Sinfully Sweet Desserts

Startmg value Unadjusted Trial Balance

December 31, 2025

Accounts

Debit

Credit

Cash

Accounts Receivable

Allowance for Bad Debts

105,800

14,600

1,900

Inventory

Prepaid Advertising

Supplies

Accounts Payable

Unearned Revenue

10,000

1,200

4,200

14,200

12,000

7,000

72,900

28,800

74,200

Long-Term Note Payable

Common Stock

Retained Earnings

Sales Revenue

Cost of Goods Sold

Wages Expense

Utility Expense

Advertising Expense

40,200

10,700

3,400

20,900

211,000

Totals

211,000

Adjusting & Other Entries:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage