Sunland Company reported the following information in its general ledger at December 31. All sales were on account. At the end of the year, uncollectible accounts were estimated to be 11% of accounts receivable. Using your knowledge of receivables transactions, determine the missing amounts. Ignore any inventory, cost of goods sold, and refund liabilities for the purposes of this question. (Hint: You may find it helpful to reconstruct the journal entries.) Beg. bal. (a) End. bal. (c) (d) Accounts Receivable 16,900 Sale Allowance for Doubtful Accounts 600 Beg. bal. (b) Bad Debt Expense (d) End. bal. (e) 36,800 46,100 1,051

Sunland Company reported the following information in its general ledger at December 31. All sales were on account. At the end of the year, uncollectible accounts were estimated to be 11% of accounts receivable. Using your knowledge of receivables transactions, determine the missing amounts. Ignore any inventory, cost of goods sold, and refund liabilities for the purposes of this question. (Hint: You may find it helpful to reconstruct the journal entries.) Beg. bal. (a) End. bal. (c) (d) Accounts Receivable 16,900 Sale Allowance for Doubtful Accounts 600 Beg. bal. (b) Bad Debt Expense (d) End. bal. (e) 36,800 46,100 1,051

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 85APSA: Determining Bad Debt Expense Using the Aging Method At the beginning of the year, Tennyson Auto...

Related questions

Question

Please help me to solve this problem

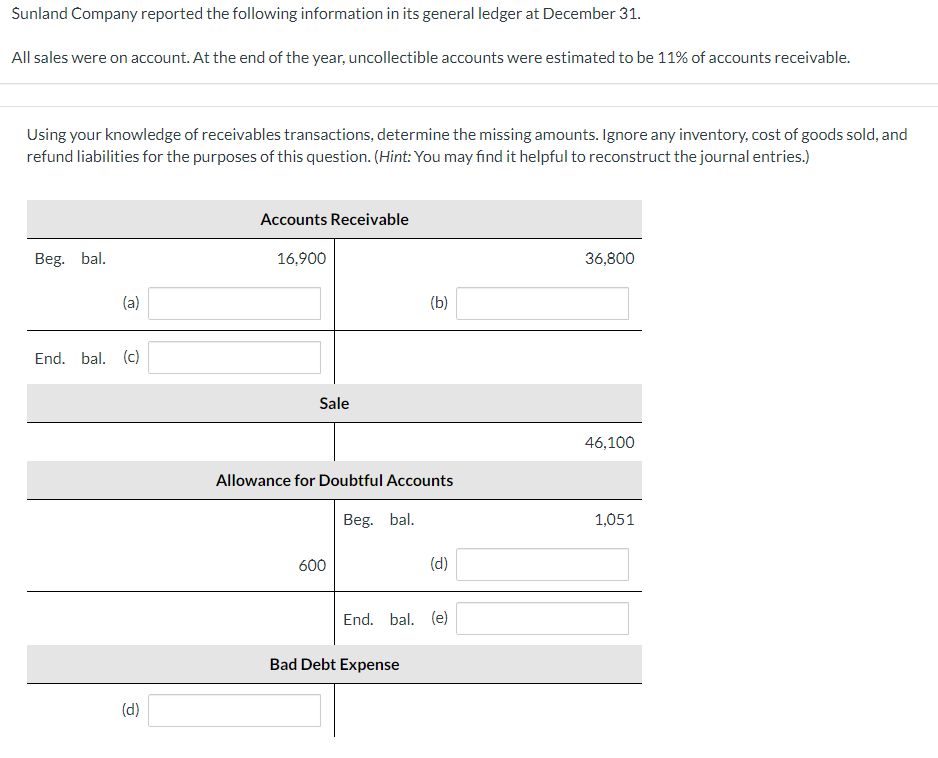

Transcribed Image Text:Sunland Company reported the following information in its general ledger at December 31.

All sales were on account. At the end of the year, uncollectible accounts were estimated to be 11% of accounts receivable.

Using your knowledge of receivables transactions, determine the missing amounts. Ignore any inventory, cost of goods sold, and

refund liabilities for the purposes of this question. (Hint: You may find it helpful to reconstruct the journal entries.)

Beg. bal.

(a)

End. bal. (c)

(d)

Accounts Receivable

16,900

Sale

Allowance for Doubtful Accounts

600

Beg. bal.

(b)

Bad Debt Expense

(d)

End. bal. (e)

36,800

46,100

1,051

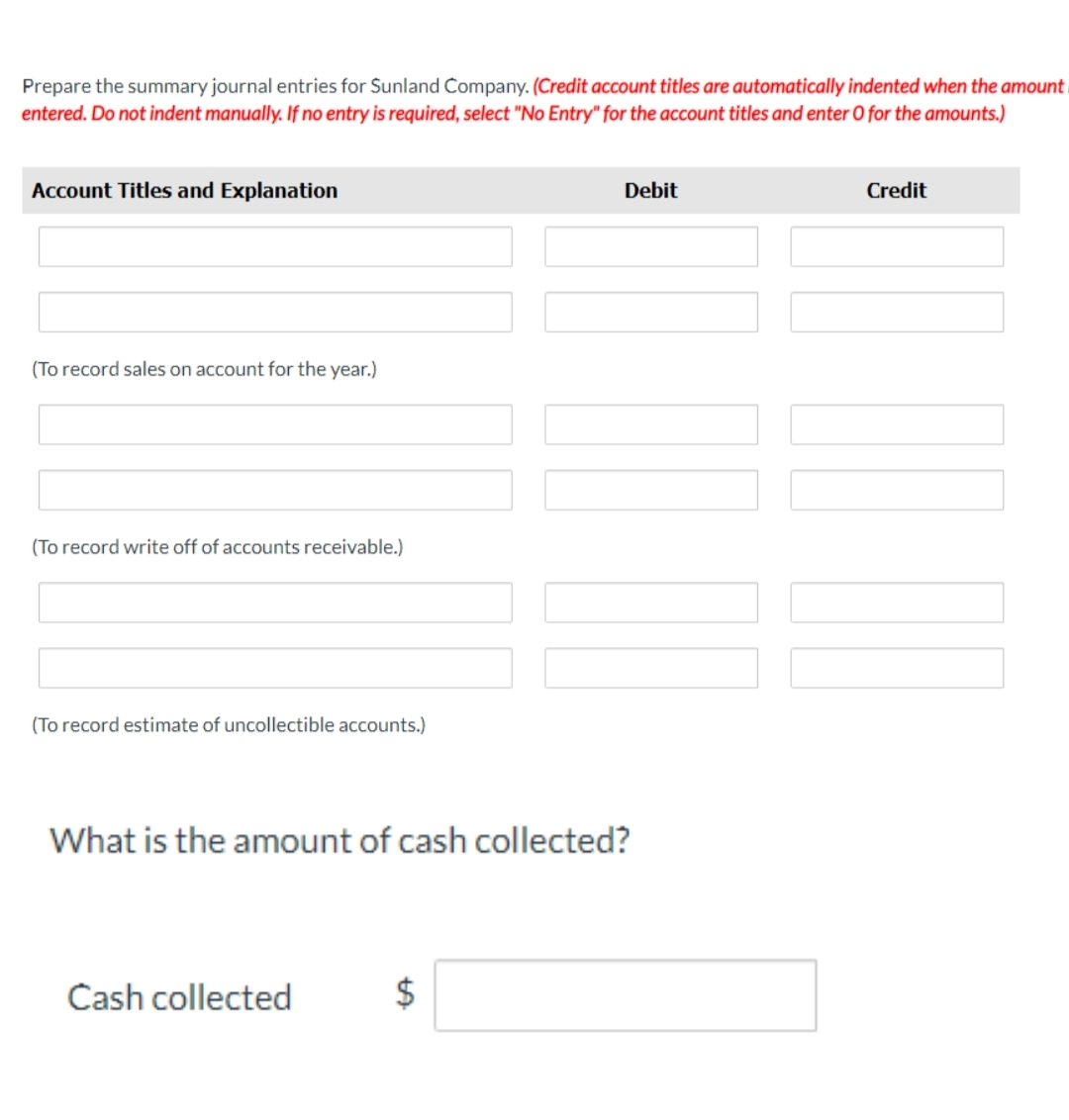

Transcribed Image Text:Prepare the summary journal entries for Sunland Company. (Credit account titles are automatically indented when the amount

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Account Titles and Explanation

(To record sales on account for the year.)

(To record write off of accounts receivable.)

(To record estimate of uncollectible accounts.)

Cash collected

Debit

What is the amount of cash collected?

$

00

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,