Recording Acquisition Costs Following are three separate cases. Case 1. Equipment with a list price of $36,000 is purchased on account; terms are 2/10, n/30. Payment is made within the discount period Case 2. Equipment with a list price of $24,000 is purchased on account; terms are 2/10, n/30. Payment is made after the discount period. Any purchase discounts lost are recorded as interest expense. Case 3. Equipment listed at $10,800 (less a 2% discount for cash purchases) is purchased for cash. To take advantage of this discount, the company simultaneously borrowed $9,600 from a bank by issuing a 60-day, 15% note, which is paid in full with interest at its maturity date. For Case 1 and Case 2, prepare journal entries for (a) equipment acquisition, and (b) cash payment. Case 1 Account Name To record acquisition of equipment. To record payment on account. Case 2 Account Name Dr. Dr. Cr. Cr.

Recording Acquisition Costs Following are three separate cases. Case 1. Equipment with a list price of $36,000 is purchased on account; terms are 2/10, n/30. Payment is made within the discount period Case 2. Equipment with a list price of $24,000 is purchased on account; terms are 2/10, n/30. Payment is made after the discount period. Any purchase discounts lost are recorded as interest expense. Case 3. Equipment listed at $10,800 (less a 2% discount for cash purchases) is purchased for cash. To take advantage of this discount, the company simultaneously borrowed $9,600 from a bank by issuing a 60-day, 15% note, which is paid in full with interest at its maturity date. For Case 1 and Case 2, prepare journal entries for (a) equipment acquisition, and (b) cash payment. Case 1 Account Name To record acquisition of equipment. To record payment on account. Case 2 Account Name Dr. Dr. Cr. Cr.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 5QE

Related questions

Question

answer please in detail

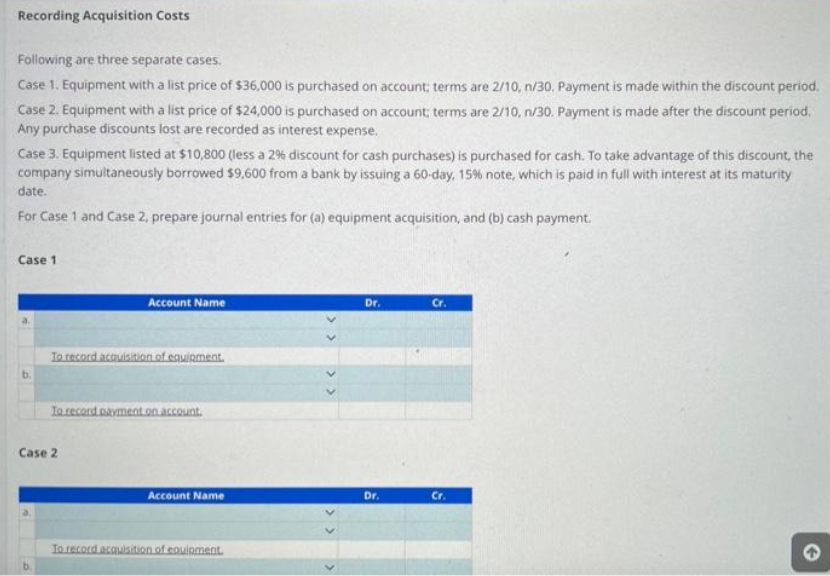

Transcribed Image Text:Recording Acquisition Costs

Following are three separate cases.

Case 1. Equipment with a list price of $36,000 is purchased on account; terms are 2/10, n/30. Payment is made within the discount period.

Case 2. Equipment with a list price of $24,000 is purchased on account; terms are 2/10, n/30. Payment is made after the discount period.

Any purchase discounts lost are recorded as interest expense.

Case 3. Equipment listed at $10,800 (less a 2% discount for cash purchases) is purchased for cash. To take advantage of this discount, the

company simultaneously borrowed $9,600 from a bank by issuing a 60-day, 15% note, which is paid in full with interest at its maturity

date.

For Case 1 and Case 2, prepare journal entries for (a) equipment acquisition, and (b) cash payment.

Case 1

Account Name

To record acquisition of equipment.

To record payment on account.

Case 2

Account Name

To record acquisition of equipment.

<<

Dr.

Dr.

Cr.

Cr.

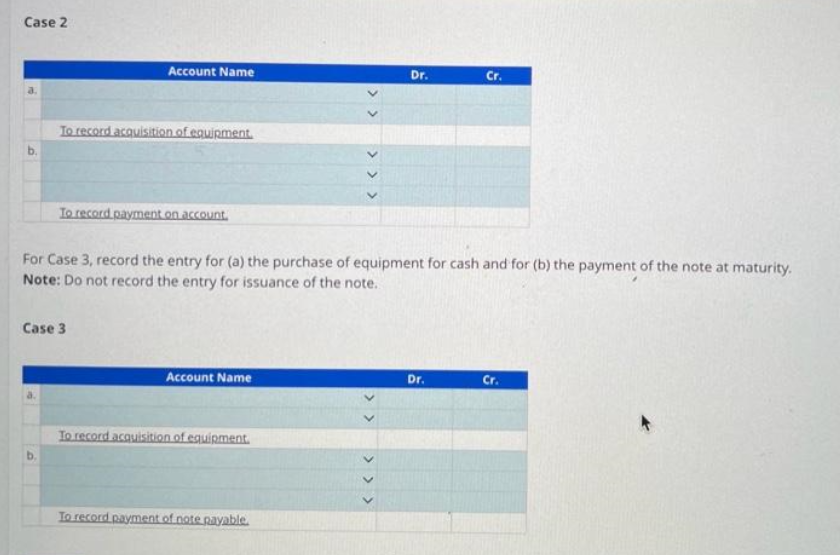

Transcribed Image Text:Case 2

Account Name

To record acquisition of equipment.

To record payment on account.

Case 3

Account Name

For Case 3, record the entry for (a) the purchase of equipment for cash and for (b) the payment of the note at maturity.

Note: Do not record the entry for issuance of the note.

To record acquisition of equipment.

くくくくく

To record payment of note payable.

Dr.

> > > > >

Cr.

Dr.

Cr.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning