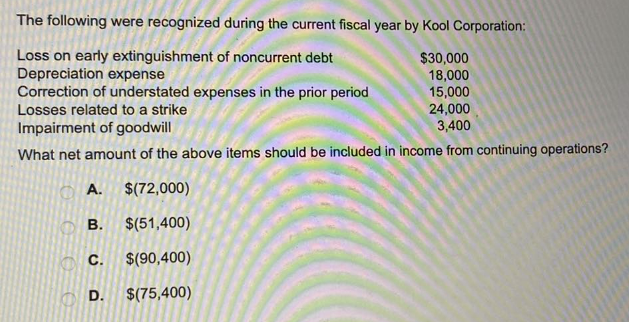

The following were recognized during the current fiscal year by Kool Corporation: Loss on early extinguishment of noncurrent debt $30,000 Depreciation expense 18,000 Correction of understated expenses in the prior period 15,000 Losses related to a strike 24,000 Impairment of goodwill 3,400 What net amount of the above items should be included in income from continuing operations? A. $(72,000) $(51,400) $(90,400) $(75,400) B. C. D.

Q: 1. How much is the NCI at the end of 2019? 2. Net Income Attributable to Parent.

A: NCI: non-controlling interest (NCI) is an ownership stake of less than 50% in a corporation, where…

Q: Jason’s Doughnut Shop had cash sales for the day of $700. In addition, all sales are subject to an…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: What is Jousif's gross profit for his first year of trading?

A: Solution Calculated the Gross profit for the first year of the Jousif's company Gross profit…

Q: Complete the cash flow statement using the indirect method on the template provided.

A: `Solution Calculated the Cash flow statement of ICY Company under the Indirect Method…

Q: 2-61. Yolo Windows, a manufacturer of windows for commercial buildings, reports the follo account…

A: The cost of goods manufactured includes the total cost of goods that are finished during the period.…

Q: Macy of New York sold LeeCo. of Chicago office equipment with a $5,600 list price. Sale terms were…

A: FOB New York is the FOB Shipping point which means that the title to the goods will pass from the…

Q: Tom and Jerry both took out loans for $600.00 on 2011-01-14. Both loans mature on 2011-07-11 and…

A: A day-count convention is a methodology to calculate the amount of interest on debt securities.…

Q: 7) In 2021-22, Steven (who is not a Scottish taxpayer) has business profits of £45,250, bank…

A: Tax liability is defined as the payment that is owed by an individual, business, or other entity to…

Q: Juliet opened an Office Cleaning Service company on January 1, 2021. During the year she had the…

A: Liabilities are financial obligations that a business have to pay to their creditors it means to a…

Q: total revenue is incorrect

A: Total Revenue consist of Revenue from Operation (Sales Revenue) Other Income (Interest Income,…

Q: Madison Corp. has a hurdle rate/required rate of return of 9%. Operating Average income $115,000…

A: The residual income is the amount of income earned in excess as compared to minimum required return…

Q: I need the right numbers for the square in red

A: The solution has been provided for only the journal entries for which the solution has been sought.…

Q: Use the above information to determine cash flows from investing activities. minus sign.)

A: Cash flow from investing activity is a section of cash flow statement. It shows cash inflow and…

Q: A company values its inventory of engines using the FIFO (first in,first out) method. At 1 May 20x5…

A: The closing inventory is the amount of inventory which is left in the stock at the end of the…

Q: Suppose that a firm has the option to make or buy a part. Its annual requirement is 11,000 units. A…

A: 4. Total cost for the buy option = 800+6*11000 =…

Q: On April 1, 9,000 shares of $8 par common stock were issued at $26, and on April 7, 2,000 shares of…

A: Journal Entry is the primary step to record the transaction in the books of accounts. The increase…

Q: Cash collected from clients Cash disbursements; Salaries paid to employees for services rendered…

A: Under accrual accounting, revenues that have been generated but not yet received and expenses that…

Q: fixed costs

A: The break-even point in business, specifically cost accounting means the point at which total…

Q: For the following treasury bill bought in 2007, find (a) the price of the T-bill, and (b) the actual…

A: Treasury Bills: Treasury bills are the borrowing instrument of the money market used by the…

Q: In December 2020 Sally purchased an annuity that pays her $1,000 per month for 16 years. She paid…

A: Given in the question: Annuity purchased for = $150,000 During the year 2021, Sally has received the…

Q: Consolidated financial statements are required by GAAP in certain circumstances. This information…

A: Consolidated financial statements are statements prepared by parent company . Parent company is a…

Q: Complete the following table: Note: Do not round net price equivalent rate and single equivalent…

A: Working : Net price equivalent rate (in decimals) = (1 - discount 1) x (1 - discount 2) x (1-…

Q: Marigold Corporation was organized on January 1, 2025. It is authorized to issue 11,000 shares of…

A: Journal Entries - Journal Entries are the records of the transactions entered into by the company…

Q: Stilley Corporation had eamings after taxes of $466,000 in 20X2 with 200,000 shares outstanding. The…

A: Earnings per share is the per share value of the amount earned by the shareholders from the profits…

Q: 18 1 2 3 4 5 6 7 8 9 10 11 12 13 19 15 A B IX ✓ fx C Chapter 9-Assignment 1.4 Problem 1: Calculating…

A: PAYBACK PERIOD Payback Period is one of the Important Capital Budgeting Technique. It is the most…

Q: [The following information applies to the questions displayed below.] In the current year, Randa…

A: Income statement is prepared by the business organizations so as to know how much amount of gross…

Q: Gates Appliances has a return-on-assets (investment) ratio of 17 percent. a. If the…

A: Return on equity is calculated to know the profitability of the firm and it indicates the actual…

Q: Bramble Corp. reports operating expenses in two categories: (1) selling and (2) general and…

A: Selling Expenses: Selling Expenses are those expenses which relates to the sales part of the…

Q: A company had stock outstanding as follows during each of its first three years of operations: 3,000…

A: Preference Share Preference Shares are the shares which have been issued with preference right…

Q: Cash collected from clients Cash disbursements; Salaries paid to employees for services rendered…

A: As per the information given in the question, utilities cost incurred in year 1 is $37000 and actual…

Q: Newark Company has provided the following information: Cash sales, $450,000 Credit sales,…

A: The net sales is reported in the income statement of the company. The cost of goods sold would be…

Q: Maplewood Supply received a $5,350 invoice dated 4/15/20. The $5,350 included $350 freight. Terms…

A: The terms defines the amount of discount within the given time period. If payment is made within…

Q: Audit notes: a. Your purchases cut-off procedures resulted to the following information: December…

A: Accounts payable is a current liability arising out of purchase of merchandise in an orderly…

Q: Malibu Inc. reported the following (in millions) on its year-end balance sheet: Total liabilities…

A: Non-owner finance is money provided to a firm in exchange for anything like a guaranteed payback,…

Q: 8. The Supplies account shows a balance of $2,500 on December 31, 2021 before adjustments. A…

A: Golden Rules of Accounting: Account Debit Credit Personal Accounts The Receiver The…

Q: On 1 January 20X0 Alpha Co purchased 90,000 ordinary $1 shares in Beta Co for $270,000. At that date…

A: When a firm has numerous divisions or subsidiaries, its financial records are referred to as having…

Q: In using the average method how many units were completed from process 1 and transferred to process…

A: One of the accounting techniques that is frequently employed by businesses that produce identical…

Q: Prepare the journal entries to record the treasury stock transactions in 2025. a

A: Journal entry is a primary entry that records the financial transactions initially. The transactions…

Q: On the first day of the fiscal year, a company issues a $784,000, 6%, 10-year bond that pays…

A: A Issue price $823,800 B Face value $784,000 C=A-B Premium on bonds payable $39,800 D No.…

Q: Discuss well about the exchange Rate Mechanisms of currencies; what does it mean “Independent…

A: Answer:- Currency meaning:- The public uses currency, an officially recognized type of money, for…

Q: Pratt Company acquired all of the outstanding shares of Spider, Inc., on December 31, 2021, for…

A: Calculation of Goodwill: Particulars Amount ($) Amount ($) The consideration transferred at…

Q: Star Co had an on-going litigation claim which had been brought against the company for damage to a…

A: Lets understand the basics. As per IAS 37 "Provision, contingent liabilities and contingent assets,…

Q: Use the information in the adjusted trial balance presented below to calculate current assets for Ta…

A: Current Assets are the assets which is realised within the operating cycle of the company or…

Q: Jitrah Sdn Bhd is a Malaysia tax resident company. Jitrah is registered under sales tax. Jitrah…

A: “Since you have posted a question with multiple sub-parts, we will provide the solution only to the…

Q: On 1 January 20X0 Alpha Co purchased 90,000 ordinary $1 shares in Beta Co for $270,000. At that date…

A: The amount of a company's net income that isn't distributed as dividends is referred to as retained…

Q: Rose opened an Office Cleaning Service company on January 1, 2020. During 2020 she had the…

A: Cash flow statement includes: Cash flows from operating activities Cash flows from investing…

Q: Cash Accounts receivable Teaching supplies Prepaid insurance Prepaid rent Professional library.…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: Low Carb Diet Supplement Inc. has two divisions. Division A has a profit of $176,000 on sales of…

A: Given, Divison A:- Profit = $176,000 Sales = $2,490,000 Divison B:- Profit =…

Q: Franklin Corporation issues $83,000, 10%, 5-year bonds on January 1 for $86,700. Interest is paid…

A: Amortization of Premium: Bonds are sold at a premium when the stated interest rate is higher than…

Q: Record the effects of each item using a journal entry. (If Required" in the first account field

A: S.No Transaction Dr/Cr Paticulars Debit ($) Credit ($) 1 a Dr Cash 40000 Cr Common Stock…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

- Consider the following situations and determine (1) which type of liability should be recognized (specific account), and (2) how much should be recognized in the current period (year). A. A business depreciates a building with a book value of $12,000, using straight-line depreciation, no salvage value, and a remaining useful life of six years. B. An organization has a line of credit with a supplier. The company purchases $35,500 worth of inventory on credit. Terms of purchase are 3/20, n/60. C. An employee earns $1,000 in pay and the employer withholds $46 for federal income tax. D. A customer pays $4,000 in advance for legal services. The lawyer has previously recognized 30% of the services as revenue. The remainder is outstanding.Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.Unusual income statement items Assume that the amount of each of the following items is material to the financial statements. Classify each item as either normally recurring (NR) or unusual (U) items. If unusual item, then specify if it is a discontinued operations item (DO). a. Interest revenue on notes receivable. b. Gain on sale of segment of the company's operations that manufactures bottling equipment. c.Loss on sale of investments in stocks and bonds. d. Uncollectible accounts expense. e. Uninsured flood loss. (Hood insurance is unavailable because of periodic Hooding in the area.)

- Lowell Corporation's results for the year ended December 31, 2021, include the following material items: Sales revenue $ 8,400,000 Cost of goods sold 6,000,000 Selling and administrative expenses 1,300,000 Loss on sale of investments 200,000 Loss on discontinued operations 500,000 Loss on impairment from continuing operations 80,000 Lowell Corporation's income from continuing operations before income taxes for 2021 is: A) $900,000. B) $880,000. C) $320,000 D) $820,000.For 20X1, Silvertip Construction, Inc., reported income from continuing operations (after tax) of $1,650,000. On November 15, 20X1, the company adopted a plan to dispose of a component of the business. This component qualifies for discontinued operations treatment. During 20X1, the component had pre-tax operating losses of $95,000. The component’s assets had a book value of $760,000 on December 31, 20X1. A recent market value analysis of these assets placed their estimated selling price at $735,000, less a 6% brokerage commission. Management appropriately determines that these assets are impaired and expects to find a buyer for the component and complete the sale early in 20X2. Prepare a partial income statement for Silvertip including EPS disclosures for the year ended December 31, 20X1. Begin at income from continuing operations. Assume a 21% income tax rate and 1,000,000 shares of outstanding common stock. (Round your answers to 2 decimal places under "Earnings per share".)For 20X1, Silvertip Construction, Inc., reported income from continuing operations (after tax) of $1,650,000. On November 15, 20X1, the company adopted a plan to dispose of a component of the business. This component qualifies for discontinued operations treatment. During 20X1, the component had pre-tax operating losses of $95,000. The component’s assets had a book value of $760,000 on December 31, 20X1. A recent market value analysis of these assets placed their estimated selling price at $735,000, less a 6% brokerage commission. Management appropriately determines that these assets are impaired and expects to find a buyer for the component and complete the sale early in 20X2. Required: Prepare a partial income statement for Silvertip including EPS disclosures for the year ended December 31, 20X1. Begin at income from continuing operations. Assume a 21% income tax rate and 1,000,000 shares of outstanding common stock. (Round your answers to 2 decimal places under "Earnings per…

- The following information is related to Dickinson Company for 2020. Retained earnings balance, January 1, 2020 $ 980,000 Sales revenue 25,000,000 Cost of goods sold 16,000,000 Interest revenue 70,000 Selling and administrative expenses 4,700,000 Write-off of goodwill 820,000 Income taxes for 2020 1,244,000 Gain on the sale of investments 110,000 Loss due to flood damage 390,000 Loss on the disposition of the wholesale division (net of tax) 440,000 Loss on operations of the wholesale division (net of tax) 90,000 Dividends declared on common stock 250,000 Dividends declared on preferred stock 80,000 Dickinson Company decided to discontinue its entire wholesale operations (considered a discontinued operation) and to retain its manufacturing operations. On September 15, Dickinson sold the wholesale operations to Rogers Company. During 2020, there were 500,000 shares of common stock outstanding all year. Instructions Prepare a multiple-step income statement…A company that was to be liquidated hadthe following liabilities: Income Taxes $ 15,000 Notes Payable secured by land 120,000 Accounts Payable 48,000 Salaries Payable ($18,000 for Employee #1 and$5,000 for Employee #2) 23,000 Administrative expenses for liquidation 25,000 The company had the following assets: Book Value Fair Value Current Assets $ 130,000 $115,000 Land 60,000 100,000 Building 175,000 220,000 Total liabilities with priority are calculated to be what amount?The following information is related to Nash Company for 2020. Retained earnings balance, January 1, 2020 $901,600 Sales Revenue 23,000,000 Cost of goods sold 14,720,000 Interest revenue 64,400 Selling and administrative expenses 4,324,000 Write-off of goodwill 754,400 Income taxes for 2020 1,144,480 Gain on the sale of investments 101,200 Loss due to flood damage 358,800 Loss on the disposition of the wholesale division (net of tax) 404,800 Loss on operations of the wholesale division (net of tax) 82,800 Dividends declared on common stock 230,000 Dividends declared on preferred stock 73,600 Nash Company decided to discontinue its entire wholesale operations (considered a discontinued operation) and to retain its manufacturing operations. On September 15, Nash sold the wholesale operations to Rogers Company. During 2020, there were 500,000 shares of common stock outstanding all year. (a1) New attempt is in…

- A company that was to be liquidated had the following liabilities: Income Taxes $ 15,000 Notes Payable secured by land 120,000 Accounts Payable 48,000 Salaries Payable ($18,000 for Employee #1 and $5,000 for Employee #2) 23,000 Administrative expenses for liquidation 25,000 The company had the following assets: Book Value Fair Value Current Assets $ 130,000 $115,000 Land 60,000 100,000 Building 175,000 220,000 Total assets, available to pay liabilities with priority and unsecured creditors, are calculated to be what amount? $100,000. $335,000. $320,000. $305,000. $365,000.The following information is related to Sheridan Company for 2020. Retained earnings balance, January 1, 2020 $999,600 Sales Revenue 25,500,000 Cost of goods sold 16,320,000 Interest revenue 71,400 Selling and administrative expenses 4,794,000 Write-off of goodwill 836,400 Income taxes for 2020 1,268,880 Gain on the sale of investments 112,200 Loss due to flood damage 397,800 Loss on the disposition of the wholesale division (net of tax) 448,800 Loss on operations of the wholesale division (net of tax) 91,800 Dividends declared on common stock 255,000 Dividends declared on preferred stock 81,600 Sheridan Company decided to discontinue its entire wholesale operations (considered a discontinued operation) and to retain its manufacturing operations. On September 15, Sheridan sold the wholesale operations to Rogers Company. During 2020, there were 500,000 shares of common stock outstanding all year. (a1) Prepare a…Orange Company’s ledger revealed the following account balances as of December 31, 2020: Unamortized discount on bonds payable P120,000; Organization costs P100,000; Losses in early years of company P450,000; Trademarks P750,000 Patents P150,000; Amount set up by BOD as goodwill P300,000. How much should be presented as intangible assets shown In the statement of financial position? * P1,300,000 P1,000,000 P900,000 P0 answer not given