Recording Entries for an Installment Note Payable On January 1, 2020, a borrower signed a long-term note, face amount, $100,000; time to maturity, three years; stated rate of interest, 8%. The market rate of interest of 10% determined the cash received by the borrower. The note will be paid in three equal annual installments of $38,803 each December 31 (which is also the end of the accounting period for the borrower). Required a. Compute the cash received by the borrower and prepare a debt amortization schedule. • Note: Round your answer to the nearest whole dollar. 1. Compute the cash received by the borrower. $ 80,000 2. Prepare a debt amortization schedule.

Recording Entries for an Installment Note Payable On January 1, 2020, a borrower signed a long-term note, face amount, $100,000; time to maturity, three years; stated rate of interest, 8%. The market rate of interest of 10% determined the cash received by the borrower. The note will be paid in three equal annual installments of $38,803 each December 31 (which is also the end of the accounting period for the borrower). Required a. Compute the cash received by the borrower and prepare a debt amortization schedule. • Note: Round your answer to the nearest whole dollar. 1. Compute the cash received by the borrower. $ 80,000 2. Prepare a debt amortization schedule.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 6P: Non-Interest-Bearing Note Payable: Present Value On January 1, 2019, Northern Manufacturing Company...

Related questions

Question

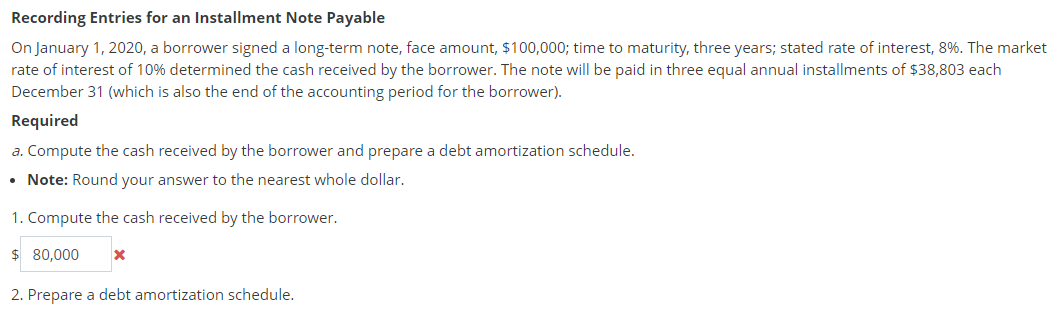

Transcribed Image Text:Recording Entries for an Installment Note Payable

On January 1, 2020, a borrower signed a long-term note, face amount, $100,000; time to maturity, three years; stated rate of interest, 8%. The market

rate of interest of 10% determined the cash received by the borrower. The note will be paid in three equal annual installments of $38,803 each

December 31 (which is also the end of the accounting period for the borrower).

Required

a. Compute the cash received by the borrower and prepare a debt amortization schedule.

Note: Round your answer to the nearest whole dollar.

1. Compute the cash received by the borrower.

$ 80,000

2. Prepare a debt amortization schedule.

Expert Solution

Step 1

Cash received by the borrower is the summation of the present value of all the installments to be paid on December 31.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning