Prepare general journal entries for the following four transactions for Entity Ltd. In this question GST is applicable; the NZ rate of GST is 15%. Entity Ltd uses the perpetual inventory system. For this question, do not prepare the journal entry to recognise the COGS.

Prepare general journal entries for the following four transactions for Entity Ltd. In this question GST is applicable; the NZ rate of GST is 15%. Entity Ltd uses the perpetual inventory system. For this question, do not prepare the journal entry to recognise the COGS.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter9: Working Capital

Section: Chapter Questions

Problem 25E

Related questions

Question

100%

Prepare general journal entries for the following four transactions for Entity Ltd. In this

question GST is applicable; the NZ rate of GST is 15%. Entity Ltd uses the perpetual

inventory system. For this question, do not prepare the journal entry to recognise the COGS.

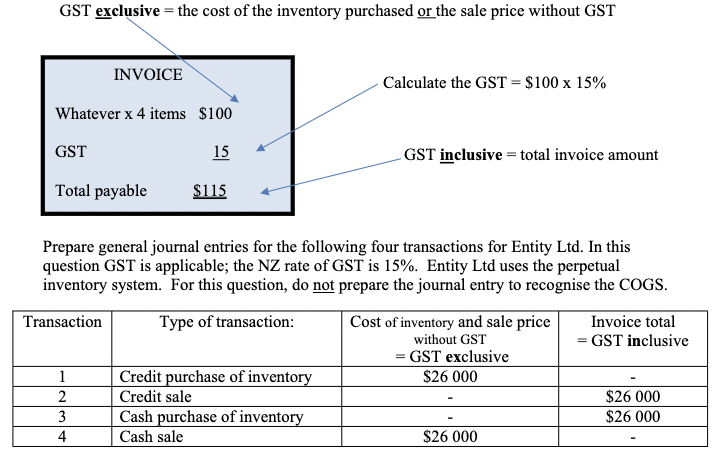

Transcribed Image Text:GST exclusive = the cost of the inventory purchased or the sale price without GST

INVOICE

Calculate the GST = $100 x 15%

Whatever x 4 items $100

GST

15

GST inclusive = total invoice amount

Total payable

$115

Prepare general journal entries for the following four transactions for Entity Ltd. In this

question GST is applicable; the NZ rate of GST is 15%. Entity Ltd uses the perpetual

inventory system. For this question, do not prepare the journal entry to recognise the COGS.

Transaction

Type of transaction:

Cost of inventory and sale price

without GST

Invoice total

= GST inclusive

= GST exclusive

Credit purchase of inventory

$26 000

1

2

Credit sale

$26 000

3

Cash purchase of inventory

$26 000

4

Cash sale

$26 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning