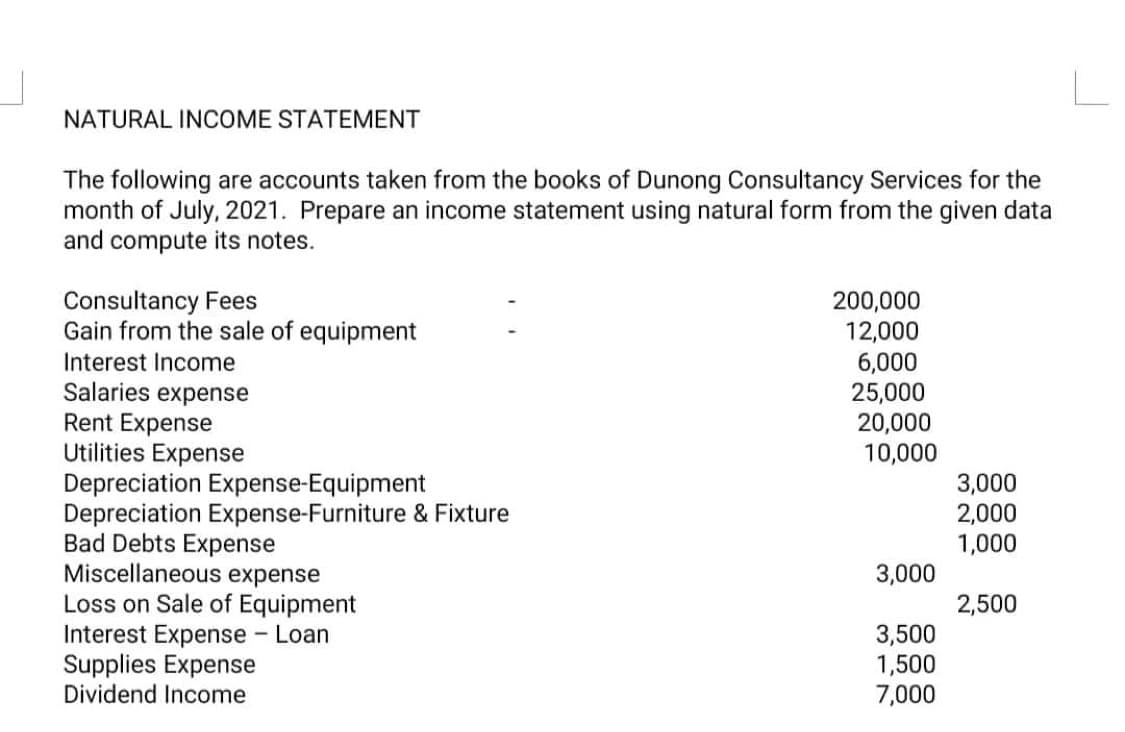

The following are accounts taken from the books of Dunong Consultancy Services for the month of July, 2021. Prepare an income statement using natural form from the given data and compute its notes. Consultancy Fees Gain from the sale of equipment Interest Income Salaries expense Rent Expense Utilities Expense Depreciation Expense-Equipment Depreciation Expense-Furniture & Fixture Bad Debts Expense Miscellaneous expense Loss on Sale of Equipment Interest Expense - Loan Supplies Expense Dividend Income 200,000 12,000 6,000 25,000 20,000 10,000 3,000 3,500 1,500 7,000 3,000 2,000 1,000 2,500

The following are accounts taken from the books of Dunong Consultancy Services for the month of July, 2021. Prepare an income statement using natural form from the given data and compute its notes. Consultancy Fees Gain from the sale of equipment Interest Income Salaries expense Rent Expense Utilities Expense Depreciation Expense-Equipment Depreciation Expense-Furniture & Fixture Bad Debts Expense Miscellaneous expense Loss on Sale of Equipment Interest Expense - Loan Supplies Expense Dividend Income 200,000 12,000 6,000 25,000 20,000 10,000 3,000 3,500 1,500 7,000 3,000 2,000 1,000 2,500

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter4: Adjusting Entries And The Work Sheet

Section: Chapter Questions

Problem 9E: Determine on which financial statement each account listed below is reported. Use the following...

Related questions

Question

Transcribed Image Text:NATURAL INCOME STATEMENT

The following are accounts taken from the books of Dunong Consultancy Services for the

month of July, 2021. Prepare an income statement using natural form from the given data

and compute its notes.

Consultancy Fees

Gain from the sale of equipment

Interest Income

Salaries expense

Rent Expense

Utilities Expense

Depreciation Expense-Equipment

Depreciation Expense-Furniture & Fixture

Bad Debts Expense

Miscellaneous expense

Loss on Sale of Equipment

Interest Expense - Loan

Supplies Expense

Dividend Income

200,000

12,000

6,000

25,000

20,000

10,000

3,000

3,500

1,500

7,000

3,000

2,000

1,000

2,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning