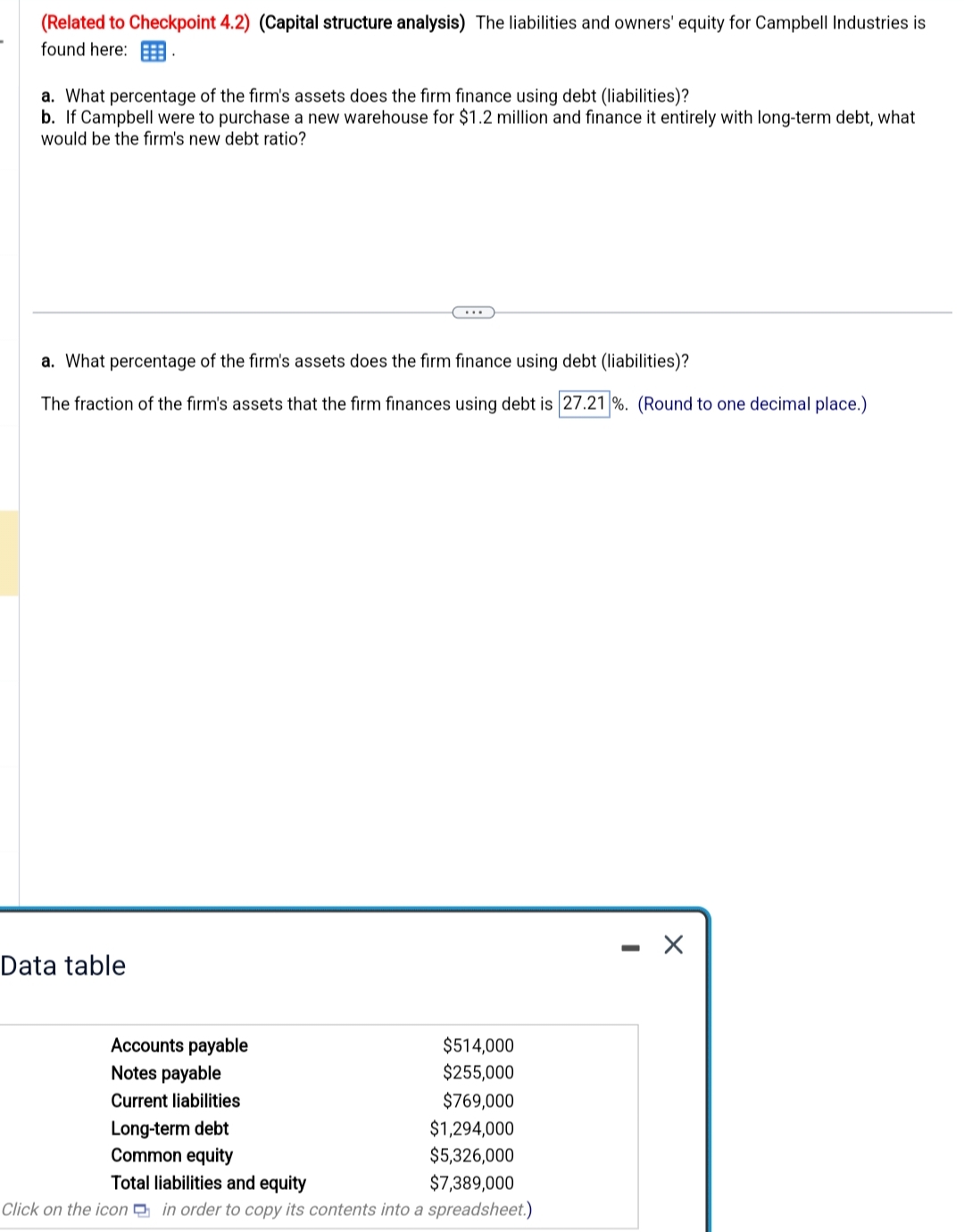

(Related to Checkpoint 4.2) (Capital structure analysis) The liabilities and owners' equity for Campbell Industries is found here: a. What percentage of the firm's assets does the firm finance using debt (liabilities)? b. If Campbell were to purchase a new warehouse for $1.2 million and finance it entirely with long-term debt, what would be the firm's new debt ratio? a. What percentage of the firm's assets does the firm finance using debt (liabilities)? The fraction of the firm's assets that the firm finances using debt is 27.21 %. (Round to one decimal place.)

Cost of Debt, Cost of Preferred Stock

This article deals with the estimation of the value of capital and its components. we'll find out how to estimate the value of debt, the value of preferred shares , and therefore the cost of common shares . we will also determine the way to compute the load of every cost of the capital component then they're going to estimate the general cost of capital. The cost of capital refers to the return rate that an organization gives to its investors. If an organization doesn’t provide enough return, economic process will decrease the costs of their stock and bonds to revive the balance. A firm’s long-run and short-run financial decisions are linked to every other by the assistance of the firm’s cost of capital.

Cost of Common Stock

Common stock is a type of security/instrument issued to Equity shareholders of the Company. These are commonly known as equity shares in India. It is also called ‘Common equity

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images