(Related to Checkpoint 9.1) (Floating-rate loans) The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital. The loan called for a floating rate that was 27 basis points (0.27 percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of the index for the previous week and had a maximum annual rate of 2.17 percent and a minimum of 1.78 percent. Calculate the rate of interest for weeks 2 through 10. Date Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Week 7 Week 8 Week 9 LIBOR 1.91% 1.64% 1.46% 1.31% 1.56% 1.68% 1.68% 1.95% 1.87%

(Related to Checkpoint 9.1) (Floating-rate loans) The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital. The loan called for a floating rate that was 27 basis points (0.27 percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of the index for the previous week and had a maximum annual rate of 2.17 percent and a minimum of 1.78 percent. Calculate the rate of interest for weeks 2 through 10. Date Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Week 7 Week 8 Week 9 LIBOR 1.91% 1.64% 1.46% 1.31% 1.56% 1.68% 1.68% 1.95% 1.87%

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 16P

Related questions

Question

Ef 543.

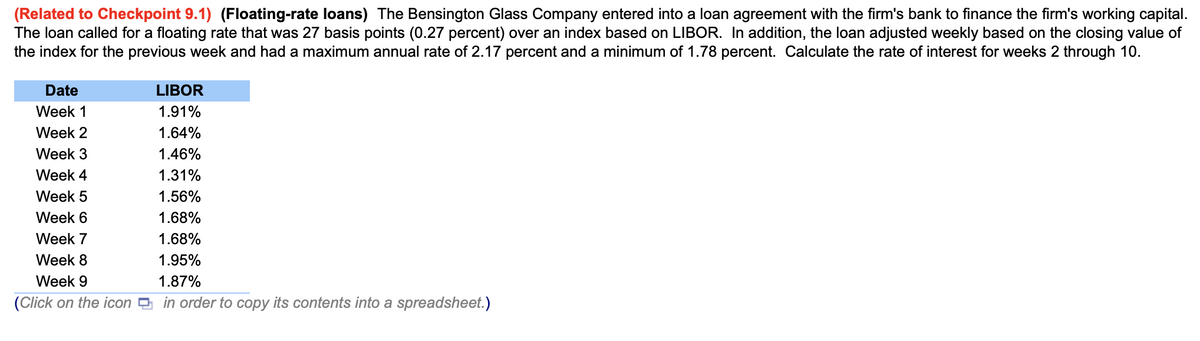

Transcribed Image Text:(Related to Checkpoint 9.1) (Floating-rate loans) The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital.

The loan called for a floating rate that was 27 basis points (0.27 percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of

the index for the previous week and had a maximum annual rate of 2.17 percent and a minimum of 1.78 percent. Calculate the rate of interest for weeks 2 through 10.

Date

LIBOR

1.91%

Week 1

Week 2

1.64%

Week 3

1.46%

Week 4

1.31%

Week 5

1.56%

Week 6

1.68%

Week 7

1.68%

Week 8

1.95%

Week 9

1.87%

(Click on the icon in order to copy its contents into a spreadsheet.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College