related to his MBA program. He had unreimbursed education expenses of $16,000 in 2021. What is the tax treatment of the unreimbursed educatio costs?

related to his MBA program. He had unreimbursed education expenses of $16,000 in 2021. What is the tax treatment of the unreimbursed educatio costs?

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 15P

Related questions

Question

This is US Tax and Law Study Guide

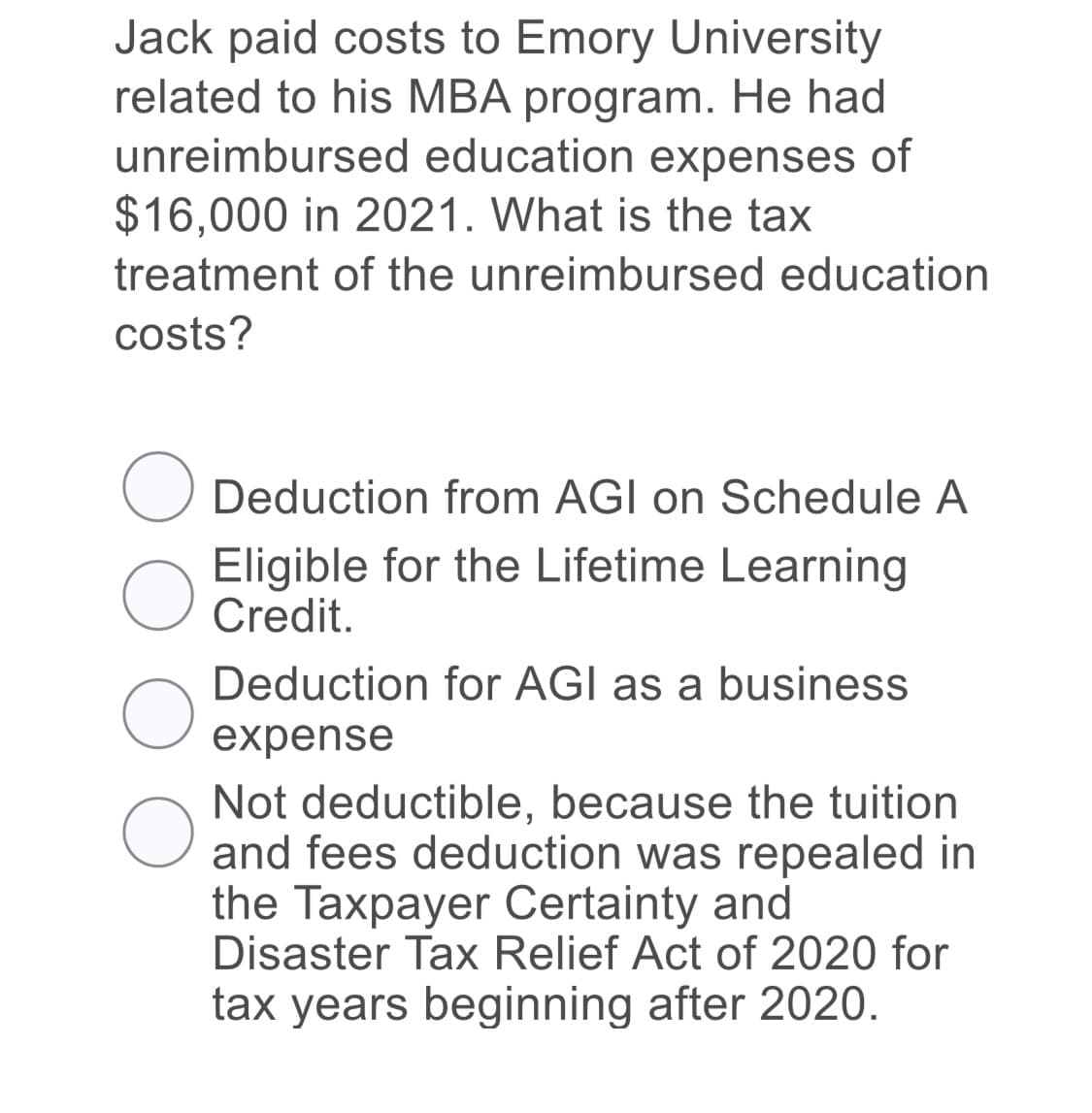

Transcribed Image Text:Jack paid costs to Emory University

related to his MBA program. He had

unreimbursed education expenses of

$16,000 in 2021. What is the tax

treatment of the unreimbursed education

costs?

Deduction from AGI on Schedule A

Eligible for the Lifetime Learning

Credit.

Deduction for AGI as a business

expense

Not deductible, because the tuition

and fees deduction was repealed in

the Taxpayer Certainty and

Disaster Tax Relief Act of 2020 for

tax years beginning after 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT