he purchase price per unit of inventory is relevant in the computation on EOQ. otal factory labor cost is composed of direct and indirect labor.

Q: QUESTION 9 Using the incomplete Flexible Budget Performance Report below, calculate the total fixed…

A: A flexible budget is prepared on the basis of the budgeted rate and on the basis of different…

Q: Use the following information for the nexct two (2) questions: On July 1, 2017. Banded Water Company…

A: Given that, Carrying amount of old machine = P10,000 Cash price of new machine = P32,000 Cash paid =…

Q: If an entity was not able to determine the fair value of both the asset received and the asset given…

A: Where the exchange of Assets have a commercial substance (sufficient cash flow can be generated in…

Q: Mary spent $21,500 for an executive development course at the Harvard Business School (including…

A: As an employee, you can claim your work-related training as a miscellaneous, itemized deduction,…

Q: 210,000 Bonds payable 200,000 Prepaid expenses

A: Net income is the total amount of money earned by an individual or company in a certain time period…

Q: Canyon Corporation's budgeted production schedule, by quarters, for the coming year is as follows:…

A: Direct material purchases (in pounds) = Total direct material required for quarter + Ending…

Q: Sales Var. cost of goods sold Fixed manufacturing costs Variable selling Fixed admin. (50%…

A: Return on investment is ratio between the Net Income and Cost of investment. It is measured in…

Q: Turn to Stone, Inc. manufactures statues of pop culture icons. All statues are the same size and…

A: Actual directmaterial cost per statue = Total cost incurred/Number of statues produced

Q: inception is $100,000. Assume that the present value of lease payments discounted at a 10% interest…

A: An operating lease tends to have a shorter duration than a capital lease, and the lessee does not…

Q: Cobb Co. can further process Product X to produce Product Y. Product X is currently selling for $30…

A: Using differential costing we will take decisions for a new proposal and it will compare additional…

Q: Users of sustainability reporting information are not just primary users such as shareholders and…

A: Solution:- Sustainability report includes the following three items as follows under:- Economic…

Q: Frame Manufacturing Corporation has provided the following sales budget information: July August…

A: Cash budget is prepared to estimate the total cash received and total cash disbursement. It is…

Q: Book credit error of current month corrected in the same month shall be: Group of answer choices…

A: The bank reconciliation statement is prepared to equate the balances of cash book and passbook with…

Q: he shares had fair value of P110 per share. July 1, 2022, Tan Beda Company purchased additional…

A: Tan Beda acquired 10% voting shares in Taint Dude . 10% is very low amount for controlling…

Q: A) A financial analyst states that company profit had increased by $1.8m compared to the previous…

A: Solution Concept Increase in profit means by how much the profit of the company has increased on…

Q: January 1, 2017, an entity disclosed the following balances: Land 4,000,000 Land…

A: The answer is stated below:

Q: Alcatraz Division of XYZ Corp. sells 80,000 units of part X to the outside market. Part X sells for…

A: In the given question, Alcatraz division is selling 10,000 units to Capone division at $ 40 per…

Q: Selected ledger account balances for Business Solutions follow. For Three Months For Three Months…

A: Under straight-line method, depreciation expense for a given year is equal to 4 times the…

Q: Superman Inc. maintains a defined benefit pension plan. At the beginning of 2022 the pension plan…

A: Defined Benefit Plan Defined benefit plan is considered to be the most acceptable pension plan which…

Q: n the following ordinary annuity, the interest is compounded with each payment, and the payment is…

A: How long will it take to have enough for a 20% down payment on a $155,000 condo in the city:- 20%…

Q: AA Company maintained cash in bank at Lunar Bank. This account is used for disbursement to various…

A: Calculation of the correct cash balance as of December 31, 2022:- P 2,230,000 is the correct answer.…

Q: (The following information applies to the questions displayed below.] BMX Company has one employee.…

A: Journal entry is to primary step to record transaction in the books of account. The amount debit and…

Q: Assets received in donation should Obe expensed upon receipt. O should not be depreciated. O be…

A: Assets received in donation or Donated assets are assets given to the entity as a gift.

Q: The aligning of goals between a corporation’s strategy and a manager’s personal goals is known as…

A: Introduction:- Goal congruence denotes same goals are shared by top managers and their subordinates.…

Q: Flint Company is preparing its direct labor budget for 2022 from the following production budget…

A: Formula: Direct labor budget = Budgeted hours required for production x wages rate per hour where,…

Q: [The following information applies to the questions displayed below.] BMX Company has one employee.…

A: Gross earnings is the amount before any deductions but after expenses. It is sales revenue less cost…

Q: Debt investments with an objective of collecting contractual cash flows is classified as: Group of…

A: Debt Investment: Investment in debt involves an investor providing money to a company or project…

Q: Leaning Tower of Pizza, Inc. is preparing its master budget for its first quarter of business. It…

A: Given information, Sales in the first quarter =$600,000 Selling price per pizza =$6 It expects to…

Q: What amount of net income will be reported in the 20x9 consolidated income statement?

A: Consolidated net income is the income which has been earned by the parent company and the subsidiary…

Q: Cane Company manufactures two products called Alpha and Beta that sell for $150 and $105,…

A: In order to determine the contribution margin per unit, the variable cost per unit is required to be…

Q: STATEMENT OF CASH FLOWS An entity provided the following data: December…

A: The question is based on the concept of Financial Accounting.

Q: On January 2, 2021, Tripod Company receives a government loan of P2,000,000 paying a coupon interest…

A: As per standard accounting practices a revenue is recognized when it is earned and…

Q: Question 1 A company produces a single product called the Fidget. The following information relating…

A: Cost volume profit analysis is the technique used by the management for decision-making. The methods…

Q: how to calculate the year-end adjustment for Allowance for Uncollectible Accounts with a debit…

A: Uncollectible amounts from client accounts are referred to as bad debts. Accounts receivable suffers…

Q: Lump-Sum Purchases; Issuance of Stock for Plant Assets 10.32 A package consisting of building and…

A: (Note: Since you have posted multiple questions, we will solve the first question for you. For the…

Q: You plan on starting a lawn mowing business by investing $700 of your own money and purchasing $500…

A: Total contribution margin = Total sales revenue - Total variable cost where, Total variable cost =…

Q: Carrot Company sells one and two-year mail order subscriptions for video of the month business.…

A: Solution Unearned subscription revenue Unearned subscription revenue means the amount that has been…

Q: Hanson Company has 350,000 shares of P10 par value ordinary shares outstanding. During the year,…

A: The retained earnings are decreased with declaration of dividend as dividend is paid to shareholders…

Q: Make the following entries related to a museum

A: a. Cash/bank Dr. 500000…

Q: Mama Mo Na Tita Ko Corporation, a manufacturer of cleaning products, is preparing annual financial…

A: Elements of the financial statements include expenses and revenues, assets and obligations, equities…

Q: Q2. You are a managerial accountant who has become privy to information about a takeover bid by your…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: TRUE OR FALSE An instrument payable out of a contingency is not negotiable even if the…

A: Since you have posted question with multiple sub-parts, we will do the first three sub-parts for…

Q: Freight and delivery charges P80,000 Non-refundable purchase taxes 70,000 Furniture cover*…

A: According to the question, we are required to compute the depreciation expenses using a 1.5…

Q: On January 2, 2021, Normal Inc. acquired 15% interest in Laco Co. by paying P1,500,000 for 7,500…

A: The investment income to be reported is equal to the total amount received from the company as a…

Q: 1) In January 2022, Utah Corporation entered into a contract to acquire a new machine for its…

A: Depreciation means the amount fixed assets written off due to normal wear and tear , normal usage ,…

Q: Operating Goods Sold ($) Margin Expenses (S) Cost of Gross Net Sales Net Profit $4,234,000 S…

A: Formula used: Net profit = Gross margin - Operating expenses

Q: RUZ, INCORPORATED Comparative Balance Sheets At December 31 2021 2020 Assets Cash $ 66,100 $…

A: Cash flow statement means the statement which shows the cash inflow and outflow during the specified…

Q: Please provide journal entries for the following: Jessica Johansen started Sewn for You, a…

A: Journal entries are the basic method for recording financial transactions in the books of accounts.…

Q: Gomez Corporation uses the allowance method to account for uncollectibles. On January 31, it wrote…

A: Allowance method for bad debts is the method in which allowance is made for the account receivable…

Q: 27. On December 31, 2022, Marizor Company believed that the assets of a cash generating unit are…

A: Impairment Loss: When the carrying value of an asset or cash-generating unit exceeds the recoverable…

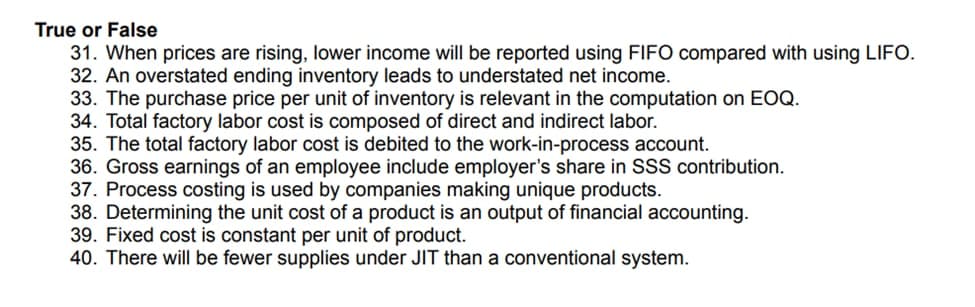

Answer items 33 & 34

Step by step

Solved in 3 steps

- If the ending inventory of a firm is overstated by $49,000, by how much and in what direction (overstated or understated) will the firm's operating income be misstated? (Hint: Use the cost of goods sold model, enter hypothetically "correct" data, and then reflect the effects of the ending inventory error and determine the effect on cost of goods sold.) operating income ? By ?Samsung Electronics reports the following regarding its accounting for inventories. Inventories are stated at the lower of cost or net realizable value. Cost is determined using the average cost method, except for materials-in-transit. Inventories are reduced for the estimated losses arising from excess, obsolescence, and decline in value. This reduction is determined by estimating market value based on future customer demand. The losses on inventory obsolescence are recorded as a part of cost of sales. 1. What cost flow assumption(s) does Samsung apply in assigning costs to its inventories? 2. If at the current year-end there was an increase in the value of its inventories such that there was a reversal of W550 (W is Korean won) million for the write-down recorded in the prior year, how would Samsung account for this under IFRS? Would Samsung’s accounting be different for this reversal if it reported under U.S. GAAP? Explain.AVERAGE AND FIFO COSTING TRUE OF FALSE Indicate whether the following statements are true of false by inserting in the blank space provided a capital “T" for true of “F” for false. Using the FIFO method: If, for any period, the beginning Finished Goods Inventory is zero, then the average ending unit cost in Finished Goods Inventory is either a number between the unit cost in the beginning WIP inventory and the current period unit costs, or it is equal to the current period unit cost. Using the FIFO method: If the units transferred out exceeds the equivalent units in WIP beginning inventory, then the unit cost of the ending WIP inventory will equal the current period unit cost. Using the FIFO method: If the beginning WIP inventory is zero, then the unit cost of units transferred out will always equal the unit costs of the units in ending WIP inventory. Using the FIFO method: The number of units transferred out equals the number of units started and completed plus the equivalent units…

- Assume that the ending inventory of a merchandising firm is overstated by $40,000. a. By how much and in what direction (overstated or understated) will the firms cost of goods be misstated? b. If this error is not corrected, what effect will it have on the subsequent period's operating income? c. If this error is not corrected, what effect will it have on the total operating income of the two periods (the period in which there is an error and the subsequent period) combined?he following data refer to Billings Company’s ending inventory: Item Code Quantity Unit Cost Unit Market Small 45 $32 $38 Medium 60 46 44 Large 65 50 42 Extra-Large 35 54 53 How much is ending inventory if the lower of cost or net realizable value rule is applied to the total inventory?1.Given a particular set of factsand assumptions, the following pairs of amounts were computed using FIFO andLIFO. For each pair of amounts, indicate which amount resulted from applyingFIFO, and which amount resulted from applying LIFO. A. Prices are rising, ending inventory is:$20,650$19,400B. Prices are rising, cost of goods sold is:$10,650$9,400C. Prices are falling, ending inventory is:$5,500$5,000D. Prices are falling, cost of goods sold is:$6,200$7,000

- During a period of rising inventory prices, a company's cost of goods sold would be higher using the LIFO cost flow method than with FIFO. True or False True FalseZimt AG uses the FIFO method, and Nutmeg Inc. uses the LIFO method. Compared tothe cost of replacing the inventory, during periods of rising prices the ending inventorybalance reported by:A. Zimt is too high.B. Nutmeg is too low.C. Nutmeg is too high.Explain how operations would have differed in Year 2 and Year 3 if the company had been using Lean Production, with the result that ending inventory was zero

- The following information is for Lawrence Company, who uses the LIFO method: Item Cost NRV MinusNormal Profit Net RealizableValue ReplacementCost a $3.40 $2.79 $4.14 $4.65 b 36.00 28.80 32.40 27.60 c 2.40 1.32 1.56 1.94 d 6.00 5.55 6.15 6.30 e 24.00 20.40 22.80 21.00 f 13.35 10.55 12.30 12.90 1. Determine the lower of cost or market for each inventory item. Item Lower ofCost or Market Value a $ b $ c $ d $ e $ f $ 2. Now assume instead that the company uses FIFO and the inventory is valued using the LCNRV rule, determine the value of each inventory item. Item Lower ofCost or Net Realizable Value a $ b $ c $ d $ e $ f $The VARCOST2 worksheet is capable of calculating variable and absorption income when unit sales are equal to or less than production. An equally common situation (that this worksheet cannot handle) is when beginning inventory is present and sales volume exceeds production volume. Revise the worksheet Data Section to include: Beginning inventory in units 15,000 Beginning inventory cost (absorption) $266,875 Beginning inventory cost (variable) $210,000, Also, change actual production to 70,000. Revise the Answer Section to accommodate this new data. Assume that Anderjak uses the weighted-average costing method for inventory. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Check figure: Absorption income, $670,000.The cost of goods sold and total operating expenses of a merchandising company are both understated by P5,300 and P 3,500 respectively. As a result of these errors, the company's gross margin is overstated (understated) by how much?