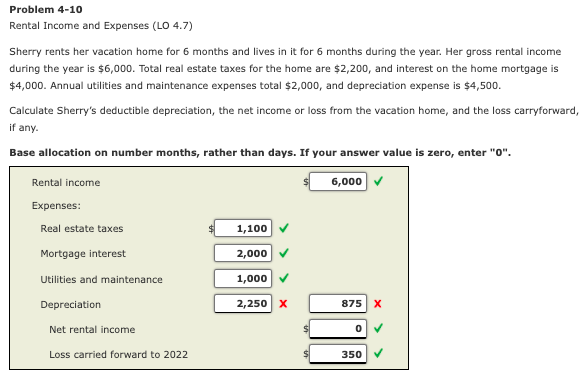

Rental Income and

Q: The Blueberry Company values its inventory by using the FIFO retail method.. The following informati...

A:

Q: Charmaine's employment was terminated by her employer on April 13 of the current year. Charmaine had...

A: Answer: Block 11 of employment is the record where the last day of the employee should be recorded.

Q: f subsequent events on

A: This is a Question relating to disclosure of subsequent events in the audit report and financial sta...

Q: Banana Company uses the retail method of inventory valuation. The following information is available...

A: The ending inventory is calculated as difference between cost of goods available for sale and cost o...

Q: Selected transactions for Angela Byron, a property manager (Byron Rental Properties), in h- business...

A: The journal keeps the record for day to day transactions of the business.

Q: 20.Pomelo Company has the policy of valuing inventory at the lower of cost and net realizable value ...

A: Inventory is one of the important current asset for the business. Mostly business prefer to use lowe...

Q: When the effective interest method is used, the amortization of the bond premium decreases interest ...

A: Lets understand the basics. For amortization of premium and discount, there are two methods which ar...

Q: sells T Shirts emblazoned with the school’s name and logo. The shirts cost $2,000 each and managemen...

A: i.) At EOQ as,

Q: From the details given below prepare aTrial Balance as at March 31, 2018. Purchases 80,000 Sala...

A: Trial Balance: Trial balance is a statement in which the closing balance of all ledger accounts are ...

Q: 30,0 g entry is IS

A: The adjusting entry is given as,

Q: 10.In periods of rising prices (inflation), the use of which of the following inventory cost flow me...

A: Under first in first out method, the goods which are brought into the inventory first are sold first...

Q: The following information is available for Canadian Tire Corporation (in $ millions): 2018 2017 2016...

A: Inventory turnover = Cost of goods sold / Average inventory where, Average inventory = (beginning in...

Q: ACAR Photography Adjusted TRIAL BALANCE Dec., 31, 2018 Debit Accounts |Cash Accounts receivable Supp...

A: Formula: Net income = Total Revenues - Total Expenses

Q: If you decide to join a partnership, which type of admission would you choose and why?

A: Solution Partnership means a business that has two or more owners who agree to share profits and are...

Q: 2. The 2000 U.S.A. tax rate for married couples was as follows: 10% on an adjusted gross income (AGI...

A:

Q: Based on the data given, Determine the Working Capital in 2018 You discovered the following errors i...

A: Rectification of Errors: It is procedure to revise mistakes/errors made in recording transaction...

Q: The following costs relate to Antonio Industries for the last quarter: Conversion cost Direct materi...

A: Prime cost refers to the sum of direct material and direct labor of the entity.

Q: Net Income $2,860,000 Transactions in Common Shares Change Cumulative Jan. 1, 2021, Beginning number...

A: Solution Earning per share is a company's Net profit divided by the number of common shares it has ...

Q: A man buys a house and lot worth P1M if paid in cash. On the instalment basis he pays P500,000 down ...

A: Lets understand the basics. In this question, we are required to prepare installment payment schedul...

Q: Imagine

A:

Q: Anticipate TWO (2) drawbacks from the adverse selection on financial safety nets.

A: Financial Safety Nets- A financial safety net is not one savings account or an insurance guideline. ...

Q: The unearned rent account has a balance of P36,000. If P4,000 of the P36,000 is uneamed at the end o...

A: Theory concept: Journalizing: Each and Every business transaction are to be recorded in Journal book...

Q: Give example of personal assets

A: An asset is a resource owened by individual or business that provides p...

Q: Blue Limited uses a perpetual inventory system. The inventory records show the following data for it...

A: FIFO is the method of inventory valuation whereby the goods that are initially bought are to be sold...

Q: X Accounting for Partnershi...

A:

Q: The 2021 balance sheet for Hallbrook Industries, Inc., is shown below. HALLBROOK INDUSTRIES, INC. Ba...

A: Ratio analysis means where different ratio of various years of years companies has been compared and...

Q: CASE 3-22 Plantwide versus Departmental Overhead Rates; Pricing LO3-1, LO3-2, LO3-3, LO3-4 "Blast it...

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question...

Q: Problem 3-15 High-Low Method; Predicting Cost [LO1, LO2] Crosshill Company's total overhead costs at...

A: Here is given a multiple Sub-parts, As per the Guidelines I give the solution of first 3 Sub-parts p...

Q: Seagull Company uses the retail method of inventory valuation. The following information is availabl...

A: The cost of ending inventory is calculated as difference between cost of goods available for sale an...

Q: Account Code Account Titles Padilla, Drawings Equipment Accounts Payable Notes Payable Land Prepaid ...

A: Introduction: Income statement: All revenues and expenses are to be shown in the income statement. I...

Q: On January 1, 2022, Bon Hok, Dyon Ok and Meow Meng agreed to form a partnership with the following c...

A: Partnership Formation: The creation of a partnership necessitates the development of a voluntary "as...

Q: The Cash account balance of Kingbird, Inc. at July 1 is $570. The total of the debit entries to the ...

A: Debit to cash account means an increase in cash balance whereas credit to cash account decrease in c...

Q: Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt work...

A: Salary of Matt 70200 Salary of Meg 33200 Short term capital gain less short term capital loss (...

Q: 7.The following data pertain to a particular item sold by Pomegranate Company. 8/1 – Beg. invy: 2,0...

A: Under the weighted average method of inventory valuation, the weighted average cost per unit of the ...

Q: The unearned rent account has a balance of P36,000. If P4,000 of the P36,000 is unearned at the end ...

A: Adjusting entries are recorded in the books in order to add the correct effect of transactions in th...

Q: Why transaction is 2880. Please explain

A: Supplies consumed is the amount of supplies or the inventory which has been consumed during the year...

Q: If management’s profit guidelines mandate gross margins of 25 percent, calculate the markup percenta...

A: Here in this question, we are required to calculate the markup percentage. For solving this question...

Q: Interest on balance with Central bank RO 3500 Interest on fixed deposit RO 1100 Locker rent RO 520 T...

A: Lets understand the basics. Operating profit is a operating revenue less operating expense. Operatin...

Q: Comprehend and Apply the elements of costing to the job environment. Evaluate and Integrate the rol...

A: costing is system for assigning the cost to the business and its element. costing involved assignmen...

Q: Justine Co. produced 5,500 outdoor chairs for Job Order No. 610. Total material cost was P 51,700. E...

A: Unit cost means the cost of product per unit produced. It is computed by dividing the total cost by ...

Q: In planning stage, materiality is determined at the O Disclosure level O Materiality is not determin...

A: Hi student Since there are multiple questions, we will answer only first question.

Q: The journal entry needed to record P5,000 of advertising for Westwood Manufacturing would include: O...

A: Advertising Expense is a financial statement account that reports the dollar amount of advertisement...

Q: A retired 78-year-old individual is unmarried, has no dependents, and holds a part- time job that pa...

A: For the year 2021, the standard deduction for a single person is $12,550. Furthermore, single and he...

Q: Banana Company uses the retail method of inventory valuation. The following information is available...

A: Using FIFO method, the goods Purchased first are to be sold first. FIFO stands for First in First o...

Q: Post the appropriate entries to T accounts for Work in Process and Finished Goods, using the identif...

A: The inventory of goods posed by an entity which are not in saleable condition and still requires som...

Q: 9) Building depreciation (10) Construction oquipment depreciation 40,000 30,000 Using the transactio...

A:

Q: Let's try these: Prepare the journal entries for the following transactions: July 1- Mr. Bon Hok wit...

A: Partnership firm is a corporate structure where two or more persons come together to share profits o...

Q: 5. Alexander owns an art gallery. He accepts paintings and sculpture on consignment and then receive...

A: Variable Cost - This is vary with the number of show/ number of units produced. if more number of un...

Q: 28. Lindsay and Malcolm form Yellow Corporation. Lindsay transfers equipment worth $950,000 (basis o...

A: This question is the multi-option question in which we have to find out the correct answer Gain is s...

Q: COST-BENEFIT ANALYSIS Cost of Capital = .14 Design A Design B Project-Completion time 24 months 24 m...

A: Net Present Value=(Present Value of Cash Inflows-Present Value of Cash Outflows) Payback period=Init...

Income statement: The income statement determines the net income of the business by subtracting the total expenses from the total revenue. There is a net loss in case the total expenses are more than the total revenue.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Problem 6-47 (LO. 3) Adelene, who lives in a winter resort area, rented her personal residence for 14 days while she was visiting Brussels. Rent income was $5,000. Related expenses for the year were as follows: Real property taxes $3,800 Mortgage interest 7,500 Utilities 3,700 Insurance 2,500 Repairs 2,100 Depreciation 15,000 If an answer is zero, enter "0". a. Determine how much of the rental income is reportable. $fill in the blank 1 b. Determine whether the expenses are deductible. Select "Yes" if deductible otherwise select "No". Depreciation Real property taxes Repairs Utilities Mortgage interest Insurance c. Determine the effect the rental activity has on Adelene's AGI. $fill in the blank 8Problem 9-33 (LO. 5) Melanie is employed full-time as an accountant for a national hardware chain. She recently started a private consulting practice, which provides tax advice and financial planning to the general public. For this purpose, she maintains an office in her home. Expenses relating to her home for 2020 are as follows: Real property taxes $3,600 Interest on home mortgage 3,800 Operating expenses of home 900 Melanie's residence cost $350,000 (excluding land) and has living space of 2,000 square feet, of which 20% (400 square feet) is devoted to business. The office was placed in service in February 2019, and under the Regular Method, Melanie had an unused office in the home deduction of $800 for 2019. Assume there is sufficient net income from her consulting practice. Click here to access the depreciation table. Round deprecation to the nearest dollar. a. What amount can Melanie claim this year for her office in the home deduction under the Regular…Problem 9-33 (LO. 5) Melanie is employed full-time as an accountant for a national hardware chain. She recently started a private consulting practice, which provides tax advice and financial planning to the general public. For this purpose, she maintains an office in her home. Expenses relating to her home for 2020 are as follows: Real property taxes $3,600 Interest on home mortgage 3,800 Operating expenses of home 900 Melanie's residence cost $350,000 (excluding land) and has living space of 2,000 square feet, of which 20% (400 square feet) is devoted to business. The office was placed in service in February 2019, and under the Regular Method, Melanie had an unused office in the home deduction of $800 for 2019. Assume there is sufficient net income from her consulting practice. depreciation table below. Round deprecation to the nearest dollar. 8-7cCost Recovery Tables Summary of Tables Exhibit 8.3 Regular MACRS table for personalty. Depreciation…

- Problem 6-48 (LO. 3) During the year (not a leap year), Anna rented her vacation home for 30 days, used it personally for 20 days, and left it vacant for 315 days. She had the following income and expenses: Rent income $7,000 Expenses Real estate taxes 2,500 Interest on mortgage 9,000 Utilities 2,400 Repairs 1,000 Roof replacement (a capital expenditure) 12,000 Depreciation 7,500 If an answer is zero, enter "0". Assume a 365-day year. In your computations round any fractions to four decimal places. Round your final answer to the nearest dollar. a. Compute Anna's net rent income or loss and the amounts she can itemize on her tax return, using the court's approach to allocating property taxes and interest. In the table below, if an expense is an itemized deduction select "Yes", otherwise select "No". Real property taxes Utilities Repairs Depreciation Roof replacement Mortgage interest Anna has itemize…Problem 6-50 (LO. 1, 3) Chee, single, age 40, had the following income and expenses during 2021: Income Salary $43,000 Rental of vacation home (rented 60 days, used personally 60 days, vacant 245 days) 4,000 Municipal bond interest 2,000 Dividend from General Electric 400 Expenses Interest on home mortgage 8,400 Interest on vacation home 4,758 Interest on loan used to buy municipal bonds 3,100 Property tax on home 2,200 Property tax on vacation home 1,098 State income tax 3,300 State sales tax 900 Charitable contributions 1,100 Tax return preparation fee 300 Utilities and maintenance on vacation home 2,600 Depreciation on rental portion of vacation home 3,500 Calculate Chee's net income from the vacation home, itemized deductions and taxable income for the year. If Chee has any options, choose the method that maximizes his deductions. In your computations, round any fractions to four decimal places. Then, round any amounts to the…A2 6 b Ms. Cressida bought a car for $48,000 exactly three years ago. After making an up-front equity payment of $5,000, she borrowed the rest of the car value from her bank in the form of a five-year loan. She negotiated a loan rate of 2.5% APR with semi-annual compounding. She makes loan payments of an equal dollar amount every two weeks (i.e., biweekly), and her first loan payment was due two weeks after she signed the loan contract. b. What is the effective biweekly interest rate on Cressida’s loan?

- Problem 3-39 (LO. 1, 2, 3, 4, 5, 6) Charlotte (age 40) is a surviving spouse and provides all of the support of her four minor children (ages 4, 8, 11, and 14) who live with her. She also maintains the household in which her parents live and furnished 60% of their support. Besides interest on City of Miami bonds in the amount of $5,500, Charlotte's father received $2,400 from a part-time job. Charlotte has a salary of $80,000, a short-term capital loss of $2,000, a cash prize of $4,000 from a church raffle, and itemized deductions of $10,500. Click here to access the standard deduction table to use, if required. If an amount is zero, enter "$0". a. Compute Charlotte's taxable income.$fill in the blank 1 b. Using the Tax Rate Schedules (click here), tax liability (before any allowable credits) for Charlotte is $fill in the blank 2 for 2021. c. Compute Charlotte's child and dependent tax credit.Charlotte's child tax credit is $fill in the blank 3, of which $fill in the blank 4 may be…A2 6 c Ms. Cressida bought a car for $48,000 exactly three years ago. After making an up-front equity payment of $5,000, she borrowed the rest of the car value from her bank in the form of a five-year loan. She negotiated a loan rate of 2.5% APR with semi-annual compounding. She makes loan payments of an equal dollar amount every two weeks (i.e., biweekly), and her first loan payment was due two weeks after she signed the loan contract. c. What is Cressida’s biweekly loan payment?6. In the current year, Clara rented her apartment on AirBnb for 13 days. She received gross rental income of $3,100. Her expenses for the apartment are: - Operating expenses $4,000 - Depreciation $2,000 - Mortgage interest and Property taxes $4,000 - Utilities/repairs $2,000 Calculate the income and expenses reported for the rental activity. What will Clara report on her tax return for this rental activity? $3,100 income, $3,100 expenses $3,100 income, $0 expenses Clara will not report anything. $3,100 income; $12,000 expenses

- A2 6 e Ms. Cressida bought a car for $48,000 exactly three years ago. After making an up-front equity payment of $5,000, she borrowed the rest of the car value from her bank in the form of a five-year loan. She negotiated a loan rate of 2.5% APR with semi-annual compounding. She makes loan payments of an equal dollar amount every two weeks (i.e., biweekly), and her first loan payment was due two weeks after she signed the loan contract. e. What is the total amount of interest that Cressida would have paid to the bank after five years of loan payments?Problem 3-8Transportation (LO 3.3) Martha is a self-employed tax accountant who drives her car to visit clients on a regular basis. She drives her car 4,000 miles for business and 10,000 for commuting and other personal use. Assuming Martha uses the standard mileage method, how much is her deductible auto expense for the year? a. The deductible business auto expense is $. b. Where in her tax return should Martha claim this deduction? The expense should be deducted on Martha's .Problem 4-44 (LO. 3) Liz and Doug were divorced on December 31, 2020, after 10 years of marriage. Their current year's income received before the divorce was as follows: Doug's salary $41,000 Liz's salary 55,000 Rent on apartments purchased by Liz 15 years ago 8,000 Dividends on stock Doug inherited from his mother 4 years ago 1,900 Interest on a savings account in Liz's name funded with her salary 2,400 Allocate the income to Liz and Doug assuming that they live in: a. California. Doug: $ Liz: $ b. Texas. Doug: $ Liz: $