Replacement Analysis The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The steamer has 6 years of remaining life. If kept, the steamer will have depreciation expenses of $550 for 5 years and $300 for the sixth year. Its current book value is $3,050, and it can be sold on an Internet auction site for $3,560 at this time. If the old steamer is not replaced, it can be sold for $800 at the end of its useful life. Gilbert is considering purchasing the Side Steamer 3000, a higher-end steamer, which costs $11,100, and has an estimated useful life of 6 years with an estimated salvage value of $1,700. This steamer falls into the MACRS 5-years class, so the applicable depreciation rates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. The new steamer is faster and allows for an output expansion, so sales would rise by $2,000 per year; the new machine's much greater efficiency would reduce operating expenses by $1,700 per year. To support the greater sales, the new machine would require that inventories increase by $2,900, but accounts payable would simultaneously increase by $700. Gilbert's marginal federal-plus-state tax rate is 25%, and the project cost of capital is 12%. What is the NPV of the project? Do not round intermediate calculations. Round your answer to the nearest dollar. $ Should it replace the old steamer? The old steamer should be replaced.

Replacement Analysis The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The steamer has 6 years of remaining life. If kept, the steamer will have depreciation expenses of $550 for 5 years and $300 for the sixth year. Its current book value is $3,050, and it can be sold on an Internet auction site for $3,560 at this time. If the old steamer is not replaced, it can be sold for $800 at the end of its useful life. Gilbert is considering purchasing the Side Steamer 3000, a higher-end steamer, which costs $11,100, and has an estimated useful life of 6 years with an estimated salvage value of $1,700. This steamer falls into the MACRS 5-years class, so the applicable depreciation rates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. The new steamer is faster and allows for an output expansion, so sales would rise by $2,000 per year; the new machine's much greater efficiency would reduce operating expenses by $1,700 per year. To support the greater sales, the new machine would require that inventories increase by $2,900, but accounts payable would simultaneously increase by $700. Gilbert's marginal federal-plus-state tax rate is 25%, and the project cost of capital is 12%. What is the NPV of the project? Do not round intermediate calculations. Round your answer to the nearest dollar. $ Should it replace the old steamer? The old steamer should be replaced.

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 11P: REPLACEMENT ANALYSIS St. Johns River Shipyards is considering the replacement of an 8-year-old...

Related questions

Question

None

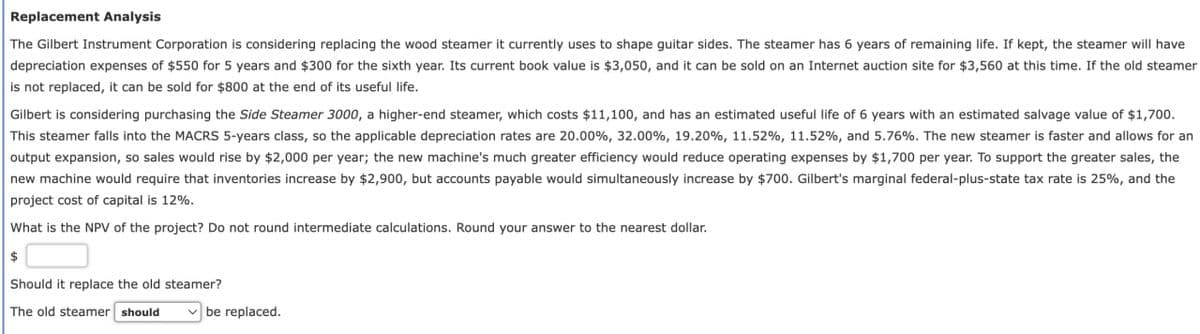

Transcribed Image Text:Replacement Analysis

The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The steamer has 6 years of remaining life. If kept, the steamer will have

depreciation expenses of $550 for 5 years and $300 for the sixth year. Its current book value is $3,050, and it can be sold on an Internet auction site for $3,560 at this time. If the old steamer

is not replaced, it can be sold for $800 at the end of its useful life.

Gilbert is considering purchasing the Side Steamer 3000, a higher-end steamer, which costs $11,100, and has an estimated useful life of 6 years with an estimated salvage value of $1,700.

This steamer falls into the MACRS 5-years class, so the applicable depreciation rates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. The new steamer is faster and allows for an

output expansion, so sales would rise by $2,000 per year; the new machine's much greater efficiency would reduce operating expenses by $1,700 per year. To support the greater sales, the

new machine would require that inventories increase by $2,900, but accounts payable would simultaneously increase by $700. Gilbert's marginal federal-plus-state tax rate is 25%, and the

project cost of capital is 12%.

What is the NPV of the project? Do not round intermediate calculations. Round your answer to the nearest dollar.

$

Should it replace the old steamer?

The old steamer should

be replaced.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning