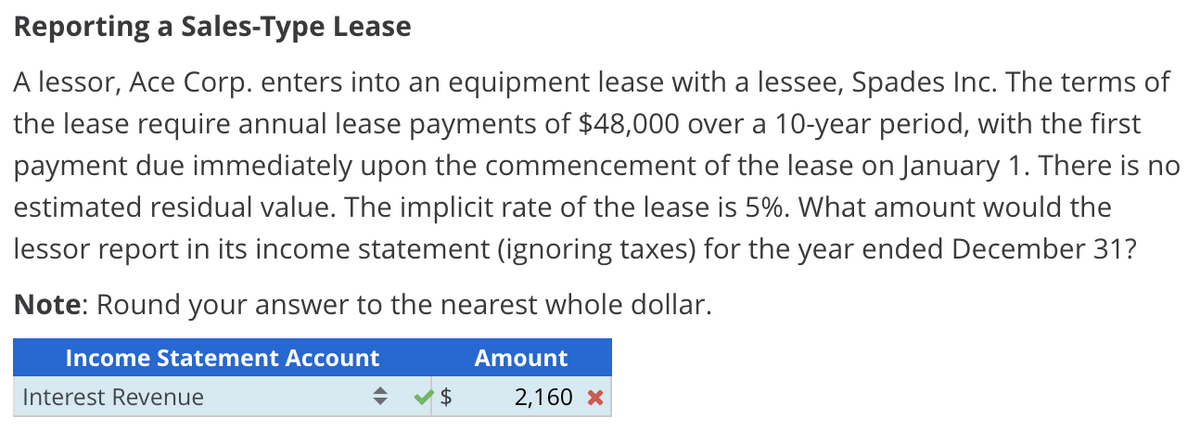

Reporting a Sales-Type Lease A lessor, Ace Corp. enters into an equipment lease with a lessee, Spades Inc. The terms of the lease require annual lease payments of $48,000 over a 10-year period, with the first payment due immediately upon the commencement of the lease on January 1. There is no estimated residual value. The implicit rate of the lease is 5%. What amount would the lessor report in its income statement (ignoring taxes) for the year ended December 31? Note: Round your answer to the nearest whole dollar. Income Statement Account Interest Revenue $ Amount 2,160 x

Q: 1. What is the unit product cost under variable costing? 2. What is the unit product cost under…

A: Variable costing and absorption costing both is managerial accounting cost concept. The main…

Q: barn that cost $46,000 to construct is placed in service midyear 20-year Click the icon to view a…

A: Introduction:- (MACRS) means The modified accelerated cost recovery system It is used to calculate…

Q: Ping and Juno decide to form a partnership on 30 June 2020. They secure the services of Timothy…

A: LIABILITIES AMOUNT ASSETS…

Q: [The following information applies to the questions displayed below.] Onslow Company purchased a…

A: Introduction:- Depreciation is a non cash expenses. Depreciation is charged on fixed asset over a…

Q: The following is an example of a Citator which provides details of how later cases or rulings have…

A: Shepard's Citator allows the researchers to track particular judicial decisions, statues and other…

Q: St. Mark's Hospital contains 560 beds. The occupancy rate varies between 60% and 90% per month, but…

A: 1-a. 60% occupancy = 560 beds x 60% x 30 days = 10,080 bed days 80% occupancy = 560 beds x 80% x 30…

Q: Problem 14-2A (Algo) Straight-Line: Amortization of bond premium LO P3 The bonds are issued at a…

A: Bond refers to the borrowing security that is issued by the company to raise funds from the market…

Q: 000. Price $300 Maturity (years) 30

A: Answer :

Q: 1. The following accounts receivable information pertains to Growth Markets LLC. Past-Due Category…

A: Introduction:- The bad debt is expense for the company. It is the amount of receivables that is…

Q: Chona company failed to recognize accruals and prepayments since the inception of its business three…

A: Income statement shows the company's revenues , expenses and profitability over a period of time. It…

Q: Assume a sales price per unit of $25, variable cost per unit $21, and total fixed costs of $161280.…

A: Break even point = Fixed cost / Contribution margin ratio Contribution margin ratio = (selling…

Q: Weld Co. has determined its December 31,2020, inventory on a FIFO basis as $300,000. Information…

A: Lets understand the basics. IAS 2 - Inventories deals with the valuation of the inventory. As per…

Q: The company incurred $800 of income tax but has made no tax payments this year. Record the…

A: Adjusting journal entry: At year-end when the company finalizes its accounts, any unrecognized…

Q: Atotal of 10,000 was invested in two business ventures. A and B. At the end of the first year, A and…

A: RETURN ON INVESTMENT The return is the profit you make as a result of your investments. Return…

Q: A partnership that consists of two classes of partners, one that participates in management of the…

A: Partnership Account - A partnership is a mutual agreement enter into two or more entities for the…

Q: At December 31, 2020, the balance sheet of Meca International included the following shareholders'…

A: Treasury Stock - Treasury Stock is the shares repurchased by the company from the open market. It is…

Q: In each of the following cases, compute the corporation’s regular tax: Use 2017 tax rate schedule if…

A: Regular tax means that regular tax imposed on the taxable income of a corporation at the rates…

Q: to the general ledger. Footed the cash book. CASH DISBURSEMENTS: E. Compared cancelled checks with…

A: Cash - Cash is defined in bookkeeping and financial accounting as current assets made up of money or…

Q: When is manufacturing overhead underapplied? When is it overapplied? ( in Managerial Accounting )

A: The overhead is applied to the production on the basis of predetermined overhead rate. The…

Q: Martin Clothing Company is a retail company that sells hiking and other outdoor gear specially made…

A: Cash Collection Schedule :— This budget is prepared to estimate the collection of cash from customer…

Q: how to calculate additions to plant , property, and equipment

A: Please see Step 2 for the required information.

Q: The following information applies to the questions displayed below.] Autumn Company began the month…

A: Journal entry is the primary step to record the transaction in the books of accounts. The total…

Q: During 2022, Thomas Company made the following expenditures (all material) relating to plant…

A: Repairs and maintenance are expenses for normal maintenance and upkeep of capital assets that are…

Q: 00 Assuming that all net Sales figures and all Cast of goods the are at retarl Sold figures are at…

A: The inventory turnover ratio refers to how many times the company's product inventory was sold. If…

Q: OnJanuary 3,2020,GagneInc. paid $320,000 for a computer system. In addition to the basic purchase…

A:

Q: The adjusted trial balance of Karise Repairs on December 31 follows. KARISE REPAIRS Adjusted Trial…

A: Income Statement :— It is one of the financial statement that shows profitability of company during…

Q: Use the following information for the Quick Studies below. (Algo) [The following information applies…

A: The straight line methods the depreciation is uniform and periodic during the economic life of the…

Q: You just completed your taxes and had $3,79 withheld for income taxes and a final tax liability of…

A: A tax refund seems to be the difference between the total amount of tax paid and the total amount of…

Q: You have been asked to analyze the bids for 200 polished disks used in solar panels. These bids have…

A: Import duty is a type of tax levied on the import and specific exports of a nation's customs…

Q: Smoky Mountain Corporation makes two types of hiking boots-the Xtreme and the Pathfinder. Data…

A: The question is related to the traditional costing and Activity Based Costing. Under traditional…

Q: On 15 March 2022, Business Taxpayer, reporting on a calendar year basis, sold furniture (seven-year…

A: Calculation of depreciation for the calculation of taxable income is calculated on basis of rate…

Q: Assume that Intel has net receivables of SGD1,500,000 in 90 days. The spot rate of the Singapore…

A: Hedging is a risk management strategy used to limit risks in financial securities. It involves…

Q: Demonstrate competence in words the theory & evolution of international trade with emphasis on…

A: Comment - We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: 8. a. What is the company’s break-even point in unit sales? 9. If the sales volumes in the East and…

A: Variable costing and absorption costing comes under Cost-volume profit analysis. CVP analysis shows…

Q: Determine the direct materials price variance, direct materials quantity variance, and total direct…

A: Solution:- b-1)Calculation of direct material variance as follows under:- Direct material variance…

Q: There are three sections of the cash flow statement (operating, investing, and financing). In your…

A: Introduction: The cash flow statement is a financial statement it is showing the movement of cash…

Q: On January 1, 2023, Sheridan Ltd. sold on account 800 units of its product for a total price of…

A: The company while making sales also provide a warranty. The warranty is an expense for the company…

Q: At the beginning of Year 3 Randall Company had a $10400 balance in its accounts receivable account…

A: The allowance for doubtful accounts is created to record estimated bad debt expense for the period.…

Q: Jackson Corporation has accumulated minimum tax credits of $475,000 from tax years prior to 2019.…

A: The minimum tax credit is the amount of adjusted net minimum tax for all tax years reduced by the…

Q: Melissa recently paid $595 for round-trip airfare to San Francisco to attend a business conference…

A: Answer:- Business expenses meaning:- Costs incurred in the regular course of business are generally…

Q: 15. Wildwood, an outdoors clothing store, reports the following information for June: ABCD A. What…

A: Gross Profit - Gross Profit is the profit margin of the company available in the sales of the…

Q: year for 20 years in a f

A: Answer :Future value of an annuity due = Payment * [(1+Rate)^time - 1)/rate)*(1+rate) Future value…

Q: Questions # 16-20 are based on the information below: Nadal Athletic has the following transactions…

A: Inventory Valuation Methods are methods of valuation of inventory. There are three methods of…

Q: Several years ago, Westmont Corporation developed a comprehensive budgeting system for planning and…

A: Answer:- Flexible budget meaning:- A flexible budget is one that changes depending on the activity…

Q: Hillside issues $1,400,000 of 5%, 15-year bonds dated January 1, 2021, that pay interest…

A: Bond is a financial security which is issued by large organization in order to raise funds. Bonds…

Q: Lee Company acquired 75% of Winters Company for $600,000 on January 1, 2020. Winters reported common…

A: Non-controlling interest is that part of a subsidiary where equity shareholders own less than 50%.…

Q: Sam decided to start a printing company called, Sam Printing Inc. This company was his dream job and…

A: One of the four basic financial statements prepared by a company is the income statement which is…

Q: Explain the implications relating to ownership when goods are: In Transit (FOB) Shipping Point In…

A: In accounting there are different conditions under which a seller sells his goods to the buyer and…

Q: BALANCE TRIAL Purchases Billy Trading hadir DEBIT 46000 9000 300 CREDIT 1660 14300 1 2 3 4

A: Introduction: Each business transaction should pass journal entry by showing debit side and credit…

Q: was $1.25 and the company used E als price variance for Pharoah for $180 favorable

A: Answer : Material price variance = (Standard price -Actual price) * Actual units

3

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Use the information in RE20-3. Prepare the journal entries that Garvey Company would make in the first year of the lease assuming the lease is classified as a finance lease. However, assume that Garvey is now required to make the 65,949.37 payments on January 1 each year and that the fair value at the lease inception is now 275,000 (65,949:37 4:169865).Use the information in RE20-3. Prepare the journal entries that Richie Company (the lessor) would make in the first year of the lease assuming the lease is classified as a sales-type lease. Assume that the lessee is required to make payments on December 31 each year. Also assume that Richie had purchased the equipment at a cost of 200,000.Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)

- Owens Company leased equipment for 4 years at 50,000 a year with an option to renew the lease for 6 years at 2,000 per month or to purchase the equipment for 25,000 (a price considerably less than the expected fair value) after the initial lease term of 4 years. Why would this lease qualify as a finance lease?Sales-Type Lease with Guaranteed Residual Value Calder Company, the lessor, enters into a lease with Darwin Company, the lessee, to provide heavy equipment beginning January 1, 2017. The lease is appropriately classified as a sales-type lease. The lease terms, provisions, and related events are as follows: The lease is noncancelable, has a term of 8 years, and has no renewal or bargain purchase option. The annual rentals are 65,000, payable at the end of each year. The interest rate implicit in the lease is 15%. Darwin agrees to pay all executory costs directly to a third party. The cost of the equipment is 280,000. The fair value of the equipment to Calder is 308,021.03. Calder incurs no material initial direct costs. Calder expects that it will be able to collect all lease payments. Calder estimates that the fair value at the end of the lease term will be 50,000 and that the economic life the equipment is 9 years. This residual value is guaranteed by Darwin. The following present value factors are relevant: PV of an ordinary annuity n = 8, i = 15% = 4.487322 PV n = 8, i = 15% = 0.326902 PV n = 1, i = 15% = 0.869565 Required: 1. Determine the proper classification of the lease. 2. Prepare a table summarizing the lease receipts and interest income earned by Calder for this lease. 3. Prepare journal entries for Calder for the years 2019, 2020, and 2021. 4. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the present value of next years payment approach to classify the lease receivable as current and noncurrent. 5. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the change in present value approach to classify the lease receivable as current and noncurrent.Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.

- Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.Comprehensive Landlord Company and Tenant Company enter into a noncancelable, direct financing lease on January 1, 2019, for nonspecialized equipment that cost the Landlord 280,000 (useful life is 6 years with no residual value). The fair value of the equipment is 300,000. The interest rate implicit in the lease is 14%. The 6-year lease requires 6 equal annual amounts payable each January 1, beginning with January 1, 2019. Tenant pays all executory costs directly to a third party on December 1 of each year. The equipment reverts to the lessor at the termination of the lease. Assume that there are no initial direct costs. Landlord expects to collect all rental payments. Required: 1. Next Level (a) Show how landlord should compute the annual rental amounts, (b) Discuss how the Tenant Company should compute the present value of the lease payments. What additional information would be required to make this computation? 2. Next Level Prepare a table summarizing the lease and interest receipts that would be suitable for Landlord. Under what conditions would this table be suitable for Tenant? 3. Assuming that the table prepared in Requirement 2 is suitable for both the lessee and the lessor, prepare the journal entries for both firms for the years 2019 and 2020. Use the straight-line depreciation method for the leased equipment. The executory costs paid by the lessee are in 2019: insurance, 700 and property taxes, 800; in 2020: insurance, 600 and property taxes, 750. 4. Next Level Show the items and amounts that would be reported on the comparative 2019 and 2020 income statements and ending balance sheets for both the lessor and the lessee, using the change in present value approach.Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.

- Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement dated January 1, 2019, that provides for it to lease non-specialized heavy equipment from Scott Rental Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of 20,000 to be paid in advance at the beginning of each year. 2. The cost, and also fair value, of the heavy equipment to Scott at the inception of the lease is 68,036.62. The equipment has an estimated life of 4 years and has a zero estimated residual value at the end of this time. 3. Adden agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. Scotts interest rate implicit in the lease is 12%. Adden is aware of this rate, which is equal to its borrowing rate. 6. Adden uses the straight-line method to record depreciation on similar equipment. 7. Executory costs paid at the end of the year by Adden are: Required: 1. Next Level Determine what type of lease this is for Adden. 2. Prepare a table summarizing the lease payments and interest expense for Adden. 3. Prepare journal entries for Adden for the years 2019 and 2020.Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of 100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is 2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswells incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of 7,000 annually, related to taxes on the property, are paid by Caswell directly to the taxing authority on Dec. 31 of each year. Required: 1. Determine what type of lease this is for the lessee. 2. Prepare appropriate journal entries on the lessees books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2019 and 2020.