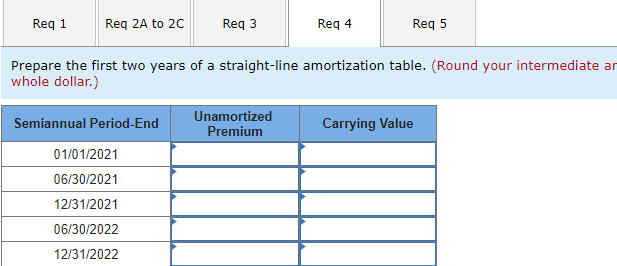

Req 1 Req 2A to 20 Req 3 Semiannual Period-End Req 4 Prepare the first two years of a straight-line amortization table. (Round your intern whole dollar.) Unamortized Premium Req 5 Carrying Value

Req 1 Req 2A to 20 Req 3 Semiannual Period-End Req 4 Prepare the first two years of a straight-line amortization table. (Round your intern whole dollar.) Unamortized Premium Req 5 Carrying Value

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 16E

Related questions

Question

Can you please help me with Reg 4 and Reg 5

Transcribed Image Text:Req 1

Req 2A to 2C

Semiannual Period-End

Req 3

01/01/2021

06/30/2021

12/31/2021

06/30/2022

12/31/2022

Prepare the first two years of a straight-line amortization table. (Round your intermediate ar

whole dollar.)

Req 4

Unamortized

Premium

Req 5

Carrying Value

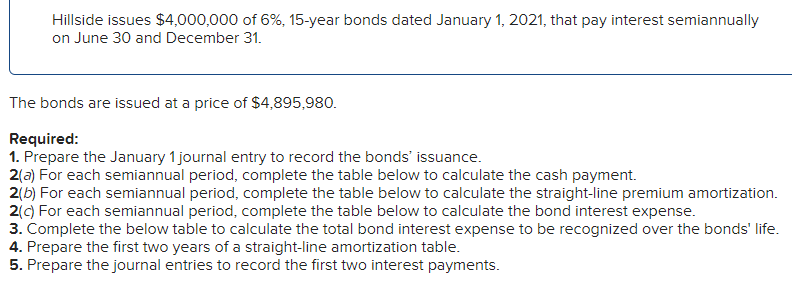

Transcribed Image Text:Hillside issues $4,000,000 of 6%, 15-year bonds dated January 1, 2021, that pay interest semiannually

on June 30 and December 31.

The bonds are issued at a price of $4,895,980.

Required:

1. Prepare the January 1 journal entry to record the bonds' issuance.

2(a) For each semiannual period, complete the table below to calculate the cash payment.

2(b) For each semiannual period, complete the table below to calculate the straight-line premium amortization.

2(c) For each semiannual period, complete the table below to calculate the bond interest expense.

3. Complete the below table to calculate the total bond interest expense to be recognized over the bonds' life.

4. Prepare the first two years of a straight-line amortization table.

5. Prepare the journal entries to record the first two interest payments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College