REQU 1. Determine the correct amount of the following as of Dec. 31, 2019: a. Trade receivables, current asset b. Trade receivables, other assets c. Non-trade receivables, current assets

REQU 1. Determine the correct amount of the following as of Dec. 31, 2019: a. Trade receivables, current asset b. Trade receivables, other assets c. Non-trade receivables, current assets

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter8: Receivables

Section: Chapter Questions

Problem 8.4BE: Analysis of receivables method At the end of the current year, Accounts Receivable has a balance of...

Related questions

Question

100%

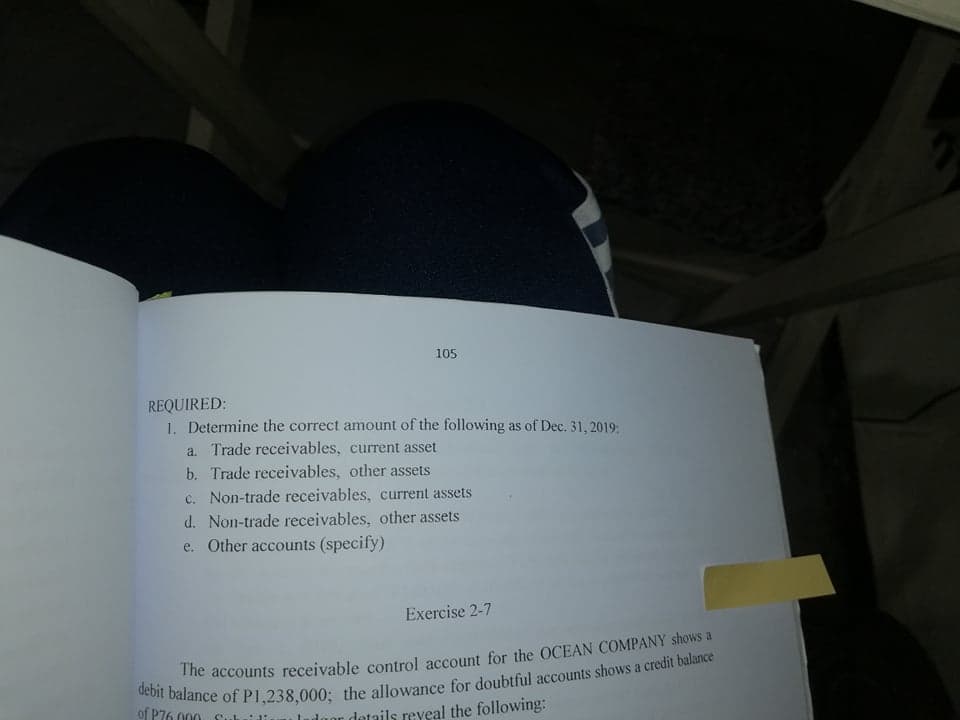

Transcribed Image Text:105

REQUIRED:

1. Determine the correct amount of the following as of Dec. 31, 2019:

a. Trade receivables, current asset

b. Trade receivables, other assets

c. Non-trade receivables, current assets

d. Non-trade receivables, other assets

e. Other accounts (specify)

Exercise 2-7

of P76.000 Subaidi

or details reveal the following:

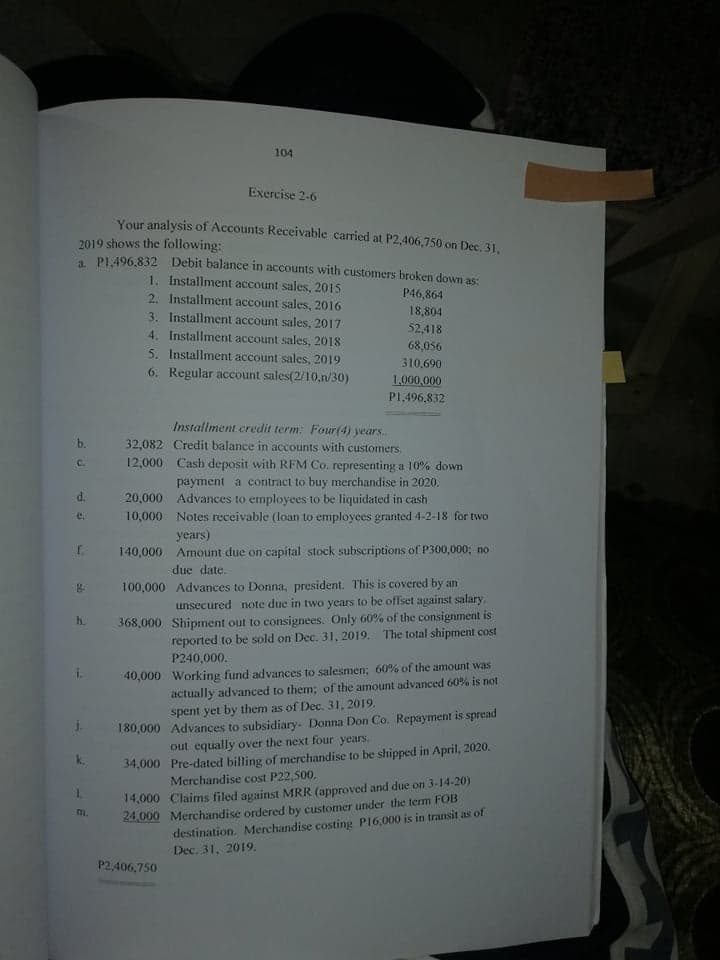

Transcribed Image Text:104

Exercise 2-6

Your analysis of Accounts Receivable carried at P2,406,750 on Dec. 31,

2019 shows the following:

1 PL.496,832 Debit balance in accounts with customers broken down as:

1. Installment account sales, 2015

2. Installment account sales, 2016

3. Installment account sales, 2017

4. Installment account sales, 2018

5. Installment account sales, 2019

P46,864

18,804

52,418

68,056

310,690

6. Regular account sales(2/10,n/30)

1.000,000

P1,496,832

Installment credit term: Four(4) years.

b.

32,082 Credit balance in accounts with customers.

C.

12,000 Cash deposit with RFM Co. representing a 10% down

payment a contract to buy merchandise in 2020.

20,000 Advances to employees to be liquidated in cash

10,000 Notes receivable (loan to employees granted 4-2-18 for two

d.

e.

years)

f.

140,000 Amount due on capital stock subscriptions of P300,000; no

due date.

100,000 Advances to Donna, president. This is covered by an

unsecured note due in two years to be offset against salary.

368,000 Shipment out to consignees. Only 60% of the consignment is

reported to be sold on Dec. 31, 2019. The total shipment cost

h.

P240,000.

40,000 Working fund advances to salesmen; 60% of the amount was

actually advanced to them; of the amount advanced 60% is not

spent yet by them as of Dec. 31, 2019.

180,000 Advances to subsidiary- Donna Don Co. Repayment is spread

out equally over the next four years.

34,000 Pre-dated billing of merchandise to be shipped in April, 2020.

i.

j.

14,000 Claims filed against MRR (approved and due on 3-14-20)

24,000 Merchandise ordered by customer under the term FOB

destination. Merchandise costing P16,000 is in transit as of

Merchandise cost P22,500.

1.

m.

Dec. 31, 2019.

P2,406,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,