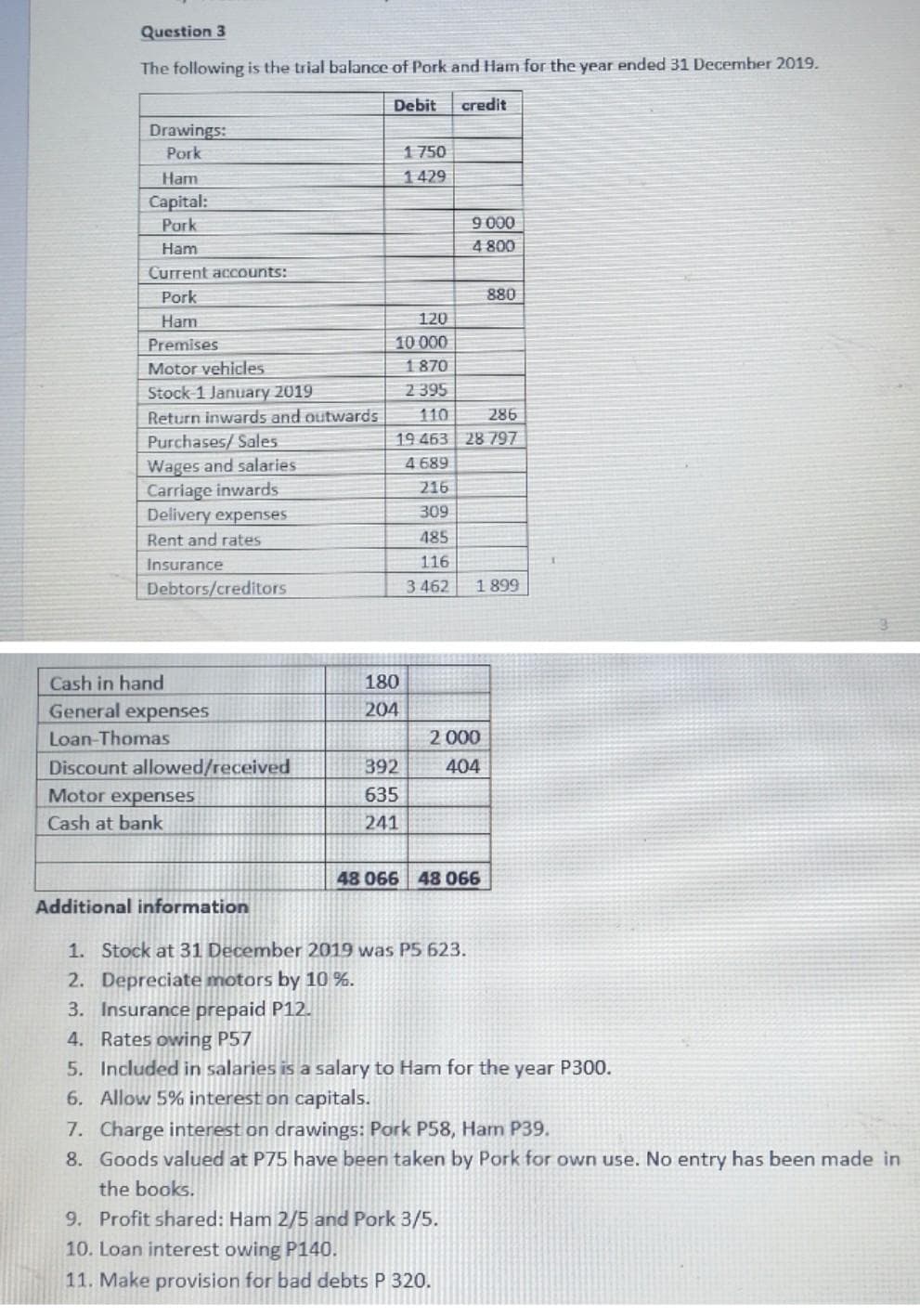

Required to prepare : A) Trading and profit and loss appropriation account for the year ended 31 December 2019. B) A balance sheet as at 31 December 2019

Q: X Answer is complete but not entirely correct. CHEETAH СOРY Depreciation Schedule-Double-Declining-B...

A: solution given Cost of machine $110000 Residual value 27500 Useful life 4 years ...

Q: Rafner Manufacturing has the following budgeted data for its two production departments. Budgeted Da...

A: Overhead rate can be calculated by total overhead cost divided by cost centre

Q: Stephanie's Bridal Shoppe sells wedding dresses. The average selling price of each dress is $1,000, ...

A: Total sales = 200 dresses x $1,000 per dress = $200,000 Total variable cost = 200 dresses x $400 per...

Q: Complete the following table (assume the overtime for each employee is a time-and-a-half rate after ...

A: Solution: Total time worked in the week = 12 + 8 + 10 + 8 + 6 + 3 = 47 hours Regular time = 40 hours...

Q: ABC Ltd enters into a five-year lease agreement with Legal Ltd on 1 July 2023 for an item of machine...

A: initial measurement of the lease liability Present value of 140,000 at the rate of 8% for the ...

Q: Front Range Cabinet Distributors in Colorado Springs, Colorado, sells to its contractors with a 48% ...

A: Selling Price = Cost + Markup where, Markup = Cost x Markup %

Q: The Social Security Administration increased the taxable wage base from $127,200 to $128,400. The 6....

A: Solution:- a)Calculation of the percentage increase in the base as follows under:- Taxable base incr...

Q: The expected income each year from the new shelving products is: Win Corporation is considering the ...

A: Answer) P 52,500 Answer) P 52,500 Calculation of income statement ...

Q: The following information is about Green Tea Ltd. Beginning Net income book value ($'000 000) of equ...

A: Abnormal earnings = Net Income – Equity Charge = Net Income – Beginn...

Q: ed to buy your shares for P 4,200. A

A: 40 SHARES X 200 EACH = 8000 Buyback = 40 x 4,200 = 168,000

Q: Which of the following techniques can be used by management to overstate long-lived assets? * A. Al...

A: Long lived assets are also known as Non-current assets which provides economic benefits for a period...

Q: Prepare the general journal entries to record revaluation of the assets. Prepare the general journal...

A: Larry Adams, Hazel Adams, and Isiah Adams are partners in the partnership firm and they agree to adm...

Q: Calculate the gross earning for an apple picker based on the following differential pay scale: (Roun...

A: The gross earning depends on the apples picked and the varying pay scales. The first 1000 apples wo...

Q: Win Corporation is considering to replace its old equipment with a new one. The old equipment had a ...

A: The net amount of investment is equal to original amount of investment minus cash inflow at the time...

Q: Presented below is an income statement for Kinder Company for the year ended December 31, 2022. Kind...

A: The question is based on the concept of Financial Accounting.

Q: FOB SHIPPING POINT, who is the owner of goods in transit

A: The invoice made at the time of sale includes the invoice price, payment terms, discount terms, etc....

Q: The following transactions apply to Pecan Co. for Year 1, its first year of operations: 1. Received ...

A: The accounting equation states that assets equal to sum of liabilities and equity. The balance sheet...

Q: Maturity value Discount Discount period Net proceeds from discounting Carrying amount of the notes r...

A: Maturity Value = 2,500,000 + 10% of 2500000 x 180 days /365 days = 2,623,287 Discount = 12% of 26232...

Q: Cash Effective Decrease in Outstanding Date interest interest balance balance 1/1/2021 $ 207,020 6/3...

A: Formula: Effective Int rate = Interest / Outstanding balance x 100

Q: Copperfield Manufacturing employs a weighted average process costing system for its products. One pr...

A:

Q: Brian May, guitarist for Queen, does not know how to price his signature Antique Cherry Special that...

A: Price = Cost + Markup where, Markup = Cost x Markup %

Q: Morris Industries manufactures and sells three products (AA, BB, and Sales Price Variable Cost Produ...

A: The break even sales are the sales where business earns no profit no loss during the period. The wei...

Q: Required: 1. Determine budgeted production for April, May, and June. 2. Determine budgeted cost of m...

A: Budgeted production refers to a form of budget which shows the number of units of a specific product...

Q: Explain the relationship between Contribution Margin ratio and Number of Breakeven units.

A: Disclaimer: “Since you have asked multiple question, we will solve the first question for you. If yo...

Q: Eliza Vega started an accountinin on June, investing 523,000. Her net loss for the month was \$3,000...

A: Statement of Owner's Equity refers to the statement which shows the Capital balances at the start of...

Q: Given the following information calculate: A. The closing book inventory at cost: B. The gross cost ...

A: Retail inventory method refers to an accounting method which is used by the companies to compute the...

Q: What is the difference in a data and findings?

A: Data is the combination of raw facts which is used for providing information and conclusions to the ...

Q: 16. In 2011, the maximum amount that you could have contributed to your RRSP (Registered Retirement ...

A: RRSP is a retirement saving plan launched by the government of Canada for the citizens of their coun...

Q: In the US/Canada tax treaty one of the factors considered when deciding which country has jurisdicti...

A: citizenship means the country to which the individual belongs.

Q: Abe Factor opened a new accounting practice called X-Factor Accounting and completed these activitie...

A: Solution Accounting equation = Assets = Liabilities + Capital.

Q: A manufacturer has been shipping his product (moderately heavy machines), mounted only on skids with...

A: Every manufacturing or trading organization has to maintain some stock for ease of operations and to...

Q: What effects on a retail store's accounting equation occur when merchandise returned by customers is...

A: Introduction:- The following Accounting Equation used for preparation of balance sheet as follows un...

Q: Prepare an income statement for Tea Company for year ended December 31, 20 Debit 10,900 154,000 5,40...

A: Three components of the income statement are as follows: Gross profit component ( it gives details ...

Q: Phil Williams and Liz Johnson are 60% and 40% partners, respectively, in Williams & Johnson Partners...

A: Profit and Loss Appropriation Account:- This account is used for final appropriation of profit betwe...

Q: Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. May 11...

A: Journal Entry is the basic book of accounts that used to record the transactions immediately after i...

Q: 1. True or false: For the following items, identify if the statements are true or false. Choose the ...

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any ...

Q: Determine if sole proprietorship, partnership, or corporation. Select all that is applicable between...

A: A partnership is the type of business where two or more partners agree to operate a business and sha...

Q: Amaya Company offered existing shareholders a rights issue of one for 5 shares at a price of P6 per ...

A: Earnings Per Share- Earnings per share refer to the portion of the profit that each shareholder earn...

Q: Compañía CSB, S.A., requires short-term financing and requests a loan from Banco del Comercio, and p...

A:

Q: At the beginning of its 2013 financial year, Rueda Corporation purchased equipment for $100,000. The...

A: Revaluation of assets means measurement of assets at its fair value. Revaluation can be upward reval...

Q: Can i get a step by step explanation on the book to bank method?

A: Book to bank method is a bank reconciliation method in which the reconciliation starts from the bala...

Q: Fill in the blanks below: Driver Usage Activity Cost Activity Driver Activity Cost: Activity Cost: P...

A: Activity based costing refers to a method a costing which is used by the companies to assign the ind...

Q: Stephanie's Bridal Shoppe sells wedding dresses. The average selling price of each dress is $1,000, ...

A: Operating income can be calculated by deducting the total variable cost and fixed cost from the tota...

Q: Guests Monday Tuesday Wednesday Thursday Friday Saturday Sunday Week's Total P 1 Daily Average P 2 R...

A: In order to determine the daily average, the total sum of observations (Revenue / Served ) are requi...

Q: C&S Marketing (CSM) recently hired a new marketing director, Jeff Otos, for its downtown Minneapolis...

A: The question is based on the concept of Financial Accounting.

Q: Briefly explain why land does not depreciate.

A: Depreciation is reduced in the value of assets due to natural ability to decrease due to continuous ...

Q: Accounting Quake Corporation paid $1,680,000 for a 30% interest in Tremor Corporation's outstanding ...

A: A business combination is a transaction or agreement in which the acquirer obtains a stake in the ac...

Q: dney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. y 11 Syd...

A: Journal is the book of original entry in which all the transactions of the business are recorded ini...

Q: The Harriott manufacturing company uses job order costing system. The company uses machine hours to...

A: A pre-determined overhead rate is the rate used to apply manufacturing overhead to work-in-process i...

Q: Complete the following table: (Do not round net price equivalent rate and single equivalent discount...

A: solution the given chain discount of 8/5/3 means that the discount is in a series of 8% , then 5% an...

Required to prepare :

A) Trading and

B) A

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- 3. The following was the trial balance extract from ABC Trading as at 31 March 2019.Particulars DEBIT (RM) CREDIT (RM)Purchases and Sales 22,800 41,000Inventory on 1 April 2018 5,100Capital 8,170Bank overdraft 4,300Cash 140Discount allowed and received 1,440Returns inwards and outwards 790Carriage outwards 2,180Office expenses 450Fixtures and fittings 1,210Delivery van 2,000Accounts receivables and account payables 11,900 6,720Rent and insurance 1,790Drawings 2,850Wages and salaries 8,980TOTAL 61,690 61,690Additional information as at 31 March 2019:a. Inventory on 31 March 2019 was RM4,250b. Wages and salaries accrued as at 31 march 2019 was RM210; outstanding office expenses was RM30c. Rent and insurance prepaid was RM150Required:i. Prepare the Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 March 2019ii. Prepare Statement of Financial Position as at 31 March 2019Question 4Young Traders is owned by Yvonne Young. Young Traders is not a VAT vendor and uses the perpetualinventory system. Goods are sold at a mark‐up of 50% on cost price. The following pre‐adjustment trialbalance appeared in the books of Young Traders at the end of their current financial year, 30 April 2020:Pre‐adjustment Trial Balance of Young Traders as at 30 April 2020Debit (R) Credit (R)Capital (1 May 2019) 1 200 000Vehicles 550 000Accumulated Depreciation on Vehicles (1 May 2019) 205 000Fixed deposit (ABBA Bank) (12% p.a.) 75 000Inventory 149 000Debtors Control 123 500Allowance for Credit Losses (1 May 2019) 2 500Creditors Control 50 100Bank 199 400Sales 1 467 500Cost of Sales 914 000Sales Returns 70 000Salaries and Wages 640 000Stationery 84 500Carriage on Sales 23 700Credit Losses 13 500Telephone 82 500R2 925 100 R2 925 10020 2020© The Independent Institute of Education (Pty) Ltd 2020Page 10 of 14Additional information and adjustments at year‐end:1. According to a physical…4. The following is extracted trial balance of Grey Grig Ltd as at 30 June 2019. Grey Grig LtdTrial Balance as at 30 June 2019Particulars Debit (RM) Credit (RM)Equipment rental 940Insurance 1,804Lighting and heating expenses 1,990Motor expenses 2,350Salaries and wages 48,580Sales 382,420Purchase 245,950Sundry expenses 624Lorry 19,400Account payable 23,408Account receivable 44,516Fixtures 4,600Shop 174,000Cash at bank 11,346Drawings 44,000Capital 194,272TOTAL 600,100 600,100Inventory at 30 June 2019 was RM29,304.Required: i. Statement of Profit and Loss and Others Comprehensive Income for the year ended 30 June 2019 ii. Statement of Financial Position as 30 June 2019

- PA10. The following is the adjusted trial balance data for Nino’s Pizzeria as of December 31, Prepare a simple income statement for the year ended December 31, 2019.Rons Diner received the following bills for December 2019 utilities: • Electricity: $625 on December 29, 2019 • Telephone: $150 on January 5, 2020 Both bills were paid on January 10, 2020. On the December 31, 2019, balance sheet, Rons Diner will report accrued expenses of: a. $0 b. $150. c. $625. d. $775.Marked out of 20.00P Flag questionusing the income summary account for the month ofSiren MarketingAdjusted Trial BalanceMay 31, 2022Account TitleCashDebitCredit$8, 600Accounts Receivable$2, 500Prepaid Insurance$2,700 Accounts PayableUnearned RevenueKirk, Capital$1, 200$1, 800$5, 880Kirk, Withdrawals$1,600Service Revenue$8, 620Advertising Expenselnsurance ExpenseRent Expense Total$790$450$860$17,500 $17,500No comma or dollar sign should be included in the imput icklPrepare the closing entries in the proper order. For transactions that have more than 1 debit or more than 1 deditDebitAccount Title and Explanation Date May 31

- Q1: Below transactions from KLCC company. 2nd Jan 2019 KLCC sold goods (33,000) to Nizwa Company by cheque. 4th, Jan 2019 KLCC bought goods (14,000) from Penang company on time. 6th, Jan 2019 KLCC pay insurance (5000) by cash. 7th, Jan 2019 KLCC received (10,000) from Nizwa company by cheque. 8th, Jan 2019 KLCC bought Van (22,000) by cheque. Req: Prepare journal entries and T accounts.DATA PROVIDEDThe pre-adjustment trial balance of Wing-It (Pty) Ltd as at 31 August 2022 is presented:AccountDebitCreditProfessional fees765 000Goods sold435 000Cost of sales215 000Interest received19 500Interest on loan6 300Bank charges3 200Cleaning1 500Staff welfare650Salaries and wages35 850Municipal services6 850Printing and stationery16 715Telephone18 600Fuel and oil56 000Repairs and maintenance: Building5 200Repairs and maintenance: Vehicles6 850Capital: Blue520 000Capital: Green630 000Drawings: Blue35 000Drawings: Green27 000Current account: Blue2 500Current account: Green6 400Retained income265 000Land500 000Buildings1 500 000Accumulated depreciation on buildings21 000Vehicles380 000Accumulated depreciation on vehicles65 000Equipment and electronics79 500Accumulated depreciation on equipment and electronics1 5008% Long-term loan325 000Bank: FNB168 000Bank: ABSA32 000Debtors control account85 000Allowance for credit losses6 400Creditors control account78 600Petty cash2…Part BRequired6. Prepare journal entries to record each of the following November transactions.7. Post the November entries.8. Prepare a trial balance at November 30, 2020.9. Prepare an income statement and a statement of changes in equity for the two months endedNovember 30. 2020. as well as a balance sheet at Novembe 30. 2020.Nov. 1 Reimbursed Aster Turane's business automobile expense for 2,630kilometres at $1.60 per kilometre.2 Received $7,920 cash from Langara Lodge for computer services rendered.5 Purchased $420 of computer supplies for cash from Triple-One Supplies.8 Billed Dinwoody Entertainment $4,230 for computer services rendered.13 Notified by Kinsetta Groceries that Aster's bid of $5,950 for anupcoming project was accepted.18 Received $4,200 from Whistler Resort against the bill dated October 28.22 Donated $500 to the Hope Mission in the company's name.24 Completed work for Kinsetta Groceries and sent a bill for the agreed amount.25 Sent another bill to Whistler Resort for…

- Chandra's bakery business has the following account balances at 30 December 2019: Equipment OR 38000, inventories OR 4100, Account payables OR 2650, loan of OR 5000 bank of OR 1090, purchase return 2500, sale 23040 and capital 10000. The total amount of the trial balance is: Select one: a. OR 38660 b. OR 43190 c. OR 30190 d. Correct answer not available e. OR 35540A. You are provided with the following information form the accounts of BBS Ltd for the year ending 30 June 2019Cash Sales950 000Cost of Goods Sold35 000Amount received in advance for services to be performed in August 20199 500Rent expenses for year ended 30 June 20199 000Rent Prepaid for two months to 31 August 20191 200Doubtful debts expenses1 200Amount provided in 2019 for employees’ long-service leave entitlements5 000Goodwill impairment expenses7 000Required:Calculate the taxable profit and accounting profit for the year ending 30 June 2019.B. GYV Ltd has the following deferred tax balances as at 30 June 2019.Deferred tax asset $9 00 000Deferred tax liability $7 00 000The above balances were calculated when the tax rate, was 20 per cent. On 1 December 2019 the government raises the corporate tax rate to 25 per cent.Required:Provide the journal entries to adjust the carry-forward balances of the deferred tax asset and deferred tax liability.Question The following pre‐adjustment trial balance appeared in the books of Central Perk Furniture Storeat the end of their financial year. IGNORE VAT.Pre‐adjustment trial balance of Central Perk Furniture Store for the year ended 31 March 2020.Fol. Debit (R) Credit (R)Statement of financial position sectionCapital B1 500 000.00Drawings B2 25 000.00Land and buildings B3 865 000.00Vehicles B4 220 987.00Equipment B5 156 760.00Accumulated depreciation: Equipment(1 April 2019)B6 54 320.00Accumulated Depreciation: Vehicles(1 April 2019)B7 22 580.00Bank B8 22 430.00Debtors Control B9 35 600.00Allowance for Credit Losses‐ 1 April 2019 B10 1 780.25Petty Cash B11 1 378.98Trading inventory (1 April 2019) B12 27 865.43Mortgage Loan B13 287 650.00Creditors Control B14 31 420.00SARS(UIF/SDL/PAYE) B15 23 290.6520 2020Page 6 of 7Fol. Debit (R) Credit (R)Nominal accounts sectionSales N1 1 167 371.07Sales Returns N2 25 340.87Purchases N3 520 389.76Purchases returns N4 76 540.32Service Income N5 10…