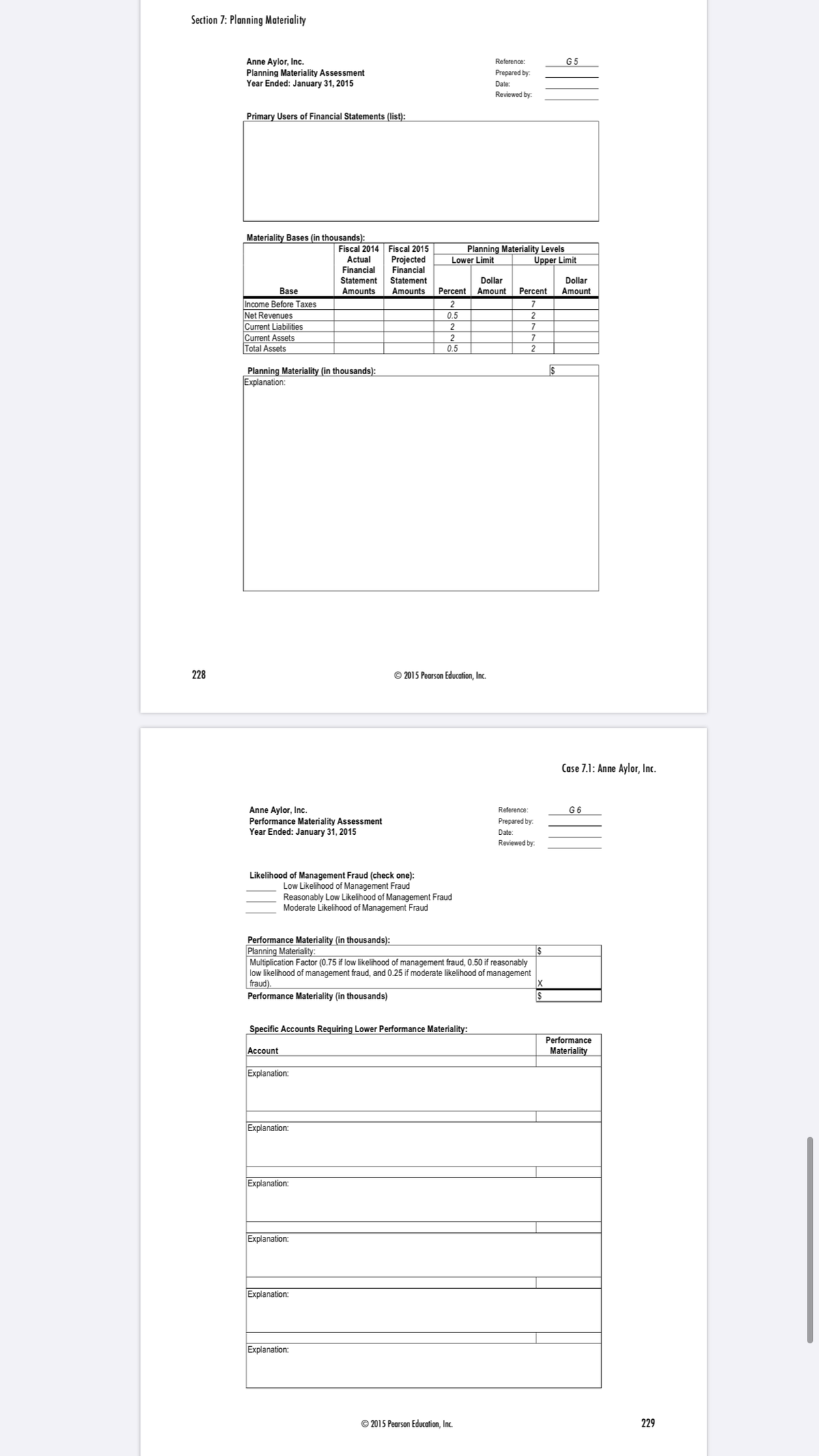

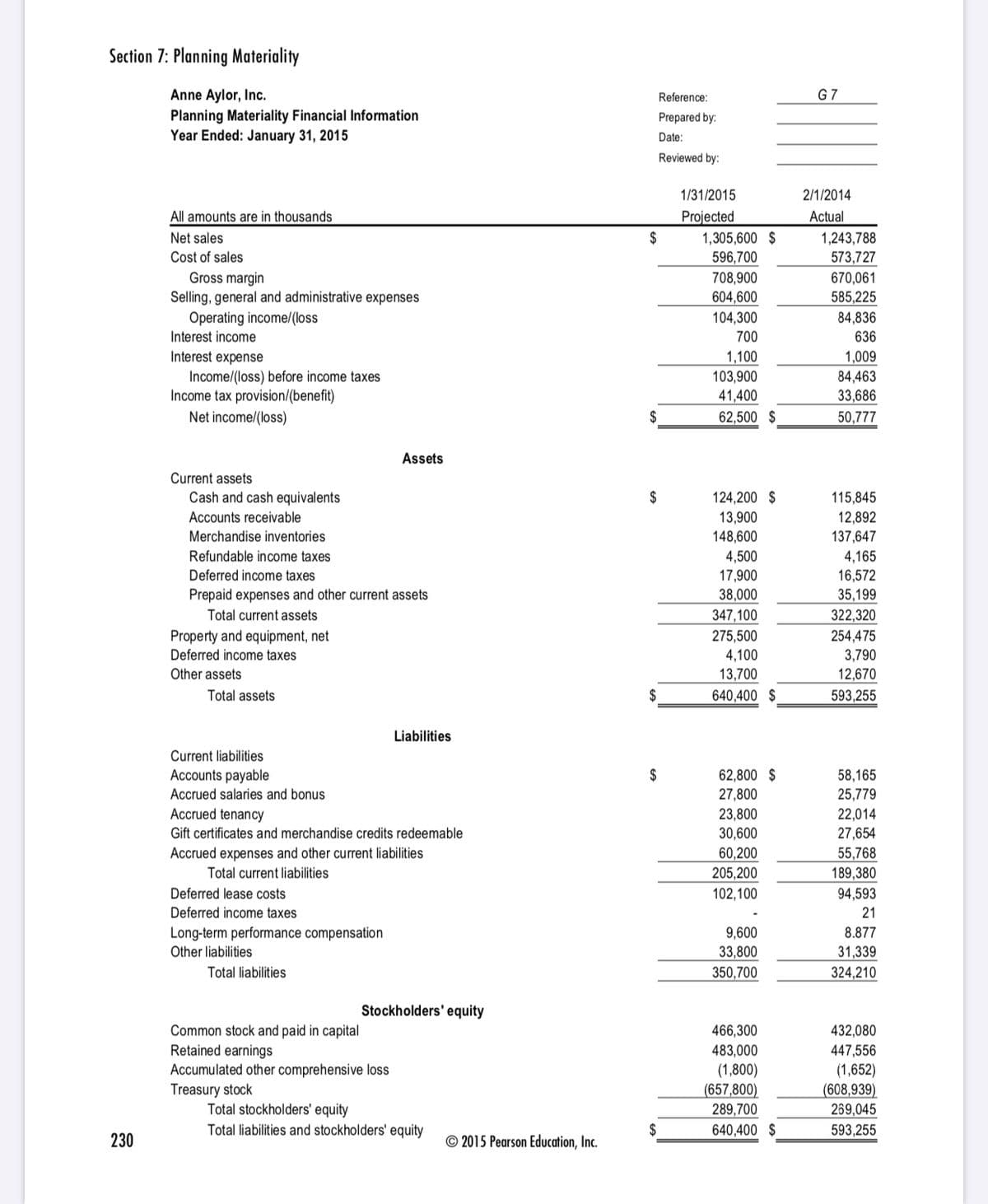

REQUIRED [1] Review Exhibits 1 and 2; audit memos G-3 and G-4; and audit schedules G-5, G-6 and G-7. Based on your review, answer each of the following questions: [a] Why are different materiality bases considered when determining planning materiality? [b] Why are different materiality thresholds relevant for different audit engagements? [c] Why is the materiality base that results in the smallest threshold generally used for planning purposes?

Case 7.1 Anne Aylor Inc. Determination of Planning Materiality and Performance Materiality by Mark S. Beasley, Frank A. Buckless, Steven M. Glover, Douglas F. Prawitt

Please answer what is required number 1 and 2

REQUIRED

[1] Review Exhibits 1 and 2; audit memos G-3 and G-4; and audit schedules G-5, G-6 and G-7. Based on your review, answer each of the following questions:

[a] Why are different materiality bases considered when determining planning materiality?

[b] Why are different materiality thresholds relevant for different audit engagements?

[c] Why is the materiality base that results in the smallest threshold generally used for planning purposes?

[d] Why is the risk of management fraud considered when determining performance materiality?

[e] Why might an auditor not use the same performance materiality amount or percentage of

account balance for all financial statement accounts?

[f] Why does the combined total of individual account performance materiality commonly exceed the estimate of planning materiality?

[g] Why might certain

[2] Based on your review of the Exhibits (1 and 2) and audit memos (G-3 and G-4), complete audit schedules G-5, G-6 and G-7.

Case 8.1 Laramie Wire Manufacturing Using Analytical Procedures in Audit Planning Mark S. Beasley, Frank A. Buckless, Steven M. Glover, Douglas F. Prawitt

Please do answer what is required and the professional judgment question

REQUIRED

[1] Perform analytical procedures to help you identify relatively risky areas that indicate the need for further attention during the audit, if any.

[2] Focus specifically on each of the following balance-related management assertions for the inventory account: existence, completeness, valuation, and rights and obligations. Link any risks you identified for this account in question 1 to the related management assertion. Briefly explain identified risks for the inventory account that require further attention, if any.

PROFESSIONAL JUDGMENT QUESTION

It is recommended that you read the Professional Judgment Introduction found at the beginning of this book prior to responding to the following question.

[3] Why might an auditor be likely to adopt a client's judgment frame in performing preliminary analytical procedures, and how might that frame affect her or his evaluation of the findings from the procedures that were performed?

More information can be view in this link

chrome://external-file/1376815_1_auditing-cases-2.3.pdf

Trending now

This is a popular solution!

Step by step

Solved in 2 steps