Required: 1.) Indicate the amount of revenue that should be allocated to the performance obligations of cach product sold in May and June 2021. Indicate with an "E" or a "U" if the revenue is carned or unearned in the month of sale. 2.) Prepare Master Grill's journal entries for cach of these products in May and June 2021. Assume the customers purchasing the R700 grills on account pay in time to get the discounts.

Required: 1.) Indicate the amount of revenue that should be allocated to the performance obligations of cach product sold in May and June 2021. Indicate with an "E" or a "U" if the revenue is carned or unearned in the month of sale. 2.) Prepare Master Grill's journal entries for cach of these products in May and June 2021. Assume the customers purchasing the R700 grills on account pay in time to get the discounts.

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 4PA: Ken Owens Construction specializes in small additions and repairs. His normal charge is $400/day...

Related questions

Question

Sir please help me urgently

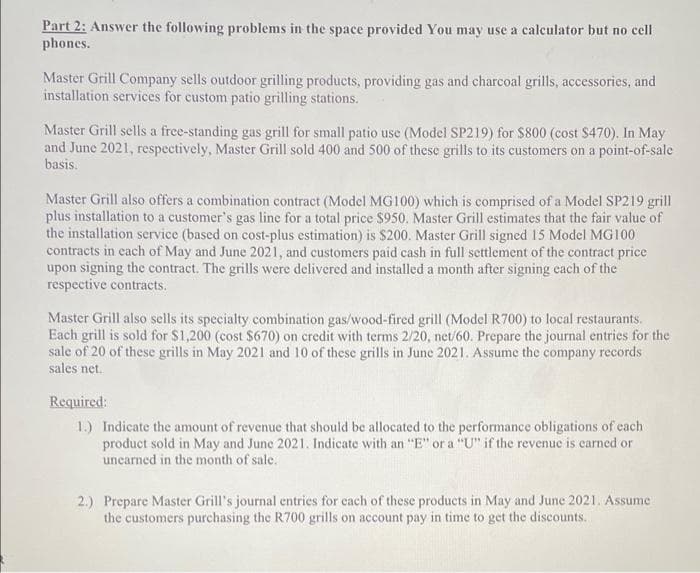

Transcribed Image Text:Part 2: Answer the following problems in the space provided You may use a calculator but no cell

phones.

Master Grill Company sells outdoor grilling products, providing gas and charcoal grills, accessories, and

installation services for custom patio grilling stations.

Master Grill sells a free-standing gas grill for small patio use (Model SP219) for $800 (cost $470). In May

and June 2021, respectively, Master Grill sold 400 and 500 of these grills to its customers on a point-of-sale

basis.

Master Grill also offers a combination contract (Model MG100) which is comprised of a Model SP219 grill

plus installation to a customer's gas line for a total price $950. Master Grill estimates that the fair value of

the installation service (based on cost-plus estimation) is $200. Master Grill signed 15 Model MG100

contracts in each of May and June 2021, and customers paid cash in full settlement of the contract price

upon signing the contract. The grills were delivered and installed a month after signing cach of the

respective contracts.

Master Grill also sells its specialty combination gas/wood-fired grill (Model R700) to local restaurants.

Each grill is sold for $1,200 (cost $670) on credit with terms 2/20, net/60. Prepare the journal entries for the

sale of 20 of these grills in May 2021 and 10 of these grills in June 2021. Assume the company records

sales net.

Required:

1.) Indicate the amount of revenue that should be allocated to the performance obligations of each

product sold in May and June 2021. Indicate with an "E" or a "U" if the revenue is carned or

unearned in the month of sale.

2.) Prepare Master Grill's journal entries for cach of these products in May and June 2021. Assume

the customers purchasing the R700 grills on account pay in time to get the discounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College