Required: 1. Translate Swoboda's financial statements into U.S. dollars in accordance with U.S. GAAP at December 31, Year 2, using the following scenarios. a. Assume the Polish zloty is the functional currency. The December 31, Year 1, retained earnings amount that appeared in Swoboda's translated financial statements was $56,250. The December 31, Year 1, cumulative translation adjustment that Swobodo's translated balance sheet was negative $506,250.

Required: 1. Translate Swoboda's financial statements into U.S. dollars in accordance with U.S. GAAP at December 31, Year 2, using the following scenarios. a. Assume the Polish zloty is the functional currency. The December 31, Year 1, retained earnings amount that appeared in Swoboda's translated financial statements was $56,250. The December 31, Year 1, cumulative translation adjustment that Swobodo's translated balance sheet was negative $506,250.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Columbia Corporation, A U.S.- based compan, acquired a 100 percent interest in Swoboda Company in Lodz, Poland, on January 1, Year 1, when the exchange rate for the Polish zloty (PLN) was $0.25. The financial statements of Swoboda as of December 31, Year 2, two years later, are as follows: Look at images!

Transcribed Image Text:• declared and paid on 15, 2, the rate

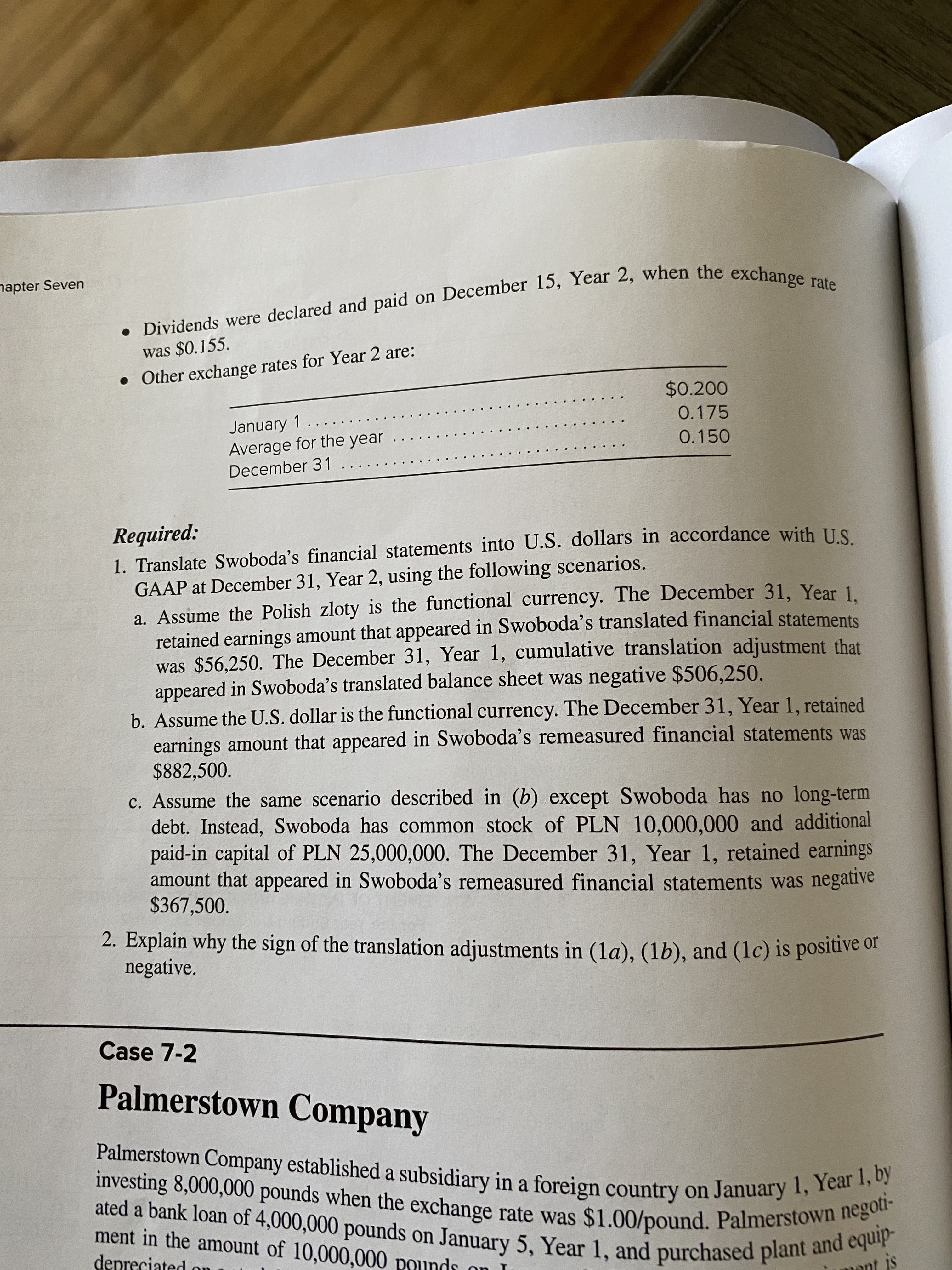

napter Seven

was $0.155.

• Other exchange rates for Year 2 are:

$0.200

0.175

January 1

Average for the year

0.150

December 31

Required:

1. Translate Swoboda's financial statements into U.S. dollars in accordance with IS

GAAP at December 31, Year 2, using the following scenarios.

a. Assume the Polish zloty is the functional currency. The December 31, Year 1

retained earnings amount that appeared in Swoboda's translated financial statements

was $56.250. The December 31, Year 1, cumulative translation adjustment that

appeared in Swoboda's translated balance sheet was negative $506,250.

b. Assume the U.S. dollar is the functional currency. The December 31, Year 1, retained

earnings amount that appeared in Swoboda's remeasured financial statements was

$882,500.

c. Assume the same scenario described in (b) except Swoboda has no long-term

debt. Instead, Swoboda has common stock of PLN 10,000,000 and additional

paid-in capital of PLN 25,000,000. The December 31, Year 1, retained earnings

amount that appeared in Swoboda's remeasured financial statements was negative

$367,500.

2. Explain why the sign of the translation adjustments in (la), (1b), and (1c) is positive of

negative.

Case 7-2

Palmerstown Company

Palmerstown Company established a subsidiary in a foreign country on January 1, pegoti-

ated a bank loan of 4,000,000 pounds on January 5, Year 1, and purchased plant mani

ment in the amount of 10,000,000 pound

depreciated

Transcribed Image Text:ation of Foreign Currency Financial Statements 325

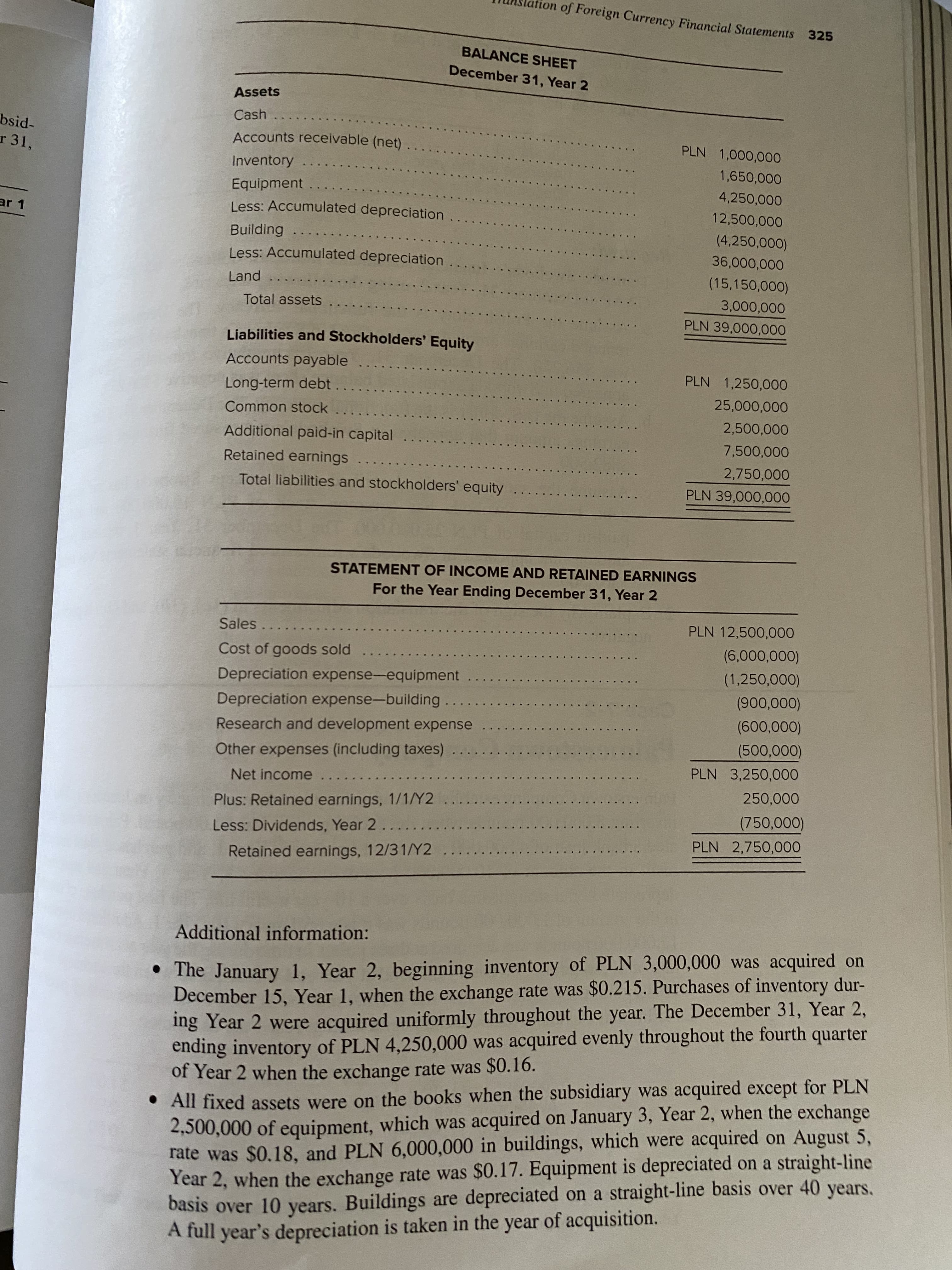

BALANCE SHEET

December 31, Year 2

Assets

Cash

bsid-

Accounts receivable (net)

r 31,

Inventory

1,650,000

Equipment

4,250,000

ar 1

Less: Accumulated depreciation

12,500,000

Building

(4,250,000)

Less: Accumulated depreciation

Land

(15,150,000)

Total assets

PLN 39,000,000

Liabilities and Stockholders' Equity

Accounts payable

PLN 1,250,000

Long-term debt

Common stock

000'000

Additional paid-in capital

7,500,000

Retained earnings

2,750,000

Total liabilities and stockholders' equity

PLN 39,000,000

STATEMENT OF INCOME AND RETAINED EARNINGS

For the Year Ending December 31, Year 2

Sales

PLN 12,500,000

Cost of goods sold

(000'000'9)

Depreciation expense-equipment

(1,250,000)

Depreciation expense-building

Research and development expense

Other expenses (including taxes)

...

PLN 3,250,000

Net income

Plus: Retained earnings, 1/1/Y2

(750,000)

Less: Dividends, Year 2

PLN 2,750,000

Retained earnings, 12/31/Y2

...

Additional information:

• The January 1, Year 2, beginning inventory of PLN 3,000,000 was acquired on

December 15, Year 1, when the exchange rate was $0.215. Purchases of inventory dur-

ing Year 2 were acquired uniformly throughout the year. The December 31, Year 2,

ending inventory of PLN 4,250,000 was acquired evenly throughout the fourth quarter

of Year 2 when the exchange rate was $0.16.

• All fixed assets were on the books when the subsidiary was acquired except for PLN

2,500,000 of equipment, which was acquired on January 3, Year 2, when the exchange

rate was $0.18, and PLN 6,000,000 in buildings, which were acquired on August 5,

Year 2, when the exchange rate was $0.17. Equipment is depreciated on a straight-line

basis over 10 years. Buildings are depreciated on a straight-line basis over 40 years.

A full year's depreciation is taken in the year of acquisition.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education